Capitec (CPI)

The year is 2001 and much like the original “Fab Four” back in the day major banking in South Africa thought it would live on forever with no competition in sight. Oh boy were they wrong. Enter Capitec, a low-cost bank which would cater to the masses.

Capitec certainly changed the face of banking over the last 18 years and has risen to be the second largest retail bank in South Africa based on clients. Recently when other banks announced fee increases Capitec said it would be cutting fees. Mostly due to stay competitive with the new kids on the block like TymeBank and Discovery Bank.

Chart below shows Capitec performance (pink) in relation to all the other major banks over a 12-month period.

Source - Bloomberg

Earnings and Outlook

Looking at the latest earnings results from Capitec, the bank Headline Earnings Per Share (HEPS) were up 19% to 4577c with a total dividend per share higher by 19% to 1750c. The last day to trade cum dividend is 15 April 2019 with payment date scheduled for the 23rd of April 2019.

Looking forward, some factors to consider are that in relation to other banking institutions, Capitec Bank might be over valued at this stage of the cycle with a Price to book (P/B) ratio of 7.44.

Chart life

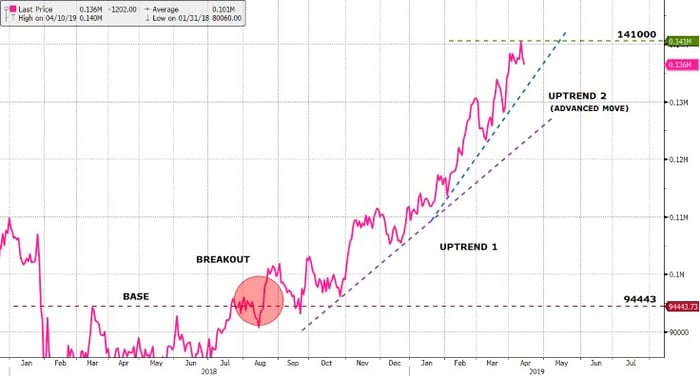

The outlook for Capitec might be mixed at this stage of the race. Technically, the stock might just gain more momentum as greed sets in which can drive the price even higher. To note, technically after a significant advance in price (parabolic) the price action usually returns to its mean (purple dotted line, Uptrend 1).

Source - Bloomberg

Portfolio particulars:

- Portfolio Hold (Current).

- Portfolio Buy opportunity on the side-line for now (Current).

- #WhatsTheBeef Long term Target price: will wait for possible correction (Future)

Know your company: Capitec (CPI)

- Capitec was established on the 1st of March 2001 with its International partners including MasterCard and Visa.

- Forbes Media released its first ever ranking of the World’s Best Banks in 2019 and Capitec was rated as the best bank in South Africa.

- Capitec runs a paperless banking system which means clients will never have to complete the same forms repeatedly.

Click logo to view Capitec

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.