Intellidex Analysis: Sygnia Itrix MSCI US

Equity markets around the globe find themselves in a bear market category year-to-date as a result of recessionary fears brought on by high inflation and high interest rates.

Sygnia Itrix MSCI US ETF (JSE:SYGUS)

Major central banks have remained unequivocal in their quest to bring inflation under control. The US Federal Reserve is on its fastest hiking cycle since the early 1980s – a period that was characterised by similar macroeconomic conditions of stubborn inflation and low economic growth. Monetary policy has been accommodative, particularly over the past decade when interest rates were virtually 0% in a bid to boost credit extended by banks and consequently consumer demand and moderate inflation. The inflation rate however remained relatively mute, partly because the lower rates fuelled stock prices.

Inflation began to tick upward towards the end of 2021 and the Fed was not alarmed as it believed that the high inflation was transitory. However, in March 2022 the Fed started to hike the federal funds rate and reassured the market that the rate hike will not hamper economic growth.

Sentiment in the market is quite bearish as the inflation rate is not budging and it appears that it will remain elevated until global supply disruptions are resolved and the war in Ukraine comes to an end. Core inflation – which excludes volatile items such as energy and food – is relatively sticky as it grew an annualised 6.6% in September from 6.3% in August. What’s more worrying for the Fed is that average hourly earnings came in at 4.98% in September, which is above the 2% target for inflation.

Among the mandates for the Fed is the need to maintain an orderly labour market and keep unemployment low. The labour market is relatively robust, which is concerning for investors as they see more room for the Fed to increase rates over the medium term. Moreover, the market is quite apprehensive given that historically, two of the last three tightening cycles have resulted in a recession. The IMF downgraded its 2022 estimate for world GDP growth to 3.2% - the lowest since 2001. The global institution cited the high interest rates and high inflation as some of the major downside risks to its forecasts. While the institution is not expecting an outright recession, it estimates that countries that account for about one-third of the world economy will experience at least two consecutive quarters of contraction. Other major economic institutions such as the OECD and World Bank are expecting slower global growth of around 2%.

|

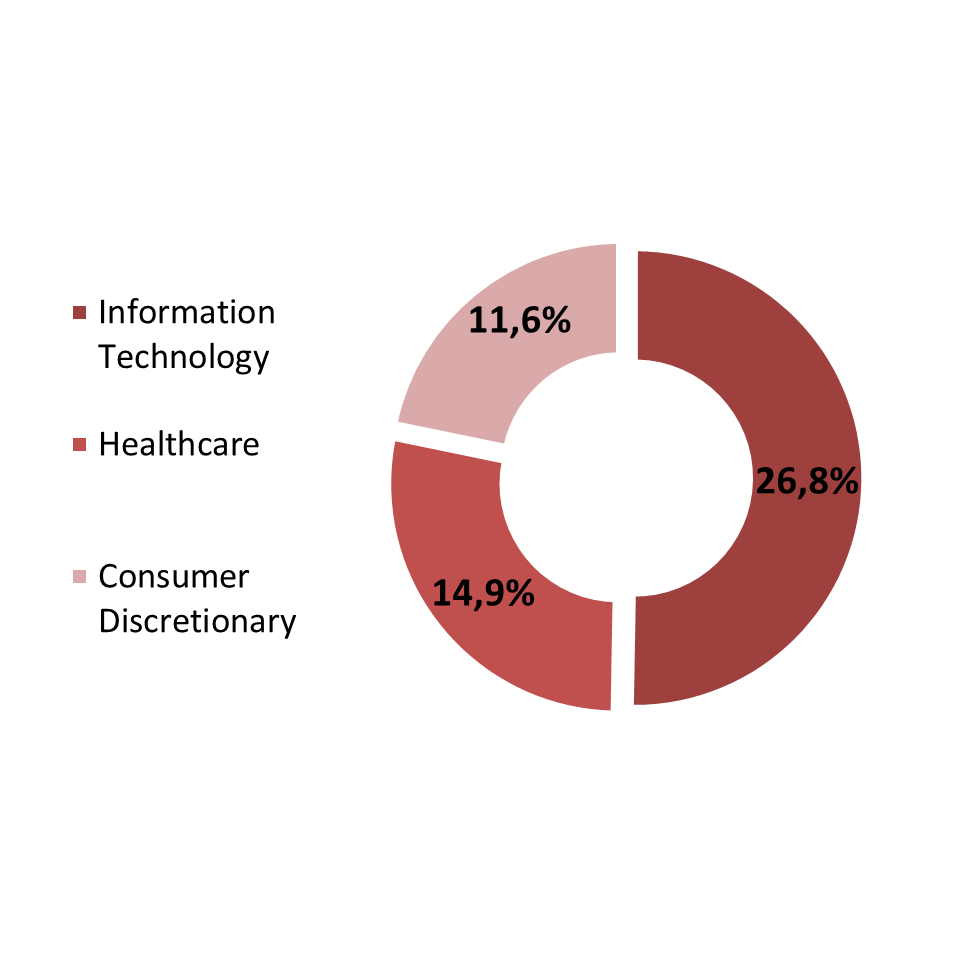

Sector allocation– top 3 (%)

