The role of Scarcity as a determinant of value

Drawing parallels between a drunk (and his dog) to Bitcoin, Earle Loxton presents a study to highlight that scarcity directly drives value. Continuing on his previous analogy comparing mining Bitcoin to mining gold, Earle underlines the monetary value in Bitcoin through Stock-to-Flow. Catch the presentation and the technical breakdown on this concept hosted via on medium.com below.

I’m Earle Loxton, the co-founder of Digital Currency Index, and this is a story of a drunk and his dog, but more of that a bit later. I’m an entrepreneur with a handful of successful startups under my name, ranging from engineering to health insurance and lately including fintech and investments.

You may know my co-founder a bit better: Michael Jordaan, ex-banker, now investor in start-ups like VALR, Rain Cellular and Bank Zero)

You may know my co-founder a bit better: Michael Jordaan, ex-banker, now investor in start-ups like VALR, Rain Cellular and Bank Zero)

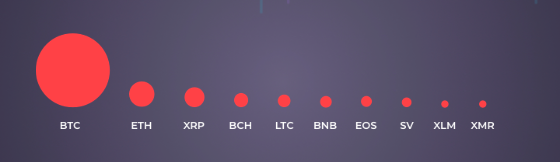

Michael and I were both intrigued by the potential of blockchain and cryptocurrencies to change the face of money as we knew it, but also that it was basically impossible to predict which protocols would eventually come out trumps. Just like the early days of the internet, it is again impossible to say which ones will be the eventual winners, hence our decision to create an investable index, and to establish the first fully regulated crypto security for South African investors.

DCX10 is a single Crypto Asset that allows our clients to securely invest in the top 10 Cryptocurrencies without the hassle of holding and balancing the individual coins in the index.

Looking back at the last 4 years, we noticed that Bitcoin, being the most significant Crypto, would always lead the charge, but that the so-called altcoins (such as Ethereum, XRP and Litecoin) would then suddenly take off as speculators presumably went searching for even higher returns.

Back testing showed that a simple market weighted index outperformed Bitcoin by a substantial margin.

For instance: Since 1 January 2016, Bitcoin is up 2130% while DCX10 is up just more than 3100%.

In a nutshell: DCX10 is a Crypto asset created on the Ethereum blockchain, also known as an ERC20 token. When a client buys a DCX10 token on our platform, our backend converts the funds into the underlying Cryptos, mints the corresponding number of tokens on the blockchain, and issues those tokens to our client.

This also means that DCX10 is fully collateralised, as they say.

But what does the future hold and could Crypto be the next Asset Class that creates generational wealth?

Since Bitcoin currently represents close to 80% of the DCX10 Index, I will limit my argument around the prospects of Bitcoin as the protagonist.

Bitcoin is the first scarce digital object the world has ever seen. It is scarce like silver and gold, and can be sent over the internet, radio and even satellite.

In the words of Satoshi:

Surely this digital scarcity has value. But how much? In the next few minutes, I will attempt to quantify scarcity using stock-to-flow, and use stock-to-flow to model bitcoin’s value. This piece is based on the work by an anonymous quantitative analyst from the Netherlands that goes by the Twitter handle OneTrillionDollar/PlanB. Welbedank!

Scarcity and Stock-to-Flow

Dictionaries usually define scarcity as; a situation in which something is not easy to find.

Nick Szabo, inventor of Bitgold, a precursor to Bitcoin and believed by many to be the illusive Satoshi Nakamoto, has this to say:

