ETF Tuesday: Db x-tracker (now Sygnia) FTSE 100 Index ETF

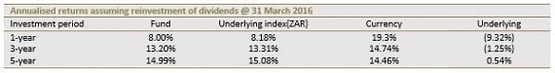

Suitability: This is our final piece in our analysis of the family of rand-denominated international ETFs offered by Deutsche Bank. Our focus for this week, the DB x-tracker FTSE 100, invests in companies listed in the UK. Similar to the rest of the DB x-tracker range, DB x-tracker FTSE 100 will perfectly fit in the “rand hedge” strategy. Returns are driven by the weakness of the rand and the performance of large UK-listed companies. Historically, most of the returns have come from weakness in the rand against the pound rather than gains in the underlying stocks. While the fund has a fantastic annualised three-year return of 13%, its underlying stocks have lost 1.25% per year over the past three years.

A call on the future performance of the rand is, however, difficult to make at the moment. The upcoming UK referendum, where voters will decide on remaining or leaving the European Union, is creating a lot of uncertainty. While there are strong economic arguments both for and against the UK’s exit, many analysts believe an exit is likely to have a significant negative effect on the pound. With those risks, we think it’s wise to be cautious and it would be better to consider investing in this fund only after the referendum on 23 June.

What it does: The fund mimics the price and yield performance of the FTSE 100 index. The FTSE 100 Index is a market capitalisation weighted index representing the performance of the 100 largest UK-listed companies which pass screening for size and liquidity. The index represents approximately 81% of the UK’s market capitalisation.

Advantages: Since the fund is rand-settled, it means you can invest in foreign stocks without any exchange control issues – it does not count against any foreign exposure limits. By buying just one rand-denominated unit of the ETF you have access to a wide portfolio of UK equities. Also, while registered in the UK, most of the stocks tracked by this fund have significant export and international operations, which increases their diversification and attractiveness.

Disadvantages: The underlying index makes use of market capitalisation to weight constituents. One potential flaw of this method is that it increases the allocation to a company’s stock as its price and valuation increases. As a result, it can lead to concentrated positions in stocks which may be overvalued.

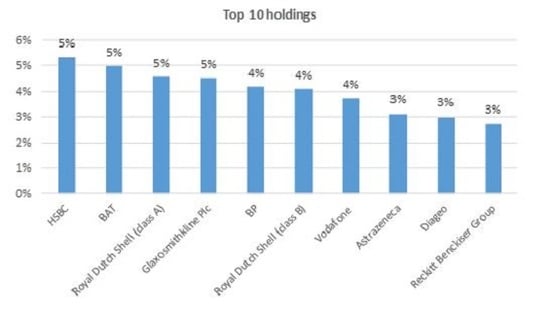

Top holdings: The top 10 holdings of this fund occupy 40% of the fund. The biggest one, HSBC, constitutes about 5%. That offers great diversification compared with most JSE-listed market cap weighted ETFs.

Fees: For the year to end-March, 0.86% of the average net asset value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. While this is slightly elevated compared with most local equity ETFs, it is far lower than what one would incur using other means of gaining offshore exposure.

Risk: This is a pure equities investment so the performance is likely to be volatile. Investment in this fund exposes you to a number of risks including general market risks and risks related to exchange rates, interest rates and inflation, as well as legal and regulatory risks.

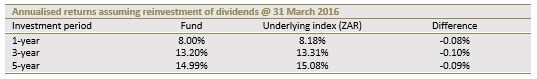

Historical performance: The fund’s performance depends on how you invest – through a single lump-sum payment or regular payments. A lump-sum investment (which tracks the index’s movements more accurately) of R1,000 made five years ago would be worth R2,010 today. The table below reflects the fund’s historical returns in percentage terms for a lump-sum investment.

Fundamental view

This investment is tantamount to taking a short (negative) position on the rand and a positive view on the both the pound and the UK-listed companies. But as shown on the table below it is the exchange rate gains that have been driving the performance of this fund.

The recovery in the UK economy since the financial crisis of 2008 has been slow relative to historical standards, but way better than most of its developed counterparts. Its growth slowed a little in 2015 to 2.2% (2014: 2.9%), but consumer spending growth remains relatively strong, helped by lower oil prices. As long as low energy prices remain low, consumer spending is expected to continue driving growth. While this outlook for the UK is good news for the UK’s equity market and this fund, most of the constituents in the ETF are multinational companies that generate substantial earnings outside of the UK. Global economic prospects are important to such counters. On that front, economic growth in China and other key emerging countries, the US Fed’s interest rate policy and the pace of the eurozone recovery have a big influence on global prospects.

Alternatives: As an alternative to this ETF, you may consider the DB x Japan, DB x USA and DB x Euro funds which invest in Japan, the US and eurozone respectively. Another option is the DB x World which diversifies across those markets and others.

BACKGROUND: Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, industrial companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the Easy Equities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Risk: This is a pure equities investment, so the performance is likely to be volatile. Investment in this fund exposes you to a number of risks including, general market risks, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

Fees: For the year to end-March, 0.86% of the average net asset value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. While this is slightly elevated compared with most local equity ETFs, it is far lower than what one would incur using other means of gaining offshore exposure.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

You can check out other ETF Tuesday posts here.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.