The Satrix Quality SA ETF ticks most of the boxes on our check list for a good ETF – low cost, sound

investment philosophy, well-diversified, decent size and high tracking efficiency. Its investment philosophy, which seeks to capture “high-quality stocks” on the JSE, is well grounded in finance theory. Quality metrics are robust screens and often result in selecting companies that can generate strong future cash flows while limiting exposure to stocks that are unprofitable or highly indebted.

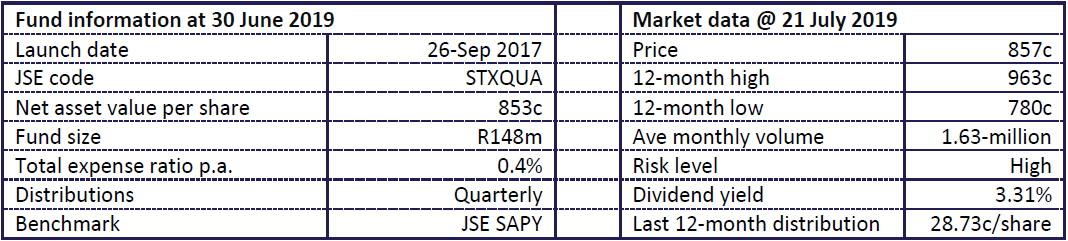

The underlying index has a tight methodology which ensures the fund is always well-diversified: it caps its exposure to a single sector at 40% and a single stock at 10%. The main issue we have with Satrix Quality SA ETF is its elevated total expense ratio of 0.4%. This is a bit steep when compared with local alternatives.

Fund description: The Satrix Quality SA ETF selects constituents based on a score calculated from a stock’s return on equity, accruals ratio and leverage. The top 20% of all JSE-listed companies with the highest scores based on those criteria are included. It also applies liquidity rules which help it to closely track its index. To ensure that the fund achieves its goal of investing in quality stocks, individual counters’ market cap weights are further tilted by a weight based on factor scores.

Click logo to view

Satrix Quality SA ETF on EasyEquities

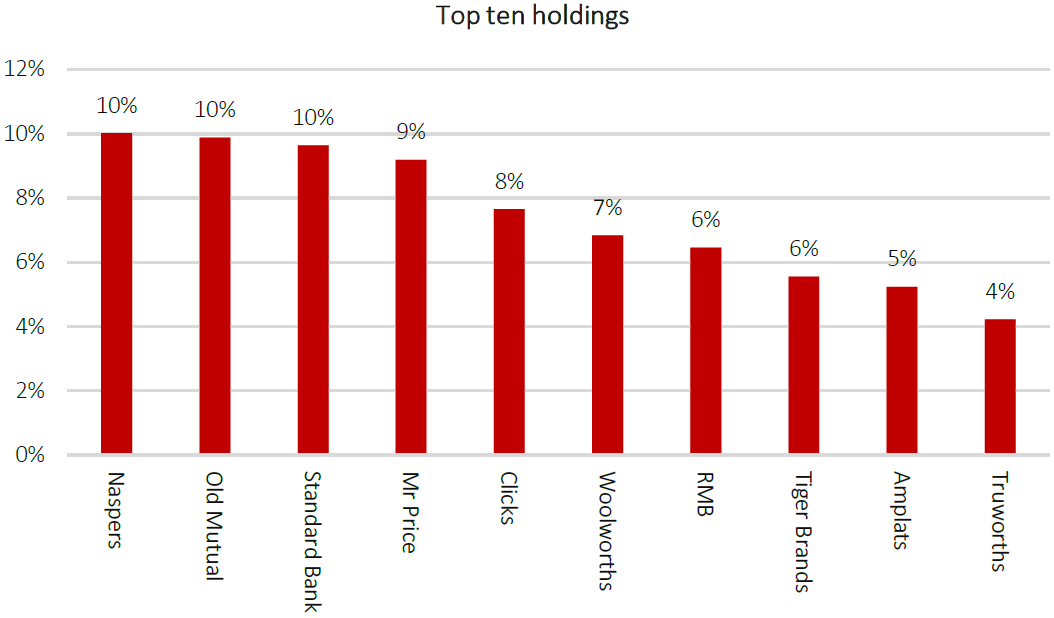

Top holdings: Satrix Quality SA is well-diversified with a basket of 22 constituents spread across eight JSE sectors. Notably, no single stock dominates the fund. The fund’s top 10 investments account for 70.5% of the portfolio. The fund is notably overweight SA-facing counters.

Suitability: The ETF is aggressive and ideal for investors with a medium- to long-term investment horizon. Single-factor funds tend to exhibit cyclicality in their performance. Hence it may be wise to combine Satrix Quality SA with other factors such value, size and low volatility.

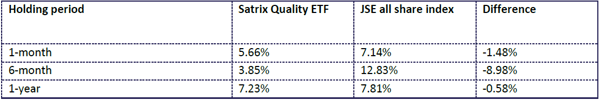

Historical performance:

Net asset value performance to end-June 2019

Fundamentals: Satrix Quality SA is heavily linked to the performance of the local economy due to its large exposure to SA-facing stocks. As a result, it requires a strong resurgence in the domestic economy for its constituents to thrive and to be viewed favourably by investors. This seem unlikely in the short to medium term with the economy projected to remain in the doldrums. The South African Reserve Bank expects GDP growth for 2019 to average 0.6% and 1.8% and 2% for 2020 and 2021 respectively.

Click logo to view

Satrix Quality SA ETF on EasyEquities

Given such forecasts, sentiment towards local counters is likely to remain depressed, which could hurt the fund’s performance. However, the low valuations in local stocks create attractive entry points for the Satrix Quality SA ETF, which long-term investors may want to take advantage of. What is encouraging is that it holds quality counters in good financial standing and which can weather the storm. Satrix Quality SA ETF is also exposed to the rand exchange rate and global economy through Naspers and some mining counters.

Fund statistics

Alternatives: Satrix Quality SA has no direct alternative. It is the only ETF that applies the quality methodology on the JSE.

Invest in

Satrix Quality SA ETF

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read the 2017 -

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Guide to recommendations

A buy recommendation is made where the target price is 10% above the current price, a sell when it is 10% below the current price, and a hold recommendation when it is within 10% of the current price. The risk measure is a subjective determination guided by the beta of the share price. We also examine the financial and operating leverage of the business. ©This document is copyrighted by Intellidex (save for information contained in this document provided by third parties which may be copyrighted to them) and may not be distributed in any form without the express prior written permission of Intellidex.

Analyst declaration

The research analyst who prepared this report (or a member of his/her household) has no financial interest in the securities, or derivatives thereof, issued by this company.