|

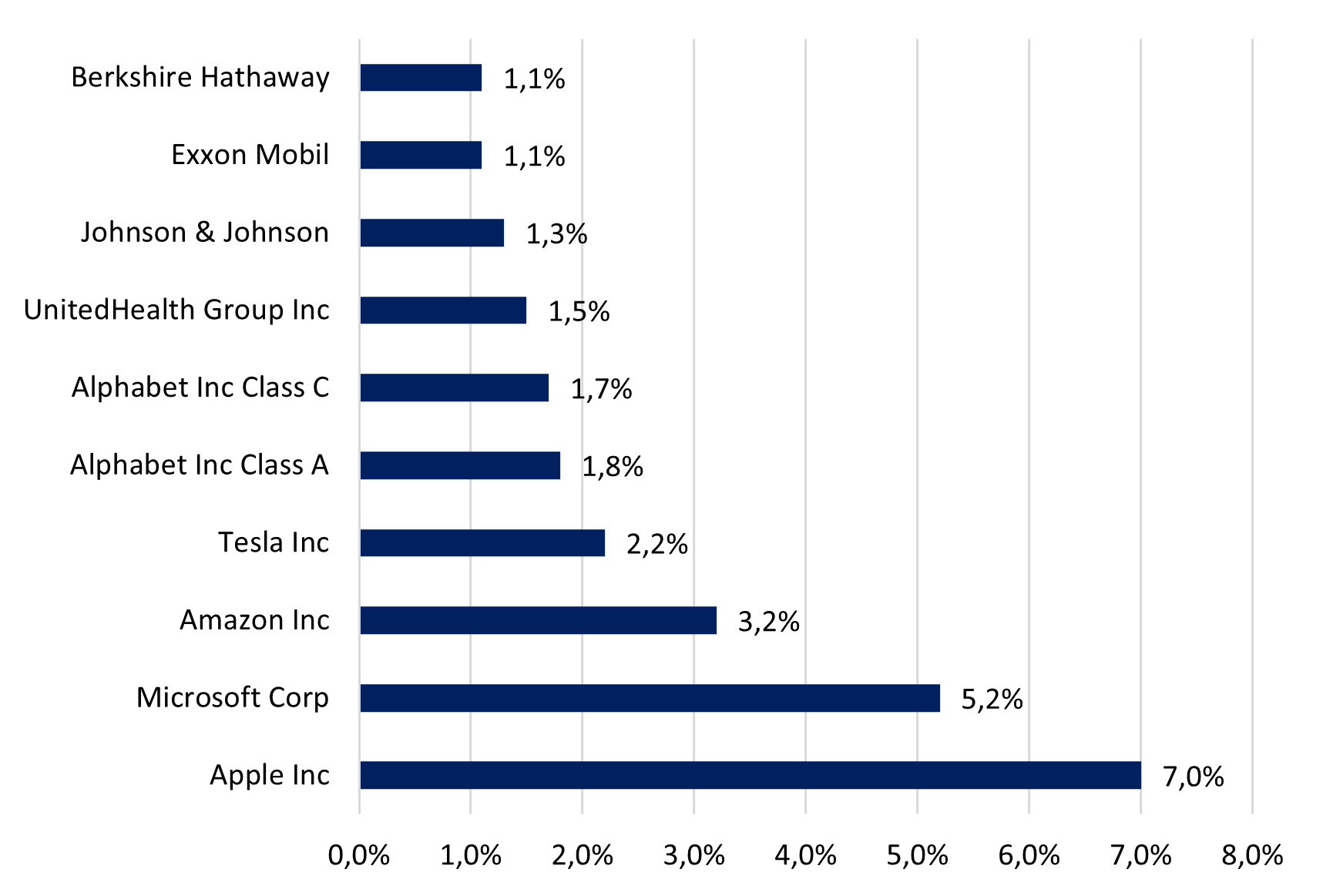

Investment approach and portfolio composition The Sygnia Itrix MSCI USA ETF tracks the MSCI USA Index to provide investors with capital and income returns net of fees.

|

|

Fund suitability

Fees

Alternative funds

Investors should consider avoiding the temptation to chase bear-market rallies based solely on macro indicators. The depressed stock prices present opportunities, particularly in the financials, defence and energy sectors. These stocks are within the Sygnia Itrix MSCI US ETF. |