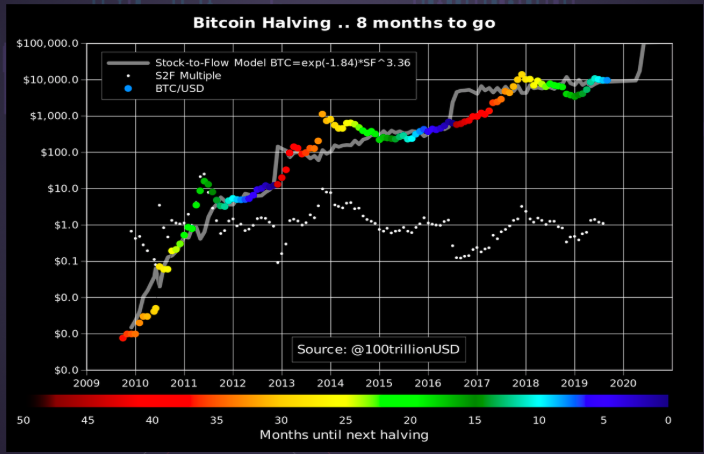

Bitcoin has unforgeable costliness, because it costs a lot of electricity to produce new bitcoins. Producing bitcoins cannot be easily faked. Note that this is different for fiat money and also for most altcoins, most of which that have no supply cap, have no proof-of-work (PoW), have low hashrate, or have a small group of people or companies that can easily influence supply etc.

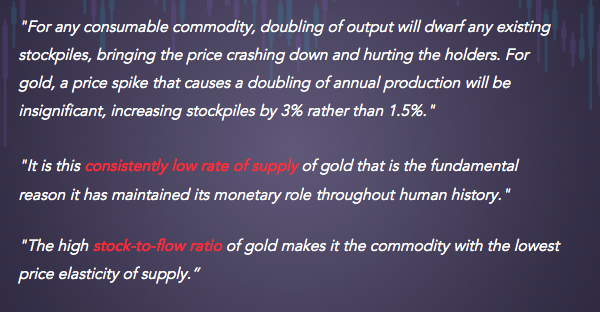

Saifedean Ammous talks about scarcity in terms of stock-to-flow (SF) ratio. He explains why gold and bitcoin are different from consumable commodities like copper, zinc, nickel, brass, because they have high SF.

So, scarcity can be quantified by Stock-to-Flow (SF).

Let’s look at some SF numbers.

Gold has the highest SF 62 - it takes 62 years of production to get to current gold stock. Silver is second with SF 22. This high SF makes them monetary goods. Bitcoin currently has a stock of 17.9m coins and supply of 0.7m/yr, equating to a SF of roughly 26.

This places bitcoin in the monetary goods category like silver and gold. Bitcoin market value at current prices is $180bn.

Supply of bitcoin is fixed. New bitcoins are created in every new block. Blocks are created every 10 minutes (on average), when a miner finds the hash that satisfies the PoW required for a valid block. The first transaction in each block, called the coinbase, contains the block reward for the miner that found the block. The block reward consists of the fees that people pay for transactions in that block and the newly created coins (called subsidy). The subsidy started at 50 bitcoins, and is halved every 210,000 blocks (about 4 years). Thats why the halvings are very important for bitcoin’s money supply and SF. Halving also causes the supply growth rate (in bitcoin context usually called monetary inflation) to be stepped and not smooth.

Stock-to-Flow and Value

The hypothesis in this study is that scarcity, as measured by SF, directly drives value.

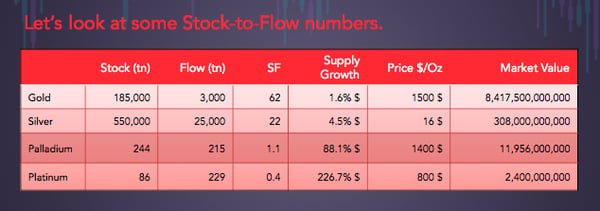

A first scatter plot of SF vs market value shows that it is better to use logarithmic values on the market value axis, because it spans 8 orders of magnitude (from $10,000 to $100bn). Using logarithmic values on the axis for SF as well reveals a good linear relationship between S2F and Market Value.

Fitting a linear regression to the data confirms what can be seen with the naked eye: a statistically significant relationship between SF and market value. The likelihood that the relationship between SF and market value is caused by chance is close to zero. Of course other factors also impact price, regulation, hacks and other news, that is why R2 is not 100% (and not all dots are on the straight black line). However, the dominant driving factor seems to be scarcity or SF.

