Rolls-Royce is cruising in profits amid uncertainties

There's compound interest to be earned in the luxury brand!

You've probably heard of Rolls-Royce, right? It's a luxurious brand that continues to stand out beyond ordinary market conditions. It may be something to keep on your radar as earnings and sales grow amid uncertainties. Could this represent an opportunity for compound interest? as more money pours into Rolls-Royce.

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." - Albert Einstein. Since the journey to explore international markets began for many at no minimum, EasyEquities recently introduced European and London stocks. With that being said, we continue looking for opportunities that may help EasyVSTRs to continue growing their wealth

EasyGBP

Rolls-Royce Holdings PLC (RR)

It's not the automotive business you are thinking of, since the company is a subsidiary of BMW, which we'll get to 👀. Trading at £0.79 a share as of writing, Rolls-Royce Holdings is a British multinational defence and aerospace company, with a £10.9 billion revenue for the 2021 financial year, comprising 41% civil aerospace, 31% defence, 25% power systems and 3% new markets.

Given the current geopolitical tensions that have raised security concerns – where many countries started investing more in their defence, resulting in strong demand for the group – Rolls-Royce has seen significant improvement in its operations. The company reported underlying profits of £414 million (£513 million statutory), from losses the previous year, with a backlog of £50.6 billion during FY21. Commenting on the annual performance, Warren East, Chief executive officer, said:

"We have improved our financial and operational performance, continued to deliver on our commitments and created a better-balanced business capable of sustainable growth. We have achieved the benefits of our restructuring programme a year ahead of schedule, positioning Civil Aerospace to capitalize on increasing international travel. In defence, we have seen growth driven by strong demand in all our markets and in Power Systems, we achieved record order intake in the last quarter." View the full presentation here

Outlook

Given the current market conditions, the company may continue to see a rise in demand for its energy storage offerings as more customers seek alternatives to avoid high energy prices. This may help earnings move closer to where the company is trading in the long term as the company becomes a key role player in the advancement of clean energy.

Furthermore, Rolls-Royce created a new segment that will focus on opportunities introduced by the transition to net-zero. The company also said: "We expect to generate modestly positive free cash flow in 2022, seasonally weighted towards the second half of the year."

Staying on the sustainability topic, the group recently appointed Anita Frew as the first female chair in its 116 years of existence. Studies have shown that having women in leadership contributes to the sustainability and social responsibility of the overall company.

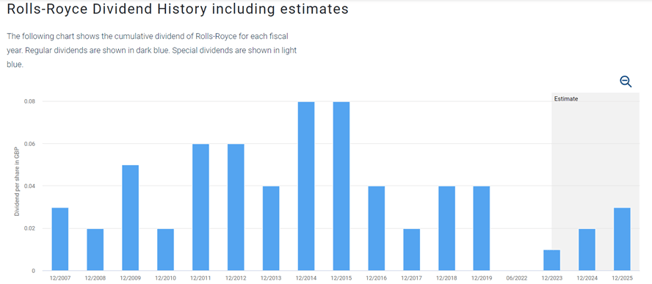

While the company may not have declared dividends, it redirects earnings to rebuild its financial performance. The group further added that it "aims to be able to recommend shareholder payments in the medium term."

Login to view Rolls-Royce Holdings PLC (RR) shares

on EasyEquities

EasyEUR

Bayerische Motoren Werke AG (BMW)

Rolls Royce is on the move financially, as the company's deliveries surpass those of other businesses in the automotive segment. As a subsidiary of BMW, Rolls-Royce motors started the 2022 year on a high note, whereby delivered units increased by 17% compared to PCP - the highest in the automotive segment.

The BMWs profit before tax as a percentage of the group of €31 billion was 39%: and while BMW may have had a 6% decline in deliveries during the first quarter of 2022 to 596k (636k Q1 FY21), the group's net profit for the period was €10 billion (€15 per share) €2.8 billion PCP (€4.26 per share).

According to the group: "In the first quarter of 2022, the automotive sector saw high global demand for automobiles on the one hand and the negative impact of ongoing supply bottlenecks for vehicle components on the other." You can check the full results here

Outlook

But beyond the name that carries weight, the company has made improvements in its management diversification, with 18.8% women of representation in management.

From a financial perspective, the current sell-off triggered by uncertainties (RIding the bear market) may present a buying opportunity as earnings start to catch up to the market price, further adding that the group is currently trading at a PE ratio of 4.7x, which may be undervalued for a company its size.

Notably, in terms of EVs, despite a decline in overall deliveries in units to 596k in the FY22 Q1 from 636k PCP, electric vehicles sales made up 15% of the deliveries - battery electric vehicle (BEV) delivers units increased to 35k in FY22 Q1 from 14k units PCP - this for one may show signs of a swift transition to the adaption of EVs for the group.

Emphasizing on the growth in demand, the company added that: "Demand for BMW, MINI and Rolls-Royce brand vehicles reached a new all-time high in the first three months of 2022. Electric mobility accounted for a significant share of this development during the period under report and continues to gain in significance at a dynamic pace."

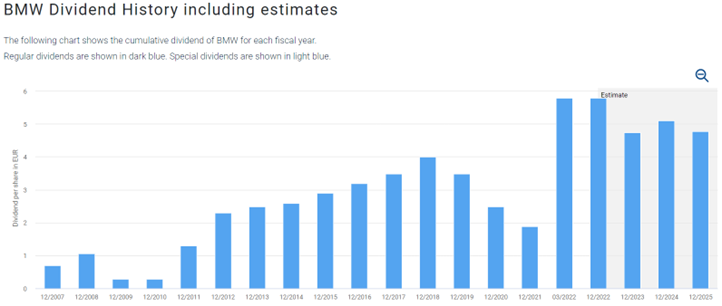

Dividends? The company has a track record of returning cash to investors, with a dividend yield of 8.1%, using the recent dividend of €5.80 and a share price of $70.80 as of writing.

Login to view Bayerische Motoren Werke AG (BMW) shares

on EasyEquities

nformed decision

At the rate of inflation, the bear may continue to play in our portfolios. This is as inflation fears continue to hinder investor sentiment and the "global dependence shift". may bring many changes to the global economy.Adding to the above, this may further present an entry point for new investors, especially with a company that has the potential of rising earnings, with some resilience against the current global headwinds of rising prices, interest rate concerns and global supply chain issues.New to investing

and want to know more about our other stock picks?

Read: The Swoosh vs The Three Stripe Company

Sources – EasyResearch, Rolls-Royce Holdings PLC, Bayerische Motoren Werke AG, Forbes, BusinessLive, Dividendstocks.cash

Follow Cay-Low Mbedzi

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by an employee of EasyEquities an authorised FSP (FSP no 22588) as general market commentary and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.