Intellidex's favourite funds for November

Each month Intellidex updates a list of ETFs, from a pool of 57 listed on the JSE, that it considers the best on offer across several asset classes. A flurry of new ETF listings this year has seen some changes to our traditional choices. Our view is, first, informed by macro developments both globally and at home. Second, we consider costs, strategy and diversification of each fund.

Generally, we classify all ETFs into five categories: domestic equity; international equity; bonds and cash; multi-asset; and dividend-focused. Not all categories are right for investors; you would want to choose asset classes that meet your unique objectives. With the advent of an emerging markets fund and a frontier markets fund, this month we split our international category into developed and developing markets.

1.1 International developments

An IMF October report forecast that the global economy will grow by 3.6% this year, improving to 3.7% in 2018. South Africa’s anticipated growth is far short of that at 0.7%.

The US, Europe and Japan dominate global equities. The US economy is on a firm path, growing by 3% in the third quarter of 2017 and unemployment is at a historical low. However, moribund inflation stayed the Fed’s hand on a third rate hike this year – it left rates unchanged last week and the next review is in December. Together with a raft of fiscal expansion policies proposed by President Donald Trump, US equities are expected to benefit, but their valuations are worryingly high.

Similarly, the eurozone grew GDP in the third quarter by 0.6%. This was ahead of expectations and pushed business confidence to its highest level in a decade, while August’s unemployment was at a multi-year low. The European Central Bank is expected to maintain its quantitative easing programme a while longer to ensure stable growth.

In Japan, Prime Minister Shinzo Abe is expected to maintain expansive economic policies following a landslide victory by his party in recent general elections. This also is expected to support the equity market. Overall, global monetary policies are still largely accommodative despite moving towards gradual monetary tightening.

1.2 Local developments

South Africa’s expected economic growth for 2017 of 0.7% is a fraction of the 2.6% that is expected for the rest of sub-Saharan Africa. Lack of political will to decisively deal with structural weakness in the economy is one of the causes. Political uncertainty remains high with the ANC conference to choose a new leader in December now just around the corner. Of immediate concern is the upcoming credit review by rating agencies S&P and Moody’s at the end of November. Another sovereign credit downgrade now seems highly likely following the bearish medium-term budget statement, which showed the fiscal deficit as a percentage of GDP is expected to widen to 4.3% from the 3.1% expected in April. A local debt downgrade would almost certainly trigger widespread selling and pile more pressure on the government by driving up its borrowing costs. This will further weaken the rand and potentially drive up inflation.

On a brighter note, the JSE all-share index has been hitting new highs, ironically off the weakness of the rand, after years of stagnancy.

1.3 Selection criteria

We believe a good ETF should be cheap. Cost differences, while appearing small on paper, can make a huge impact on an investor’s returns when compounded over time. We also prefer ETFs that avoid complex strategies that are difficult to understand. They should follow indices that make sense. A good ETF should also be tax-smart. In this case, it should qualify to be in a tax-free savings account. To avoid overconcentration, a good ETF should cap its exposure to a single sector and or a single counter. Below we provide an overview of our favourite funds for each category.

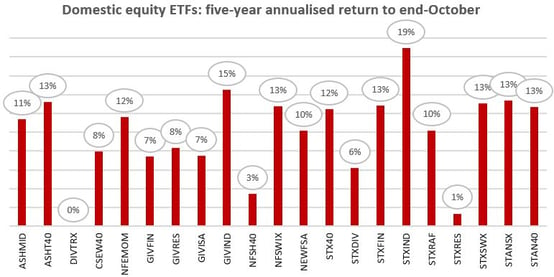

2. Domestic equity

Continuing with our theme from last month, we don’t like the increasing concentration in the top 40 where a few companies dominate. That elevates risk.

We maintain our choice in this category: the recently listed Satrix SA Quality ETF. While it may appear complicated in that it uses fundamental metrics in its criteria, it avoids the risks inherent in the top 40 index as it caps the weight of each counter and sector. Furthermore, we like its selection criteria and it offers investors potentially more diversified exposure to the entire market.

The fund scores companies using a set of quality metrics, including return-on-equity, liquidity and the leverage of the companies’ balance sheets. The top 20% of all JSE-listed companies with the highest scores based on these criteria are included in the fund. They are then weighted by market capitalisation, capping each at 10% of the fund.

The outperformance of high-quality stocks over low-quality stocks is well-documented in financial research. Empirical evidence shows that portfolios sorted on factors such as profitability and earnings quality generate high risk-adjusted returns relative to a market portfolio or a multi-factor model, but the size of the premium varies, depending on the metrics used to calculate the quality score.

