Growth in international markets slowed as US-China trade tensions escalated and fears of global economic slowdown increased. However, most asset classes delivered positive returns. The MSCI World index jumped 1.2%, thanks to growth in developed markets which more than offset losses from most emerging markets. Global government bond indices posted modest gains.

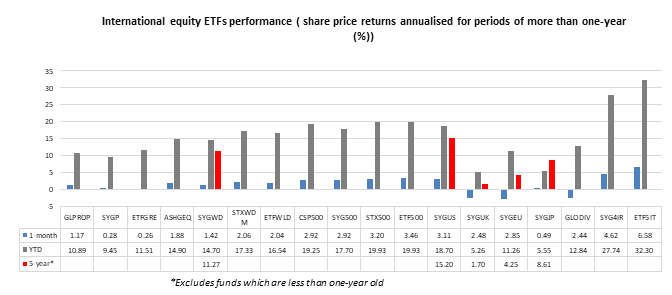

JSE ETFs tracking international equities and bonds fared better than their counterparts that track domestic stocks. Cloud Atlas Africa Real Estate ETF, which tracks property stocks in Africa excluding SA, had the best performance with a return of 17.32%. The fund is now up 11.08% this year. Stanlib S&P 500 Info Tech Index Feeder came second with a return of 6.58% (year-to-date: +32.3%). Cloud Atlas AMI Big50 ex-SA ETF, was the worst performer with a loss of 10.4% followed by Sygnia EU (-2.8%) and Sygnia UK (-2.5%).

The Global view

The performance of international assets was shaped by numerous factors including a rate cut cycle which is in motion for many economies, US-China trade relations, Brexit and economic data from some major economies. The US Federal Reserve followed many other central bankers and delivered a widely expected interest rate cut on the last day of July.

The European Central Bank gave strong hints that an easing package is on the way. The EU concluded nominations of its leaders for many of the top jobs in Brussels. Perhaps the most consequential outcome for investors was the nomination of Christine Lagarde to take over from Mario Draghi as ECB leader at the start of November. Lagarde is largely viewed as dovish and hence is expected maintain the accommodative stance on monetary policy.

(Image source: Shutterstock)

In the UK, the appointment of Borris Johnson as British prime minister saw the pound coming under pressure as investors fret over the likelihood of a no-deal Brexit. The US economy grew an annualised 2.1% in the second quarter of 2019, ahead of an expected 1.8%, following a 3.1% uptick in 2019Q1. Contrarily, China's GDP growth in the second quarter slowed to 6.2%, its lowest growth since 1992.

On the international markets, asset prices are likely to be supported by accommodative monetary policies. However, we expect to see some volatility being driven by the trade tensions between the US and China. This outlook argues for a balanced portfolio with local and offshore assets. Tactically, investors can go overweight in dividend-focused ETFs, quality ETFs and foreign ETFs.

ETFs featured

We have split international equities into developed and developing markets:

Developed:

For core international exposures, we like the Satrix MSCI World Equity Feeder ETF (up 2.06% in July, and 17.33% up YTD), and the Ashburton Global 1200 Equity ETF (up 1.88% and 14.9% in July and YTD respectively) due to their extensive geographic diversification. Satrix MSCI World beats Ashburton Global 1200 Equity ETF on costs.

Other more focused international equity themes include property and technology funds. These are worth considering for tactical or other investor-specific reasons.

Click logos to view ETFs

Emerging:

Here we choose the Satrix MSCI Emerging Markets ETF (down 1.25% in July, 6.29% up YTD) as our core portfolio for developing markets exposure. It invests in a wide range of emerging economies including some of the fastest-growing markets like China and India. The Cloud Atlas AMI Big50 (-10.4%), which focuses on African equities, can be used as a satellite fund to the core Satrix MSCI Emerging Markets fund.

Click logos to view ETFs

There's plenty more from where that came from. The team at Intellidex have more insights for the month of August. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.