Our friends from Intellidex shares their latest macroeconomic and equities outlook. To view the full report, click here.

Outlook of SA Macroeconomic environment

Politically, this year will see a transition from ANC internal party to external national elections. That simple statement does not convey the mad race to see what actors in the political economy can achieve going into the 2024 elections. This will challenge some prior momentum seen in 2022 (such as around energy and climate mitigation moving in the right direction), and in general we expect a marked step up in political noise masking a still slow but steady progression in reforms underneath. State owned entities will remain in focus as Eskom undergoes a leadership transition and all manner of distractions from what it should be doing (becoming a forward-looking grid operator) and Transnet will collapse much more rapidly operationally and financially, with serious consequences for many South African companies.

The economy itself will see inflation come off in H2 but remain slightly higher than consensus, and we do not see rate cuts this year. We are more optimistic on growth despite more records being broken on loadshedding, given the scale of energy investment coming. Government finances will slip back slightly from the relatively positive position revealed in last October’s medium-term budget policy statement, but still vs history remain relatively benign – in much the same way the shift from surpluses to a small deficit this year in the current account could be labelled. The real question in investors’ minds will be the post-2024 outcomes (both politically and for policy) and while baselines and market pricing may well firm slightly, we don’t foresee the surprises in 2023 that will really create certainty on what to expect in 2024.With events coming at us thick and fast into end 2022, a president practically resigning and then not, the resignation of Eskom CEO Andre de Ruyter, the president’s strengthening through an ANC conference, 2023 can’t be any more dramatic, can it? Of course, it can…

Overall SA Equities strategy

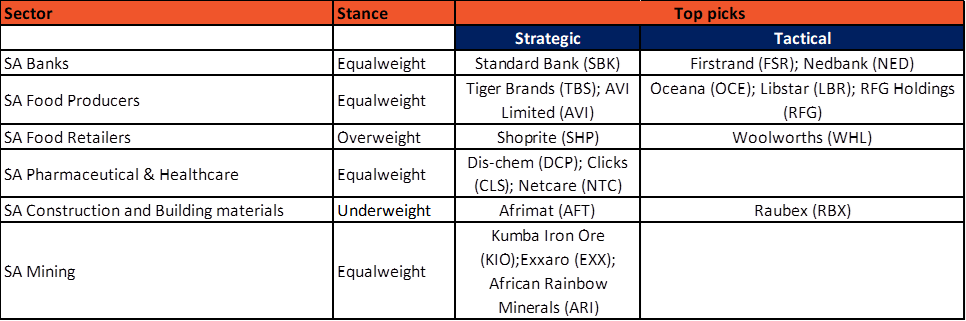

Ultimately, we believe equities strategies for 2023 should be focused on companies with solid fundamentals, which will show more resilience. Strong balance sheets with minimal debt, efficient allocation of capital, solid cash generation from operations and sustainable dividend policies – these will be the benchmarks of companies likely to outperform. The MSCI South Africa index appears undervalued compared to the MSCI World Index at 0.6x, on a PE basis, which would typically make it attractive for international investors. SA equites have a one year forward PE of 9.1x compared to 15.1x for the MSCI World Index. However, the political environment and uncertain policy environment tends to overshadow the quality of SA equities. Given the subdued growth environment in the SA economy, with added pressure from the ongoing loadshedding, companies have had to adjust business models to contend with challenges in the market. Our analysis considers both sector-level issues and company-specific issues. In the table below we show which sectors and companies which we believe should be top picks for 2023.

Sector Allocation and Top Picks

New to investing and want to know more about our other stock picks?

Read: 3 Stocks in the Era of ChatGPT

Sources – Intellidex

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by an external contributor as general market commentary and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.