I’ve cautioned on exposure to retail and apparel retail in particular for many months.

Mr Price has been particularly overpriced in relation to its business fundamentals and earnings outlook and I have rated it a Trading Sell.

Mr Price, Truworths, Massmart and JSE All Share Index based to 100

As a reminder, at the current rate of interest my share buyback model indicates an EPS breakeven level of R135 per share for Mr Price. This compares with the current share price of R165 and levels of over R230 a few weeks ago. Mr Price is down 30% from recent highs and 40% lower than highs in April 2015.

At R165, the PE on the basis of my EPS estimate for the year ended March 2017 of 1055 cents is 15,6x. I am currently estimating 2% earnings growth for F2017 and have three year compound growth at 7%.

Assuming a full year dividend of 680 cents the forward yield is 4% whilst a price of R135, in line with my buyback breakeven level, entails a yield of 5%. A much weaker price therefore offers attraction for those seeking an attractive income yield.

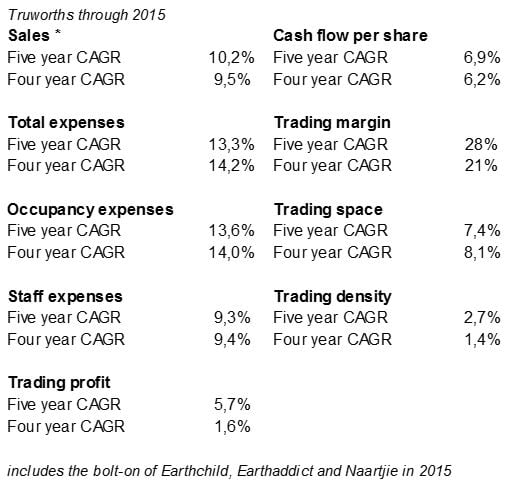

Another stock to continue being cautious on is Truworths. The metrics below are illustrative in this regard.

Expenses growth has exceeded topline and hence the declining margin and rate of growth in profit. Rental escalation is running at 7% per annum currently whilst staff costs typically rise by 8% to 9% per annum.

You need comparable sales growth to be in line with expenses for profit margins to hold up. With costs sticky and inflexible, a softer sales environment or a lack of ability to pass through price rises means negative operating leverage and lower profitability.

Truworths have repurchased shares over the years, which has assisted EPS.

If I break down the cost components of Truworths then I get like for like costs up 8,5% in a steady state situation. If sales had to grow by 6% (nominal GDP - i.e. assuming zero real growth), gross profit margin stayed the same, and other income increased by 4%, then trading profit would rise by less than 2% whilst the trading margin would fall by 1%.