As competition for the growing market of indexed products intensifies, Satrix, SA’s oldest ETF provider, is stepping up its game. After listing two new ETFs earlier this year, the fund manager is planning to add three global ETFs to its product suite. These provide local investors with low-cost access to the world’s major indices via their local stockbroker, on a real-time basis, with no offshore intermediaries involved.

This note, on the Satrix MSCI Emerging Markets ETF, is the first of three looking at the three new Satrix ETFs. The Satrix Emerging Markets ETF is the first on the JSE to invest in emerging markets indices. The term “emerging markets” was coined by economists at the International Finance Corporation in 1981, when the World Bank subsidiary was promoting the first mutual fund investing in developing economies. Since then, references to emerging markets are widely used but definitions vary widely. There are several different ones on offer, as a Google search quickly shows. A definition we’re comfortable with is that an emerging market is a country with growth potential that has some characteristics of a developed market, but does not meet the size and infrastructure levels of a developed market.

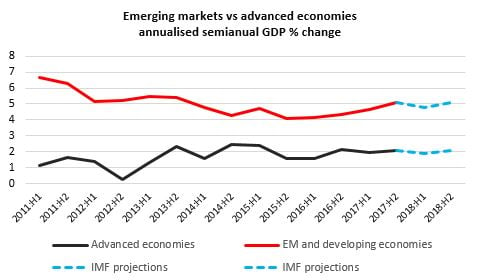

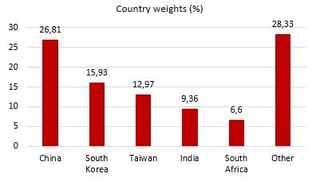

The bulk of the world’s economic growth over the past few years has come from emerging markets and the IMF projects that over the next few years they will produce 70% of world growth, with China and India accounting for 40% of that. China and India will account for nearly 38% of the Satrix fund, giving South African investors good exposure to this growth. The graph below shows the growth from emerging markets versus advanced economies

This certainly widens the international exposures that are easily available to South Africans. The underlying index covers approximately 99% of the free float-adjusted market capitalisation of listed equities in 23 countries. It currently tracks 2,655 counters, which is a very large number, which we think leads to increased trading costs with little diversification benefit at the margin. That could be negative for overall performance. The ETF is also unlikely to give investors the rand hedge qualities that you are likely to find from other foreign ETFs that invest mostly in advanced economies because of the positive correlation between emerging market currencies and the rand. However, given that South Africa is in a recession and growth prospects for most emerging markets are significantly better, there may be a decoupling between South African and other emerging markets’ performance.

How to participate

The initial public offering (IPO) opened on Friday and will close on 17 July. During this period investors can buy shares directly through their broker or through Satrix ETF platforms. The ETF is expected to be listed on the JSE on 25 July.

Suitability

The ETF is ideal for someone looking for diversified exposure to emerging markets.

What it does

The Satrix MSCI Emerging Markets ETF aims to replicate the performance of the MSCI Emerging Markets Investable Markets Index, which captures companies across 23 countries. The index currently tracks 2,655 counters.

Advantages

Although invested offshore, this and other global ETFs are considered local assets, which means investing in them won’t affect your offshore asset allocation limit of R10m a year. The provide cheap, easy access to emerging market companies which provides a way to diversify exposures.

Disadvantage

Returns from underlying stocks are not encouraging. The index returned 7.9% in rand terms per year over the past five years. The high number of stocks in which it is invested may inhibit performance.

Top holdings: The fund is concentrated in Asia with at least 56% of holdings in that continent. SA accounts for less than 7% of the fund, which is good for investors with portfolios highly concentrated in SA. In terms of sector exposure, almost a quarter of the fund is in technology stocks. Financials account for 22% followed by consumer discretionary companies with 12%.

Top holdings: The fund is concentrated in Asia with at least 56% of holdings in that continent. SA accounts for less than 7% of the fund, which is good for investors with portfolios highly concentrated in SA. In terms of sector exposure, almost a quarter of the fund is in technology stocks. Financials account for 22% followed by consumer discretionary companies with 12%.

Risk: The performance of the fund may be affected by changes in economic and market conditions, political developments, changes in government policies or changes in legal, exchange control, regulatory and tax requirements.

Fees

The Satrix Emerging Markets ETF is expected to have a total expense ratio of 0.45%, which will be far cheaper than most foreign ETFs on the market.

Performance

The historical performance of the underlying index isn’t too impressive: it returned 7.86% a year over the past five years.

Alternatives:

There is no close alternative to this ETF but investors may consider AMI Big50 ex-SA ETF Atlas, which invests in both emerging and frontier markets in Africa. Frontier markets are developing countries with slower-growing economies than emerging markets.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.