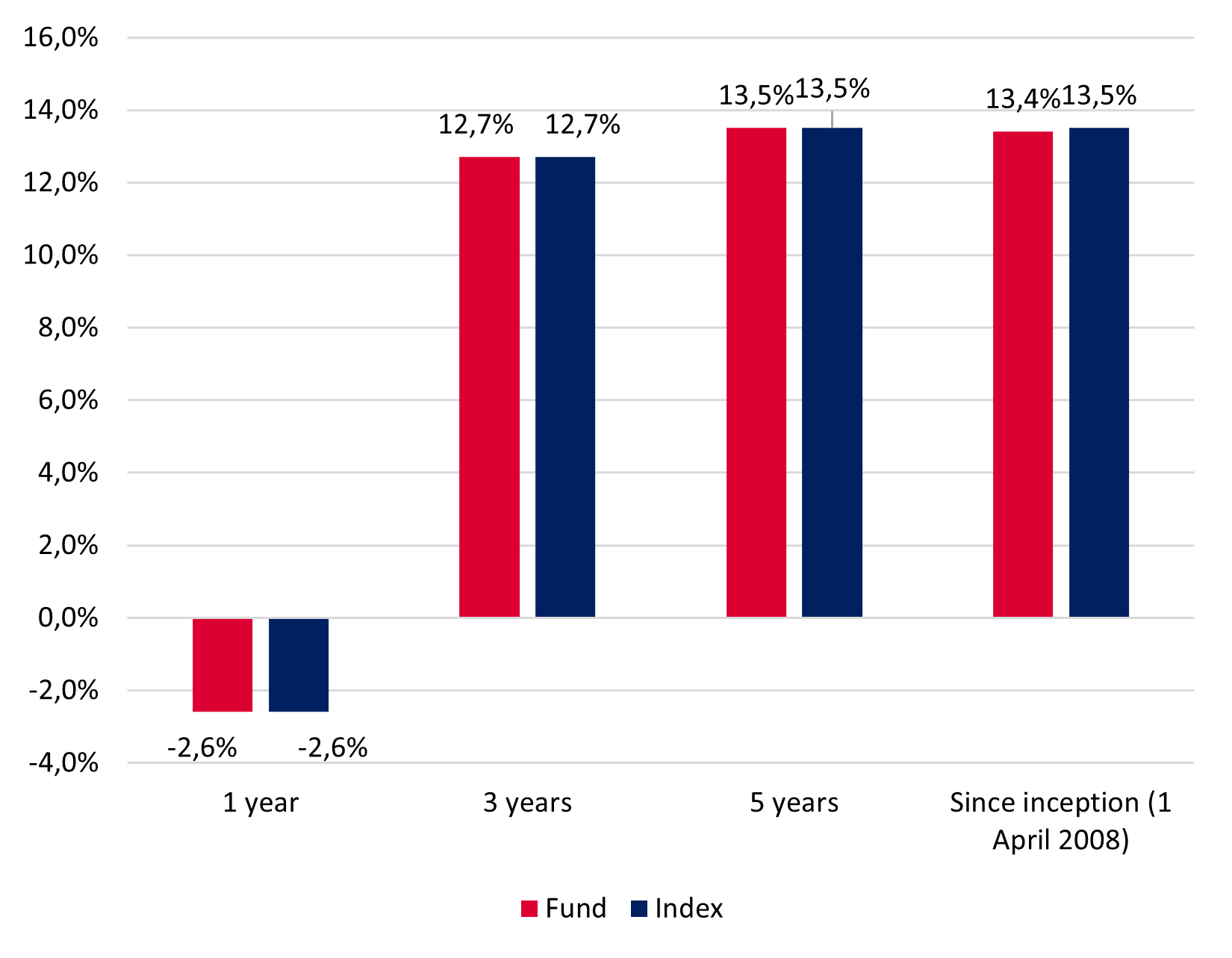

Performance Index performance to end-September 2022 (annualised for periods longer than one year; with dividends reinvested)

|

While the S&P 500 is in a bear market category, about 20% of the companies within the index have reported their Q3 earnings indicating an average increase of 8.5% in revenue, according to FactSet analysis. This is in contrast with market expectations of lower revenue growth. Morgan Stanley believes that consumer demand is relatively robust, as such, it sees more scope for companies to continue with price increases, suggesting that interest rates will be higher for longer.

Meanwhile, wall street analysts’ 2023 forecasts for corporate earnings have dropped 2% from those originally made in January 2022. This is significantly lower than the average 6% drop over the last 25 years from January through year-end.

The ETF seeks to provide investors with exposure to companies in the MSCI USA Index. Its one of the oldest ETFs listed on the JSE, evidenced by a sizeable portfolio of R5.8bn implying that it can withstand a protracted downturn. It has a tracking error of 0.06%, which signals that the fund is rebalanced frequently to match the index. It is costly though, with a total expense ratio of 0.87%.

The ETF also provides a rand hedge benefit as its returns are not only driven by the performance of the companies within the index but also the rand-dollar exchange rate.

New to investing

and want to learn more about other ETFs?

Read: Market Uncertainty ETF Picks

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.