What is very interesting is that gold and silver, which are totally different markets, are in line with the bitcoin model values for SF. This gives extra confidence in the model. Note that at the peak of the bull market in Dec 2017 bitcoin SF was 22 and bitcoin market value was $320bn, very close to silver.

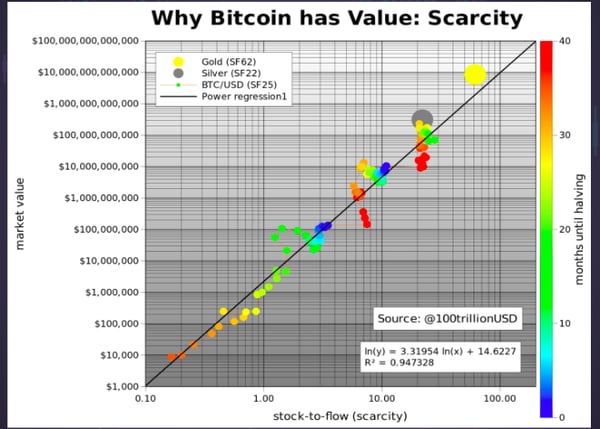

Because halvings have such a big impact on SF, months until the next halving is shown as a colour overlay in the chart. Dark blue is the halving month, and red is just after the halving. Next halving is May 2020. Current SF of 25 will double to 50, very close to gold (SF = 62).

The predicted market value for bitcoin after May 2020 halving is $1trn, which translates to a bitcoin price of $55,000.

That is quite spectacular. I guess time will tell and we will probably know one or two years after the halving, in 2020 or 2021.

You may wonder where all the money needed for $1trn bitcoin market value would come from? Silver, gold, countries with negative interest rate (Europe, Japan, US soon), countries with predatory governments (Venezuela, China, Iran, Turkey etc), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best performing asset of last 10 yrs.

We can also model bitcoin price directly with SF. The formula of course has different parameters, but the result is the same, 95% R2 and a predicted bitcoin price of $55,000 with SF = 50 after May 2020 halving.

In the chart below, Bitcoin model price is plotted based on SF (grey line) and actual bitcoin price over time, with the number of months to halving, as colour overlay. Note where SF steps up at the moment of halving (darkest blue dot).

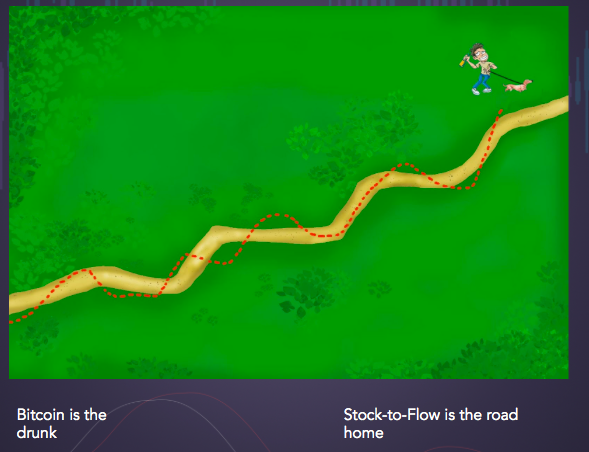

Now, as promised back to the drunk and his dog…

If we consider the value of bitcoin as the drunk then the stock-to-flow is not really the dog he walks — it is more like the road he walks on. The drunk will wander all over the road, sometimes stopping, slipping up and missing a turn here and there or even taking short cuts along the way; but generally he will follow the road home.

Simply put: Bitcoin is the drunk and Stock-to-Flow is the road home.

Parts of this article was condensed with the permission of the author PlanB — refer to https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25 for the original version.

New to the crypto markets

and want to know more about the DCX 10 index?

Read: What the ####

Digital Token FAQs can be found here for even more information

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Earle Loxton, CEO of DCX Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.