Initial public offer: Satrix MSCI World ETF

Although Satrix has the oldest index tracking ETF in SA, it has seen the market become more competitive over time, with many newer, often sexier funds, such as international ETFs that allow investors to circumvent exchange control limits. It is now stepping up its game. After listing two new ETFs earlier this year, the fund manager has added three global ETFs to its product suite. These provide local investors with low-cost access to the world’s major indices via their local stockbroker, on a real-time basis, with no offshore intermediaries involved. It has launched an emerging market fund, which we covered last week, that is the first of its kind on the JSE but the other two, MSCI World and S&P 500, compete head on with existing ETFs offered by other fund managers.

This week we focus on the Satrix MSCI World ETF. It is similar to Sygnia’s DB x World ETF (formerly run by Deutsche Bank) as they both track the same benchmark, the MSCI World index. However, pricing is likely to become a differentiating factor: Satrix forecasts a total expense ratio of 0.35% a year, which is almost half of DB x World’s 0.68% as at end-May. Another technical difference is that the Satrix MSCI World ETF will automatically reinvest dividends, while the DB x World ETF makes semi-annual distributions.

The MSCI World index represents large- and mid-cap companies across 23 developed markets globally. However, US companies command the lion’s share, constituting more than 59% of the fund. Besides diversifying your fund by country and currency, this fund also gives you exposure to various industries – such as information technology – that are underrepresented in traditional South African funds.

Unlike the emerging market ETF which offers potentially higher growth, this fund offers stability through developed market currencies. Historically, most of the fund’s returns have come from exchange rate gains, but in today’s environment it offers relatively higher underlying economic growth than SA.

How to participate

The initial public offering (IPO) opened on 30 June and will close on 17 July. During this period investors can buy shares directly through their broker such as EasyEquities or through Satrix ETF platforms. The ETF is expected to be listed on the JSE on 25 July.

Suitability

South African investors are typically overexposed to high-risk emerging markets; this ETF is ideal for a long-term investor looking to diversify, or simply to increase exposure to developed markets.

What it does

The Satrix MSCI World ETF aims to replicate the performance of the MSCI World index, which represents large- and mid-cap companies across 23 developed markets globally. The index covers approximately 85% of the free float-adjusted market capitalisation of developed markets.

Advantages

Although invested offshore, this and other global ETFs are considered local assets, which means investing in them will not affect your offshore asset allocation limit of R10m a year. It provides cheap, easy access to developed market companies, providing an ideal way to diversify your portfolio globally.

Disadvantage

Overdiversification may inhibit return performance. The fund has 1,656 constituents, which makes it difficult for big moves to occur, either up or down.

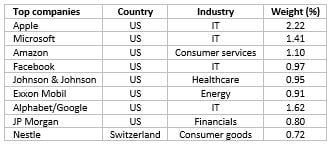

Top holdings

The top 10 companies of the fund make up 10.7% of the fund, reflecting the fund’s extensive diversification when compared with ETFs that house JSE-listed companies. Overall the fund is dominated by US companies. In terms of sectors, financial stocks are the most widely held at 17.2% of the fund, followed by IT companies with 16.1%.

Risk

This is a pure equities investment, so the performance is potentially volatile, although the extensive diversification will reduce the volatility. Investment in this fund exposes you to a number of risks including general market risks, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

Fees

The Satrix MSCI World ETF is expected to have a total expense ratio of 0.35%, way cheaper than its peer, DB x World, at 0.68%.

Performance

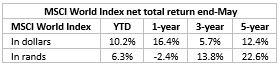

The index has performed phenomenally in the past five years in rand terms due to the depreciation of the rand. However, rand returns have shrunk as the rand has recovered since the beginning of 2016.

Alternatives

DB x World ETF, which had a total expense ratio of 0.68% a year as at end-May.

BACKGROUND: Exchange Traded Funds

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Click here for other Satrix IPO listings

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.