Intellidex 2019 reviews: Sygnia Itrix 4th Industrial Revolution ETF

Catch this insight by Intellidex on one of the most exciting ETF themes available in local markets. Tracking stocks and instruments leading the 4th Industrial Revolution, this fund is technology-centric with exposure to offshore companies. This ETF should be considered by investors with a stomach for risk, and have a long-term investment horizon.

Intellidex insight: The Itrix 4th Industrial Revolution Global Equity ETF brings companies that are at the front line of the fourth industrial revolution to the doorstep of local investors. The concept underpinning this fund is exciting.

The world is moving into a new phase of development. The first wave of the industrial revolution was the transition to new manufacturing processes in the period from about 1760 about 1840. This transition included going from hand production methods to machines. Then came the second wave which was driven by use of new sources of energy such as oil and electricity in the manufacturing processes which led to mass production, led by Ford revolutionising manufacturing with sequential production. The third industrial revolution saw the introduction of computers, the internet and new information communication technologies.

The 4th industrial revolution brings to life a range of new technologies such as autonomous vehicles, cleantech, drones, 3D printing, robotics, nanotechnology, smart buildings, virtual reality, cybersecurity, space and wearables, among others. Some of these technologies like self-driving cars, virtual reality games, medical diagnoses based on genome mapping and drone deliveries are already here.

The astounding scope of the breakthroughs being made by these technologies is likely to disrupt almost every sphere of life as we know it and investors’ portfolios need to be prepped for that. This ETF does that for you. Its approach for selecting companies, explained in detail under fund description, is robust. And its performance so far has also been impressive. However, The Itrix 4th Industrial Revolution Global Equity ETF does not come cheap: it has a total cost of 0.73%.

Fund description: The Sygnia Itrix 4th Industrial Revolution Global Equity ETF track the novel Kensho New Economies Composite Index (KNEX), which is compiled by Kensho, a US analytics company funded by Goldman Sachs, Google Ventures, Accel Partners and CNBC, among others. The index uses an algorithm to short list companies based on a word search of the company’s regulatory filings. Short-listed companies are further scrutinised before being included in the index. It includes companies identified as being the main drivers of the business strategy in the New Economy; that have a market cap of at least $100m and should have high liquidity – that is, its shares should be easy to buy or sell.

Click logo to view

Sygnia Itrix 4th Industrial Revolution Global Equity ETF

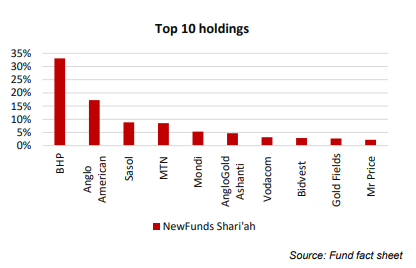

Top holdings: The Sygnia Itrix 4th Industrial Revolution Global Equity ETF’s top 10 holdings are dominated by industrial and tech companies. However, it compensates for this by investing in many stocks across different geographies. About a quarter of the fund’s assets are in non-US companies. Overall, the fund is skewed towards growth companies.

Suitability:The ETF’s bias towards innovative companies, some of which are not yet profitable, makes it riskier than most equity ETFs. Therefore, this fund should be considered by investors with a stomach for risk and who

have a long-term investment horizon.

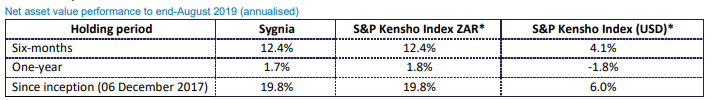

Historical performance: The fund’s overall returns are quite impressive but note that the rand returns far outstrip the dollar returns, meaning much of the gains were due to rand weakness against the dollar.

*Price return; Source: August 2019 fact sheets

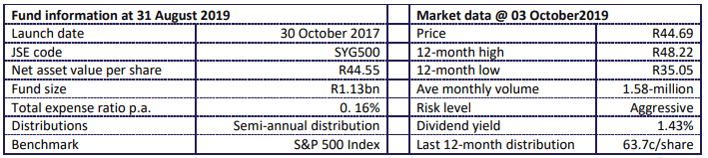

Fundamentals: The Sygnia Itrix 4th Industrial Revolution Global Equity ETF invests in offshore companies that give it some rand hedge qualities. Whenever the rand weakens the ETF’s net asset value rises and vice versa.

The ETF is well positioned to benefit from the rapid advance of the fourth industrialisation. Market analysts estimates that while up to 800-million people may be displaced by automation by 2030, the technology sector and digital work are expected to contribute $2.7 trillion to global GDP by 2025. With more than 350 companies at the forefront of research and development in its portfolio, the Sygnia ETF has a high chance of holding the next Microsoft or Google.

Click logo to view

Sygnia Itrix 4th Industrial Revolution Global Equity ETF

The global economy is expected to remain on a moderate growth path, albeit softer than 2018. The Organisation for Economic Cooperation and Development is forecasting global GDP growth of 2.9% this year and 3% next year. The IMF is a bit more optimistic with projections of 3.2% this year and 3.5% next year, while growth in the US is expected to remain above 2% in both years.

Risks include escalating trade tensions between China and the US and the US mid-term elections next year which could significantly change the global political and economic landscape.

Fund statistics:

Alternatives: The fund’s indirect alternatives are the Satrix Nasdaq 100 ETF with a total expense ratio of 0.48% and Stanlib S&P 500 Feeder ETF (TER 0.27%).

Click below to view

Sygnia Itrix 4th Industrial Revolution Global Equity ETF

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.