The dim global outlook at the beginning of the year characterised by heightened China-US trade tensions and slowing growth looks like it is now in the rear-view mirror. Prospects are set to improve as the trade negotiations are progressing well between the two economic giants. Also, there seems to be more global cohesion to stimulate growth using both monetary and fiscal tools. If this is augmented by a China-US trade deal it could propel global equities for the rest of the year.

March (which is the focus of this review) accounts for only 0.8 percentage points of the all share index’s first-quarter gains. The S&P500 gained 1.8% in March. The equally weighted portfolio of JSE listed ETFs, excluding commodity ETFs, rose 2% while Intellidex’s portfolio underperformed, edging up 1.4%.

The Global view

Global equities were lifted by a dovish stance from the US Federal Reserve, positive trade talks between China and the US and the Chinese fiscal stimulus which is beginning to pay off.

In China, both manufacturing PMI index readings eclipsed the 50-point mark (which separates expansion from contraction) in March from less than 50 in the previous two months.

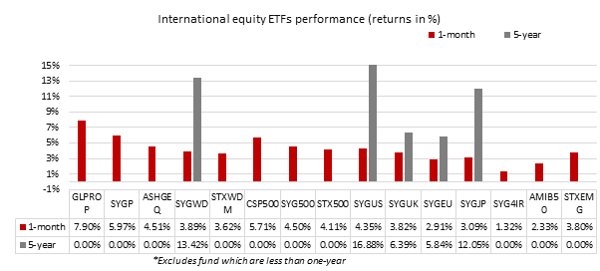

JSE funds that track companies listed on international stock exchanges were further buttressed by the weakening rand. International property and tech funds were impressive. Coreshares S&P Global Property rose 7.9% while Stanlib S&P 500 Info Tech and Satrix Nasdaq 100 increased 6.89% and 6.28% respectively.

ETFs featured

We have split international equities into developed and developing markets:

Developed:

In this category we like the Satrix MSCI World Equity Feeder ETF (up 3.62% in March), and the Ashburton Global 1200 Equity ETF (up 7.03%). They diversify their exposure across the US, Europe, Japan, Canada and Australia. With more than half of the funds invested in US stocks, investors will still have substantial exposure to the US.

Satrix MSCI World beats Ashburton Global 1200 Equity ETF on costs. Other more focused international equity themes include property and technology funds. These are worth considering for tactical or other investor-specific reasons.

Click logos to view ETFs

Emerging:

The choice in this segment is limited to two funds: Satrix MSCI Emerging Markets (up 3.08%) and the Cloud Atlas AMI Big50 (up 4.16%). Unlike the Cloud Atlas fund which invests in African stocks only, the Satrix fund invests in a wider range of emerging economies, including some of the fastest-growing markets such as China and India. In addition, the fund is the cheapest within its category, boasting a TER of 0.4%.

Click logos to view ETFs

There's plenty more from where that came from. The team at Intellidex have more insights for the month of April. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.