3.Foreign equities

3.1 Developed markets

A number of changes have taken place in this space with Sygnia acquiring Deutsche Bank’s five international funds (the former db-X ETFs). Sygnia has promised to slash the costs of operating and distributing these products. Satrix and Ashburton have also launched their own international ETFs.

.jpg?width=320&name=07112017%20(1).jpg)

We change our preferred fund to the Ashburton Global 1200 ETF from the Satrix S&P 500 ETF. The primary motivation is to de-emphasise US equities given their lofty valuations and to increase exposure to Europe and Japan, where economic prospects are improving. US equities remain the biggest contributor to fund’s returns. The Ashburton Global 1200 ETF tracks the S&P Global 1200 Index, which in turn tracks seven global indices based on their free-float market capitalisation: S&P 500 (US); S&P Europe 350; S&P TOPIX 150 (Japan); S&P/TSX 60 (Canada); S&P/ASX All Australian 50; S&P Asia 50; and S&P Latin America 40.

Invest in Ashburton Global 1200

3.2 Developing markets

Satrix and Cloud Atlas have also introduced new ETFs – theirs track emerging markets and African (frontier) markets respectively. In this space we prefer the Satrix MSCI Emerging Markets ETF because it provides exposure to high-growth economies such as China and India, which are not included in any of the funds mentioned earlier, thus offering further scope for diversification. We think South African investors generally already have sizeable African exposure through our local funds. The Satrix MSCI Emerging Markets ETF replicates the performance of the MSCI Emerging Markets Investable Markets Index, which captures companies across 23 countries.

Invest in Satrix MSCI Emerging Markets

4. Bond and cash funds

Bonds and cash are good additions to portfolios not only because of their diversification qualities but also for their ability to enhance returns. There are now six listed funds in this category:

(i) NewFunds GOVI ETF

(ii) NewFunds ILBI ETF

(iii) NewFunds TRACI 3 Month ETF

(iv) Ashburton Government Inflation ETF

(v) Satrix ILBI ETF (recently listed fund)

(vi) CoreShares PrefTrax

They each track different things: (i) tracks government bonds; (ii), (iv) & (v) track inflation-linked government bonds; (iii) tracks short-term money market instruments; and (vi) tracks listed preference shares.

.jpg?width=320&name=07112017%20(2).jpg)

If you are investing for a very short period, usually less than a year, then the NewFunds TRACI 3 Month (NFTRCI) is a natural choice, because it is least sensitive to sudden adverse interest rate movements. It is similar to earning interest on your cash at the bank with minimal possibility of capital loss.

Invest in NewFunds TRACI 3 Month

However, for a longer investment horizon, the motivation is to protect your investment against inflation – particularly in emerging markets where various external and internal variables can substantially drive up prices. Because the Satrix ILBI ETF promises to have the lowest expense ratio of 0.22%, it is our choice here. It does not have a performance history as it was launched recently, but should mimic the performance of other inflation-linked bond funds.

5. Dividend-focused funds

While the obvious choice for an investor seeking a good stream of dividends will be ETFs that filter potential investments based on dividend yields (such as the Satrix Dividend Plus ETF and CoreShares S&P South Africa Dividend Aristocrats ETF), we believe investment options should be considered on a total return basis. Total returns combine both capital growth and dividend yield. As a result, we don’t think the Satrix Dividend Plus and CoreShares S&P South Africa Dividend Aristocrats should get uncontested consideration in this category.

-1.jpg?width=320&name=07112017%20(3)-1.jpg)

We think investors looking for stable dividend income are better off investing in property funds. Recently, property stocks have offered superior dividend yields as well as decent capital gains. There are two investable property indices available: SA listed property and the capped property index. We like the capped one because it avoids a situation where a few big counters dominate a fund – as is the case with the uncapped index. Of the two ETFs that track the capped index, we prefer the newly listed Satrix Property ETF. The fund has a TER of 0.30%, which makes it the cheapest in the segment.

6. Diversified funds

Equities are regarded as the financial asset class that carry the most risk. They generally provide the best returns over time, which compensates for the high short-term volatility of returns, so they are more suited to longer-term investors.

.jpg?width=320&name=07112017%20(4).jpg)

One way to reduce risk related to equities is to invest in funds that include other asset classes such as bonds and cash. The only listed funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF. They are designed to meet two different risk appetites: Protect is more conservative, suitable for older savers nearing retirement. Growth suits younger savers with a long-term horizon.

Invest in NewFunds MAPPS Protect & NewFunds MAPPS Growth ETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews:

Satrix INDI ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.