Intellidex Reviews: RMB MidCap (Now Ashburton)

Research bought to you by intellidex

Researching Capital Markets &Financial Services

Website

Suitability: The RMB MidCap ETF is ideal for investors with a long-term investment horizon (more than five years) who can tolerate short-term but relatively elevated volatility. The ETF provides exposure to the JSE’s 60 biggest companies after the top 40.Empirical studies show that the mid-cap stocks have a higher risk profile than large caps (the JSE top 40 in SA’s context), and the implication is that it should be compensated by relatively higher returns. Although mid-caps are positively correlated to both large- and small-caps, research in developed markets shows they produce better risk-adjusted returns than either. Mid-caps provide the best of both worlds: they have more robust potential growth characteristics than large-caps and less risk (and more liquidity) than their small-cap peers. RMB MidCap is a well-diversified portfolio containing 60 stocks which mitigates the risk to an extent.

Including mid-cap exposure in a portfolio is a proven diversifier for increasing returns while minimising risk, given their favourable risk-reward characteristics. Overall, as an equities asset class, the ETF produces above-inflation returns and performs better than bonds and cash over long periods.

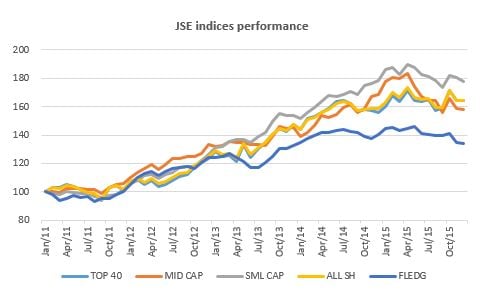

It must be noted however, that recently the JSE mid-cap index has underperformed both the large-cap (top 40) index and the small-cap index. Typically though, RMB MidCap is suitable for investors seeking above-average growth and general market exposure through a well-diversified equity portfolio at low cost.

What it does: The RMB MidCap ETF provides investors with exposure to the 41st to 100th largest companies on the JSE in terms of market capitalisation. Its returns are linked to the performance of the FTSE/JSE MidCap Index. The ETF tracks the component equities of the index in proportion to the index weightings. It pays a quarterly distribution to investors which is made up of any dividends or interest earned from the underlying shares. On 30 November, JSE mid-caps represented about R1.4trillion (or 12.5%) of the JSE’s total market capitalisation. They are reasonably distributed such that there is no one dominant firm, in contrast to the top 40 index which is very top heavy.

The RMB MidCap ETF may lend out its underlying assets against collateral. The income generated from scrip lending is applied to the fund to reduce fund expenses and there are some opportunities for investors in the ETF to lend their long exposures out in the same way.

Although it is by default a long-term buy-and-hold (passive) instrument, it can be traded actively by sophisticated investors. An investor can take advantage of intra-day price movements and low management fees for short-term trades.

The fund is rebalanced quarterly in line with the FTSE/JSE index rebalancing methodology.

Advantages

- In the long run will theoretically outperform other major asset classes such as bonds and cash

- Lower volatility than small-cap stocks

- More growth opportunities than large-cap stocks

- Well diversified with biggest holding accounting for only 4% of fund and the smallest for 1%. This reduces individual stock idiosyncratic risk

Disadvantages

- Huge exposure to the stagnant SA economy coupled with a weak rand. Although some of the companies in the index have international operations, the foreign earnings contribution is small compared to the top 40 stocks.

- There is a structural cap on performance in that if a mid-cap company enjoys fantastic growth, it falls out the mid-cap index and moves into the top 40.

