Intellidex Reviews October 2019: Local ETFs

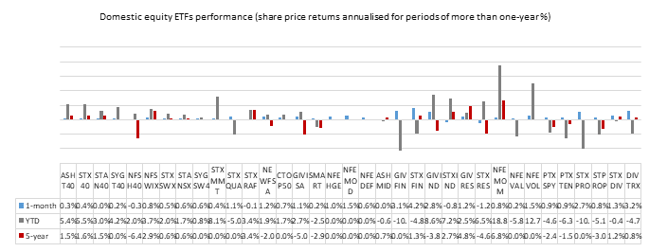

The JSE all share gained marginally as gains from industrials, health care, consumer services and financials offset declines from resources, consumer goods, telecommunications and technology.

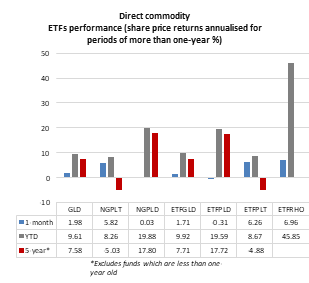

Commodity funds had a mixed month. Rhodium and Palladium continued their strong run while gold- and platinum-based funds closed in the red. The Absa NewGold Palladium was the star performer, surging 7.8%. The two platinum funds – Standard Bank Africa Platinum ETF and Absa NewPlat ETF – tanked 4.5% each. The Standard Bank Africa Rhodium ETF has been the most rewarding fund on the JSE with a return of 123.6% since the beginning of the year.

The Macroeconomic view

South Africa’s macroeconomic calendar for September kicked off with positive news of better-than-expected GDP numbers for 2019Q2. Stats SA reported that the country’s real GDP grew 3.1% quarter on quarter (annualised), driven mostly by the mining and finance industries while agriculture and construction contracted.

But subsequent data readings were less palatable. The RMB/BER Business Confidence Index fell to a 20-year low in 2019Q3. Manufacturing production, which contracted 3.6% in June, declined 1.1% year on year in July. Mining production increased 2.4% year on year in July but off a low base.

The consumer price index (CPI) accelerated in August, printing at 4.3%, up from the 4% in July and fractionally higher than consensus forecasts of 4.2%.

The ANC announced a stimulus policy aimed at resuscitating the stuttering economy.

The success of these packages in supporting economic growth depend a lot on trade developments between the US, China and now the EU. There is consensus that failure to prevent further tariffs will offset any benefits from these stimulus packages.

Locally, the pollical landscape remains shaky. Investors feel government is moving too much to the left, pushing populist policies including NHI and debt relief, which could be economically damaging. Topping it off is the ballooning debt of Eskom which recently reported a loss of R21bn in its year to end-March.

ETFs featured

Local:

With the local economy facing numerous challenges, robust risk management practices should be employed in portfolios. While we feel the Satrix SA Quality fund implicitly achieves this through its multi-dimensional approach to the selection of its constituents, there is a new (re-branded) multi-factor ETF which explicitly takes volatility into account as one of six factors it employs in fund construction. The CoreShares Scientific Beta Multifactor Index ETF fits our mould of a good investment philosophy as it is built with risk factors in mind. It was launched in May and has a great back-tested track record.

We thus change our main choice for local broad-based equity exposure to this new multi-factor fund. The fund was largely flat in September. There are extensions to this core local equity exposure that can be added in a tactical sense as a satellite fund. The NewFunds Equity Momentum fund (up 0.8% in September) is worth considering. It has performed far ahead of other equity funds under all market extremes in the past four months and has a year-to-date return of 18.8%.

Commodities:

Adding a commodity ETF to your portfolio improves diversification because commodities march to the beat of their own drum – they are not in synch with broader markets. Traditionally, gold is the preferred addition to an investor’s portfolio because over longer periods it has shown to be the least correlated with other assets. However, our preference based on our medium-term outlook is between rhodium and palladium.

The new vehicle emission laws in Europe and China are driving demand for both commodities and this is expected to continue in the foreseeable future. We are slightly more inclined towards rhodium because it is scarcer, with lower extraction rates from PGM ore. The primary production of rhodium is somewhat inelastic and is expected to decline moderate moderately over the medium term. Palladium funds gained northwards of 7.5% during September.

Important note: These ETFs do not qualify for a tax-free savings account.

There's plenty more from where that came from. The team at Intellidex have more insights for the month of August. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews

August 2019: Local Picks

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.