“Don’t put all your eggs in one basket” – an old rule of thumb that encapsulates the importance of diversifying your investments. Absa’s NewFunds has two ETFs that eliminate the need for you to worry what percentage of bonds or cash you should be holding because they are already diversified for different levels of risk tolerance. MAPPS Protect is a conservative portfolio and MAPPS Growth – our focus for this week – is more aggressive, seeking higher returns and is suitable for the more risk-tolerant investor. Both combine the most common asset classes, equities, bonds and cash.

What it does: NewFunds MAPPS Growth targets an asset allocation of: equities 75%; nominal bonds 10%; inflation-linked bonds 10%; and cash 5%. It may, however, deviate from that between rebalancing periods that are done on a quarterly basis. The equities component tracks the total return performance of SWIX 40 index. It replicates nominal bonds through the GOVI index and inflation-linked bonds through ILBI index. The cash component is held in hard cash or allowable money market instruments.

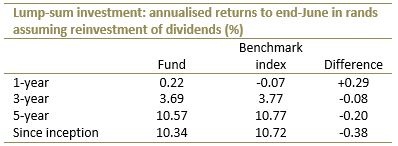

Performance review: The NewFunds MAPPS Growth fund returned 0.22% for the year to end-June.

Outlook: With three-quarters of the fund invested in equities, domestic stocks will have the biggest influence on its long-term performance. The equities holdings are dominated by consumer goods & services, health care and financial stocks. The performance of these stocks is largely dependent on economic growth prospects, locally and globally. Locally, the economy is in a technical recession amidst an unpredictable political environment, and there is little cause for market optimism. However, the ETF is invested in quality stocks, many of which derive significant business outside SA. While the past decade has been good for bonds, SA’s sovereign credit ratings downgrade earlier in the year does not bode well for bonds in the near future.

Key facts:

Suitability: Unlike its cousin, the MAPPS Protect ETF, MAPPS Growth suits investors who can tolerate more risk and are willing to accept higher variability of returns in the short term in exchange for the prospect of better returns over the long term, but without the risk of a pure equities portfolio. The fund’s asset allocation complies with pension regulations so it can be used to supplement retirement savings. As such it can be used as part of an investor’s core portfolio.

Top holdings: The top 10 assets account for 47% of the fund, with Naspers occupying 20%. Naspers’s value is largely driven by events in Chinese internet company Tencent, in which it has a 34% stake.-1.jpg?width=443&height=362&name=29082017%20(2)-1.jpg)

Risks: Because of its diversity, the ETF is considered to carry moderate risk over the medium to long term. However, the fund is disproportionately overweight in Naspers, which reduces diversification benefits.

The value of the ETF will rise and fall, tracking the underlying securities and as such investors’ capital is not protected. In our study of the local ETF market, we found that these multi-asset ETFs were actually more volatile than some of the single-asset class ETFs – it’s highest and lowest prices for the past 12 months is quite telling (see fund information table).

.jpg?width=554&height=140&name=29082017%20(3).jpg)

Alternatives: If MAPPS Growth's high exposure to equities are too aggressive, the NewFunds MAPPS Protect ETF might be a good alternative. MAPPS Protect is more conservative, allocating 40% to domestic equities, 15% to SA government bonds, 35% to SA inflation-linked bonds and 10% to cash. With this ETF, bonds have a much hiugher contribution. MAPPS Protect has a TER of 0.16%

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.