EAM is taking the world by storm, literally! Emperor Asset Management (EAM) manages some of the best performing funds around and here is a closer look at two of their bundle strategies.

Emperor Asset Management

Emperor Asset Management (EAM) runs three different strategies on the EasyEquities platform - Enhanced, Core and Thematic. In this article we focus on the Enhanced and Core Equity offering. Specifically, we are going to examine two of our most popular bundles on the ZAR platform, those are the Enhanced Equity and Core Equity bundles.

The difference between the Core range and the Enhanced is that Core only invests in ETFs while Enhanced invests in individual shares (and ETFs where no direct exposure is possible, e.g. foreign).

Log in to view Emperor Asset Management (EAM) bundles

on EasyEquities

-

-

Investment process and philosophy

Before we get into the analysis it is important to understand Emperor’s investment process and philosophy. We are a data driven, algorithmic asset manager. What this means is that we utilize technology to sift through and analyze data in the market, this can be both technical stock market data such as changes in price and volatility and could be fundamental data such as changes in companies’ free cash flow generation, book value, reported earning etc.

This analysis is then used to create our building block portfolios. The Value approach is a contrarian strategy that profits from the mean reversion after large market dislocations that push prices away from fair value. The Quality Building Block Portfolio focuses on companies with earnings quality that consistently pay dividends over time and those dividends also continue to grow over time. The Stability building block Portfolio invests in companies based on their price and business riskiness. And finally, the Momentum Building Block selects companies based on their price and earnings momentum.

Enhanced portfolios and Core portfolios

We create our Enhanced portfolios by combining these algorithmically generated building blocks (the algorithm also helps determine in what proportion to combine each of the Building Blocks). We then create our Core portfolios by investing in ETFs that most closely resemble our Enhanced portfolios.

Now that we have gone through the fundamentals of the Core and Enhanced methodology, we can see what it looks like in practice. Note that although our Core Equity portfolio invests in ETFs only, our technology allows us to drill down to see the underlying stock holdings.

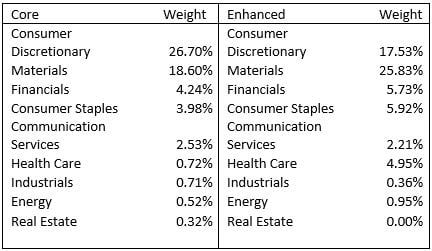

Let’s start by examining the sector allocation of the Core and Enhanced bundles.

Sector Exposure:

We can see that the two portfolios are quite similar but not totally as we are restricted due to the Core portfolio being made up of ETFs only.

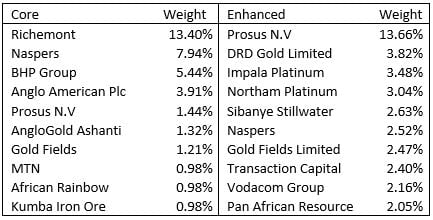

Top 10 holdings:

We need to look a bit deeper to understand exactly what is going on here. Below are the Top 10 holdings for each portfolio.

5 best performing stocks in the bundles

It is generally not a good idea to take a snapshot of a portfolio and then look back in time to see how individual shares have returned as you don’t know the historic composition of that portfolio. However, in our case we know, since this is our portfolio, we know that the current holdings are generally in line with how we have positioned the portfolio all year.

With that in mind we can use the above holdings with information as to the top performers in 2020 to date. The five best performing stock year to date in the Top 40 are Northam Platinum (168%) followed by Sibanye (126%), Gold Fields (115%), Prosus (58%) and Anglogold Ashanti (41%).

Log in to view Emperor Asset Management (EAM) bundles

on EasyEquities

Bundle performance

Both bundles have outperformed the Top 40 Total Return Index which has returned 2.41% in 2020 so far and 12.41% in 2019. In 2020 the Enhanced Equity bundle has returned 14.78% and it retuned 21.41% in 2019. In 2020 the Core Equity bundle has returned 10.73% and it retuned 15.61% in 2019.

Both the Core and Enhanced portfolios invest in international ETFs listed on the JSE (we keep our offshore exposure broadly in line, but not exactly, with ASISA mandates that govern local equity unit trusts). To boost the return of the Core portfolio we allow for a greater offshore exposure.

New to investing and want to see more Emperor Asset Management Bundles

Read: A managed portfolio to outperform crisis

We hope this has been informative. To know more about Emperor and our investment process, feel free to email info@emperor.co.za or Log on to your EE account – go under “invest Now” – Bundles – look for Emperor and enjoy!

Take note - All Performance data sourced from Bloomberg on 20 October 2020.

.png?width=2240&name=Untitled%20design%20(10).png)

Disclaimer:

Terms and conditions apply. Emperor Asset Management (Pty) Ltd is an authorised financial services provider (FSP no. 44978). The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples are for illustrative purposes only.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Shaun Krom, Chief Investment Officer of Emperor Asset Management (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.