Intellidex Reviews February 2020: International ETFs

Everybody is talking about it, so it only makes sense that coronavirus would have a dramatic effect on international markets. Despite the de-escalation of the US-China trade war, which would have seen positive sentiments in the markets, a new cause for concern has reared its head. Still, there were some winners in the exchange traded funds universe, and the Intellidex team have highlighted these below.

Fears about the economic impact of China’s coronavirus weighed on global equities, which had a superb run in 2019. Developed market equities ended 0.6% lower, with the S&P 500 closing flat. Emerging markets, which seem to be the most vulnerable to the coronavirus, lost 4.7%.

Global markets seemed to respond positively to the news of de-escalating US-China trade war, with Emerging Markets themed, and Tech-based funds having the most attractive results. The Intellidex team give investors some news to be excited about, highlighting the listing of the world's most profitable company, Aramco, meaning it may feature on a number of ETFs in the future.

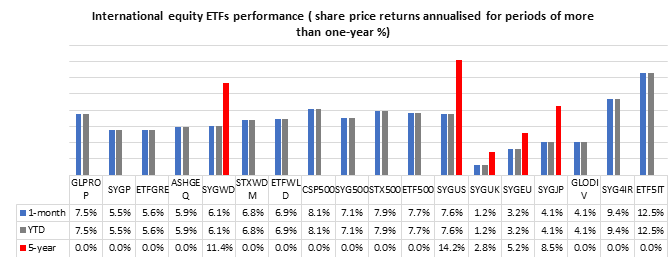

International ETFs started the year on a strong footing, thanks to the rand. All foreign ETFs delivered positive returns during January, led by tech funds: 1nvest S&P 500 Info Tech Index Feeder was up 12.5%, Satrix Nasdaq 100 ETF (+11.4%) and Sygnia/Itrix 4th Industrial Revolution (9.4%). The FirstRand US Dollar Custodian Certificate ETF (9.2%) and CoreShares S&P 500 Exchange Traded Fund (8.1%) complete the top five.

The Africa-focused fund – Cloud Atlas Africa Real Estate ETF – was the worst performer with a return of 0.4%. Other funds in the bottom five were the Satrix MSCI Emerging Markets ETF (1%), Sygnia Itrix FTSE 100 (1.2%), Sygnia Itrix EuroStoxx50 (3.2%) and Sygnia Itrix MSCI Japan Index (4.1%).

The Global view

The biggest driver of investor sentiment in January was undoubtedly the outbreak of the coronavirus which originated in Wuhan, China. To date, more than 24,324 people have contracted the disease, with 490 confirmed deaths. Cases have been confirmed in several other countries including Australia, France, Japan, Singapore, South Korea, Thailand, the US and Canada, with a total of 175 infections globally (excluding mainland China).

The outbreak overshadowed a brief flare-up in US-Iranian tensions which occurred during the month and what we think was largely positive economic data from China, the US and the eurozone. China grew at 6.0% year on year (y-o-y) in the fourth quarter of 2019, signalling that the Chinese economy is stabilising. Its December retail sales continued to grow at 8.0% y-o-y, while industrial production picked up 0.7 percentage points to 6.9% y-o-y. The US economy grew at an annualised pace of 2.1% in the final quarter of 2019 which is also solid. The eurozone experienced growth of 0.1% in the final quarter of 2019.

Globally, economic growth is expected to soften but will remain credible. Initial fears of a recession have dissipated on better-than-expected economic data across regions. There is also a feeling that major central banks are set to remain accommodative with monetary policy in the coming year, which will support growth.

ETFs featured

We have split international equities into developed and developing markets:

Developed markets:

We maintain our exposure to the broad-based Satrix MSCI World Equity Feeder ETF, which is dominated by US equities. We think US stocks are more resilient than other developed market equities during turbulence, given the relatively stronger US economy. We are, however, cognisant of the elevated US valuations relative to other developed markets. The Satrix MSCI World Equity Feeder ETF grew 6.1% in January. A good alternative, though, is the Ashburton Global 1200 Equity ETF (up 5.5%) but it has a higher total expense ratio. Other more focused international equity themes include property, dividend and technology funds. These are worth considering for tactical or other investor-specific reasons.

Emerging markets:

For developing market exposure we choose the Satrix MSCI Emerging Markets ETF (+1%) as our core portfolio for developing market exposure. It invests in a wide range of emerging economies including some of the fastest-growing markets such as China and India. The Cloud Atlas AMI Big50 (+5.5%), which focuses on African equities, can be used as a satellite fund to the core Satrix MSCI Emerging Markets fund. However, the Cloud Atlas AMI Big50 ETF has been extremely volatile since its listing on the JSE.

There's plenty more from where that came from. The team at Intellidex have more insights for the month of February. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews

February 2020: Other ETFsDisclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.