Mining

Glencore

“Disciplined start to 2016”

Miner Glencore has maintained Marketing activities operating profit guidance for the year ending December 2016 at $2,4 billion to $2,7 billion, which compares with $2 464 million in 2015 and $2 790 million in 2014. In view of the commodity bust this past year the relative stability of Marketing is a strong underpin to the rating and a point of differentiation relative to the other mining majors.

Glencore has confirmed largely unchanged production guidance on mined commodities other than oil, which is 300 000/bbl lower or about 3%. Q1 production reflects deliberate reductions in copper, zinc, lead, coal and oil whilst nickel production from own sources was 16% higher and agricultural products’ volumes were up by 89% as a result of an improved economic backdrop in Argentina and the acquisitions of Becancour in Canada and Warden in America last year.

The disciplined approach has been supportive of copper with the price now 12% below the average for calendar 2015 and at $2.12/lb above the lows of January. Copper production from Glencore sources was 4% down in Q1 2016 versus Q1 2015.

For 2016, I anticipate copper remaining the largest contributor to EBITDA at 35% followed by all of Marketing activities at 31%, coal and zinc at 13% apiece, nickel at 5%, with industrial agriculture and oil each on 2%.

Adjusted EBITDA for 2015 was $8 694 million, down 32%. At current spot prices together with the benefit of cost reductions, EBITDA in 2016 is likely to range between $8 100 million and $8 500 million.

Forecast annual free cash flow is over $3 billion. Net debt of $25,9 billion at 31 December 2015 will fall to $18 billion in 2016 and to $15 billion in 2017. This is net of the $15 billion in readily marketable inventories, which are near-cash. Net funding requirement is set to fall from $41 billion to $30 billion. As the dividend is suspended, cash is further preserved.

The recent deal to sell a 40% stake in Agricultural Products to Canada Pension Plan Investment Board will bring in $2,5 billion in cash. Closure of the deal will occur before year end. This was done I estimate on an EV/EBITDA multiple of 12,5x, a premium to peers. This business produced EBITDA for the year to December 2015 of $734 million and could conceivably generate EBITDA of $850 million this year.

Bids for the potential disposals of Cobar and/or Lomas Bayas could bring in another $1 billion.

On a DCF basis, I have a total valuation of $66 billion of which the marketing business is $21 billion and the mining business is $45 billion. Net of debt at $26 billion, and including the net marketable inventories, the equity value is $40 billion. Per share, this translates to or 274 US cents, 183 UK pence at $1.50/£1.00 and a rand value of approximately 3800 cents. If the debt situation falls to $18 billion in 2016 then the equity value increases to $48 billion which is 329 US cents, 219 pence and 4600 SA cents.

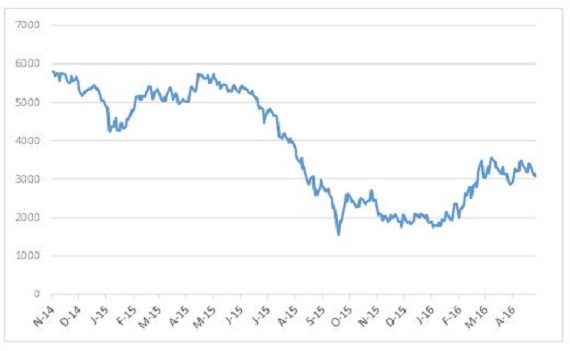

The stock has retreated to 145.6 pence from a recent high of 170.6 pence on 22 April but remains well up on lows of below 80 pence in January.

Glencore has high delta with a relatively small strengthening in commodities having a disproportionately big impact, with earnings growing ahead of the change in EBITDA.

I retain my view on Glencore as preferred mining exposure. Fair value of 183 pence and target of 219 pence. Trading Buy and Portfolio Buy maintained

Glencore share price in ZA cents