Intellidex Reviews: NewFunds Govi ETF

Research bought to you by intellidex

Researching Capital Markets &Financial Services

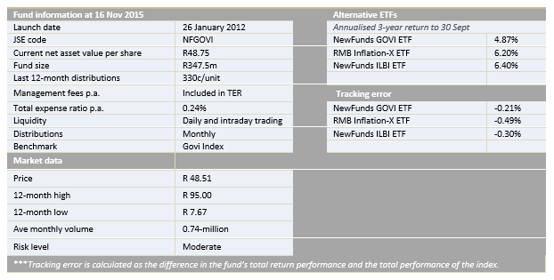

Suitability: NewFunds Govi ETF is one of the three ETFs listed on the JSE that provide investors with low-cost exposure to fixed income securities. It is suitable for investors wanting to take on minimal risk, though bonds can vary in value in response to interest rates. They can also be a good fit for a bond segment of a multi-asset class portfolio.

NewFunds Govi ETF tracks the government bond index, Govi. The ETF is the cheapest in its class and has been quite good at tracking its benchmark. It is important to note that while NewFunds Govi’s underlying investments pay periodic coupons, the fund reinvests the distributions on behalf of investors via the purchase of additional constituent securities. That means the returns are entirely in the form of capital appreciation of the ETF. For investors seeking regular income, the RMB Inflation Linked ETF does distribute dividends quarterly. Another important point is that the ETF invests in bonds that are not linked to inflation, so rising inflation can diminish the value of returns in real terms. So if you are an investor concerned with inflation risks you should consider NewFunds ILBI ETF or RMB Inflation Linked ETF.

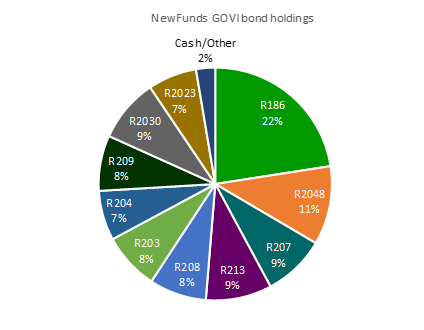

What it does: The NewFunds Govi ETF tracks the performance of the SA Government Bond Total Return Index (Govi). This index consists of bonds issued by the South African government, including only those issues in which National Treasury obliges the primary dealers to make a market. The Govi takes all bond issues by the SA government that fall into the top 10 positions of the all bond index (Albi). The selections for the Albi are based on average market capitalisation and liquidity, and only conventional listed bonds with a remaining life greater than one year throughout the quarter, are eligible.

Advantages: The main attraction of bonds as an asset class within an investment portfolio is their low correlation with stocks. Over the past decade, the Albi had a lowly correlation factor of 0.13 with the all share index. Through a single investment, NewFunds Govi provides exposure to SA’s investment-grade bonds. Absa, the issuer, provides full liquidity to enable investors to easily buy or sell units of this ETF. If there is no willing buyer or seller, Absa steps in as the counterparty.

Disadvantages: The fund is designed to replicate the performance of the Govi and does not make active bets relative to sectors, yield curve or credit quality. It is also restricted to certain government bonds, limiting its ability to provide comprehensive exposure to bonds. Corporate bonds and other issues by state-owned institutions such as Eskom and Sanral are excluded.

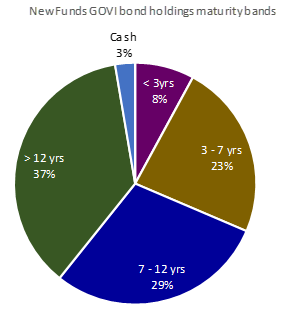

Top holdings: The fund is invested in bonds issued by the SA government with the majority of them being long-term bonds with maturities of seven years or more.

Risk: The most common risks associated with fixed income securities are inflation risk, credit risk and interest rate risk. Fortunately, all the constituents of this fund are sovereign bonds issued by the SA government which means credit risk is minimal. That said, the fund is still exposed to inflation risk and interest rate risk. Interest rate risk arises from fluctuating interest rates. As interest rates rise, bond prices fall and vice versa. The Govi currently has a modified duration of 6.3 years, so its interest rate sensitivity might be considered to be fairly moderate. That means the value of the ETF will fall 6.3% for every one-percentage point increase in interest rates.

Fees

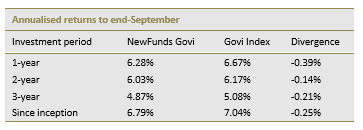

NewFunds total expense ratio is 0.24%, making it the cheapest bond ETF on the market. The fund has done quite a good job in tracking its benchmark. Since inception it has trailed its benchmark by 0.25%.

Historical performance

Over the past three years the fund returned 4.87% on annualised bases. Annualised volatility was 6%.

Fundamental view

Government bonds are traditionally seen as a safe haven in turbulent times. This is largely because they are less volatile than stocks and often their prices trend in the opposite direction to equities.

The past decade has been superb to own bonds. The Albi posted an annualised return of 8% and the IGOV, made up of government inflation-linked bonds, returned 10.1%. While these are lower than the 14% returned by the JSE top 40 total return index, the volatility of bonds of 6% is just a fraction of the 19% for the top 40 index.

Two key factors supported the performance of bonds during the period: declining interest rates and softening inflation rates. The South African Reserve Bank slashed the repo rate from 12% in 2008 to a low of 5%. Inflation on the other hand retreated from around 12% to below 3%. Now, with interest rates still near historic lows, bond prices are still relatively high. As interest rates and inflation continue to rise, bond prices will almost certainly decline. That said, the main attraction of bonds is their ability to reduce the risk in a portfolio of stocks. So despite the negative outlook on the fundamental factors that affect their short-term prices, they remain an important component of a diversified portfolio.

Alternatives

Retail investors seeking exposure to investment in fixed income assets have two other options: RMB Inflation-X ETF and NewFunds ILBI ETF.

NewFunds ILBI ETF, also issued by Absa Capital, tracks the Barclays Capital/Absa Capital South African Government Inflation-Linked Bond Total Return index of eight RSA inflation-linked bonds. All coupons received are automatically reinvested to provide a total return product. Inflation-linked bonds have an interest rate (coupon) calculated as a function of the inflation rate. Therefore, both capital and income are protected against inflation erosion. The product has an expected TER of 0,28% a year.

With the two Absa ETFs do not offer distributions, income-seeking investors might find RMB Inflation-X ETF attractive. It also provides investors with access to eight RSA inflation-linked bonds but makes quarterly distributions of interest payments to holders. The RMB Inflation-X ETFs offer a real yield of the current inflation rate plus 1,82% at present. The TER is 0,45% a year.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.