Top holdings: The top 10 holdings constitute 35% of the overall portfolio while top 10 sectors take up 78%. The biggest stock is 4% of the fund where the average is 1.7%. The real estate sector is disproportionately represented at about 19% of the fund.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is volatile, but the returns over time should compensate for volatility. The sectoral diversity of the constituent companies does diminish the risk to a degree.

|

Fund information at 31 October 2015 |

|

Alternative ETFs |

||

|

Launch date |

August 2012 |

|

Annualised 3- year return |

|

|

JSE code |

RMBMID |

|

Not available |

|

|

Net asset value per share |

R6.88 |

|

|

|

|

Fund size |

R123m |

|

|

|

|

Last distribution |

3.27c |

|

|

|

|

Management fees p.a. |

0.50% |

|

|

|

|

Total expense ratio p.a. |

0.68% |

|

Divergence*** |

|

|

Liquidity |

Daily and intraday trading |

|

Not available |

|

|

Distributions |

Quarterly |

|

|

|

|

Benchmark |

FTSE/JSE MidCap index |

|

|

|

|

|

|

|

||

|

Market data |

|

|

|

|

|

Price |

R 6.61 |

|

|

|

|

12-month high |

R 7.97 |

|

|

|

|

12-month low |

R 6.41 |

|

|

|

|

Ave monthly volume |

1.28-million |

|

|

|

|

Risk level |

Medium to high |

|

|

|

|

Dividend yield |

2.52% |

|

|

|

|

***Divergence or tracking error is calculated as the difference in the fund’s total return performance and the total performance of the index. Calculations are based on annualised 3-year returns to end-October. |

||||

Fees: The total expense ratio is 0.68%, where 0.50% goes to management fees. The balance goes to cover trust and custody fees, auditor fees and other operational expenses. Additional costs to investors associated with trading the ETF include bid-ask spreads and brokerage fees.

Historical performance: The performance of an investment in the RMB MidCap ETF depends on the method used to invest. If it is a lump-sum investment, it will mimic the ETF performance. However investing through regular instalments will see the performance lag the ETF, according to historical evidence, and the pattern is apparent in other ETFs too. So the performance described in the table below is for a lump-sum investment.

The fund has generated an annualised return of 12.6% for the past three years. It is the only ETF on the JSE which tracks mid-caps. The index’s performance runs contrary to the findings of developed market studies: for 3- and 5-year annualised returns, it has underperformed both small- and large-cap indices. However, it has exhibited less volatility than the large-cap index. Surprisingly, the small-cap index has achieved the highest return with lowest volatility. There are factors that may help explain this anomaly, which include survivorship bias and the length of period under review. In this case, survivorship bias occurs when poor performing (or failed) companies are excluded from a data set with the effect of overestimating historical results – misleadingly exhibiting high returns and low volatility.

|

Annualised returns before distributions and management fees @ 31 October 2015 |

|||

|

Investment period |

RMB MidCap |

FTSE/JSE MidCap Index |

Tracking error |

|

1-year |

6.63% |

7.40% |

-0.77% |

|

3-year |

12.58% |

13.49% |

-0.91% |

|

5-year |

n.a. |

13.89% |

n.a. |

Fundamental view : Returns on this fund are driven by the South African economy as most companies in the fund generate bulk of their income locally and represent the broad economic sectors. Thus the relatively poor performance of the mid-cap index reflects the economy’s pedestrian growth, forecast by National Treasury to be 1.5% this year and 1.7% next year.

However, the mid-cap index’s price:earnings multiple of 16 trails both the top 40’s of 18.7 and the all share index’s 19.5. This implies there is potential for a rerating, so it is possible that the performance falls in line with the findings of the research into developed markets, as mentioned above.

Property has been one of the best-performing segments of the JSE over the past few years and real estate companies make up 19% of the index. The weightings in other sectors are evenly spread.

Alternatives: There are no other ETFs on the JSE which track the mid-cap index.

Nedbank’s BettaBeta Green ETF could be loosely regarded as a peer as it contains some of the mid-cap companies It consists of a selection of stocks from the top 100 JSE-listed companies selected and weighted on both environmental and liquidity criteria. Environmental credentials are assessed with reference to the Carbon Disclosure Project and Clean Development Mechanism project databases, as supported by the United Nations. BettaBeta ETF fund has fared poorly as reflected by its 3-year annualised return of 2.4%. It has a similar cost profile with a total expense ratio of 0.65

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.