We delayed releasing this note because of two important events which took place last week: the South African elections and the outcome of the US-China trade talks. On one hand, the election results where the ANC claimed 57.5% of the vote at national level were greeted warmly by local investors with South African banks and retailers benefiting from the positive sentiment.

The Macroeconomic view

For post-election SA, what comes next in terms of policy will be important in driving growth and markets. Intellidex’s head of capital markets research, Peter Attard Montalto, says President Cyril Ramaphosa will need to effectively deploy political capital to boost growth.

This rings true as the SA economy remains on murky grounds. Manufacturing and mining activity for March were poor, compounded by the resumption of loadshedding. It is therefore encouraging that Ramaphosa is expected to reinstate a policy and research advisory unit in the presidency. The initiative is meant to give him a clear line of sight over the government, particularly the design and implementation of economic and investment policies.

In the short term we think trading on the local bourse will remain thin – as has been the theme since the beginning of the year – as the market awaits reforms and cabinet appointments and observes political machinations within ANC.

In commodity markets, platinum (+6.2%) is turning a corner as supply is tightening. In contrast rhodium tanked 9.23%. Against this backdrop, the Absa New Platinum ETF rose 3.41% while Standard Bank Africa Rhodium ETF lost 9.99% in April.

ETFs featured

Local:

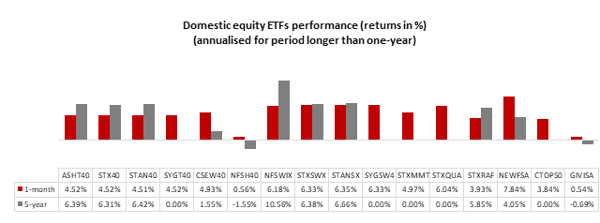

The uncertainty building before the announcement of the new cabinet and the trade war between China and the US means investors should park their money in quality assets. The Satrix SA Quality ETF remains our preferred choice. The ETF selects constituent companies using a set of quality metrics, including return on equity, liquidity and leverage.

Empirical evidence shows that portfolios created on factors such as profitability and earnings quality generate high risk-adjusted returns relative to a market portfolio. However, the size of the premium varies, depending on the metrics used to calculate the quality score. The Satrix fund is a good bet in a volatile local equity market. It rose 6.09% during April.

Investors should also consider the smart beta funds recently launched by Absa. These ETFs manage volatility and drawdowns and aim to address the issue of high short-term volatility displayed by general equity ETFs that are weighted by market capitalisation. However, they accumulate higher trading costs as they are regularly rebalanced, thus they have relatively high total expense ratios.

Click logo to view ETF

Commodities:

Adding a commodity ETF to your portfolio improves diversification because commodities march to the beat of their own drum when compared with broad markets, which makes them an excellent portfolio diversifiers.

Traditionally, gold is the preferred addition to an investor’s portfolio because over longer periods it has shown to be the least correlated with other assets. However, our preference based on our medium-term outlook is between rhodium and palladium. The new vehicle emission laws in Europe and China are driving demand for both commodities and this is expected to continue in the foreseeable future.

We are slightly more inclined towards rhodium (Standard Bank Africa Rhodium ETF) because it is scarcer, with lower extraction rates from PGM ore. The primary production of rhodium is somewhat inelastic and is expected to decline moderately over the medium term. However, gaining exposure to both commodities is not a bad idea.

Click logo to view ETF

There's plenty more from where that came from. The team at Intellidex have more insights for the month of April. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.