“Precious, but only so far”

Bottom Line:

Recent sharp share price rises in platinum miners need to be seen in the context of the profit & loss accounts of these miners being very sensitive to small movements in the US dollar prices of platinum group metals and the rand/US dollar exchange rate. As an example, a 10% move up or down in the exchange rate (assuming this applies for a full year) has at least a 350% effect on Anglo American Platinum earnings for the year ended December 2016 whereas a 10% move in the platinum price up or down has a 200% effect on Anglo American Platinum earnings. With the spot price of platinum $1,074/oz and the currency at R14,25/$ there is scope for stocks to run further if positive momentum is maintained in commodity fundamentals. Any weakness will have a disproportionately negative affect on stock prices. Amplats preferred to Implats as a trade.

Relative performance Amplats and Implats share prices – based to 100 on 3 May 2014

Market overview

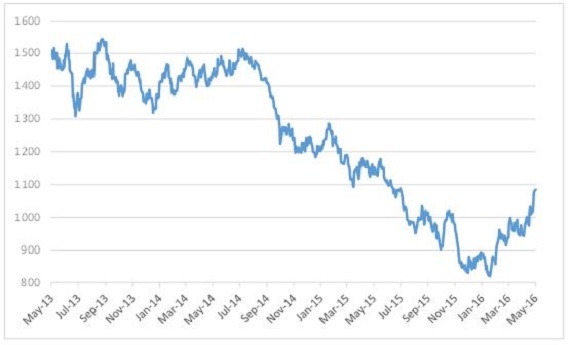

Platinum has averaged $938/oz from 4 January 2016 to 29 April 2016 and priced at $1,074/oz at the time of writing. The low point this year was $816/oz on 21 January but thereafter platinum began a steady ascent with the psychological $1,000/oz reached on 7 March. Thereafter, the price eased but did not breach $952/oz and has been on a rising trend since 7 April.

Platinum is down from highs of over $1 700/oz in 2012 and 2013 and the averages of $1 374/oz in 2012, $1,490/oz in 2013 and $1,390/oz in 2014. The price of the precious metal began a descent in late July 2014 that continued unabated through 2015, reaching a low of $832/oz on 3 December 2015 before closing December 2015 at $874/oz.

Platinum price in US dollar per ounce

If platinum maintains the current price of $1,074/oz for the remainder of the year, the average for 2016 will be $1,030/oz compared with an average of $1,060/oz for calendar 2015.

Given the sensitivity of platinum miners to quite small moves in prices of Platinum Group Metals (platinum, palladium, rhodium, iridium and ruthenium) the share prices have reacted disproportionately.

Despite the rand strengthening by 11.5% from an average of R16,28/$ in January to R14,60/$ in April, the movement in platinum has more than offset this – from an average of $856/oz in January to an average of $997/oz in April, a 16.5% move.

Anglo American Platinum, the largest by market capitalisation, was at a low of below R170 a share in January and closed 29 April at R411. Impala Platinum, the second largest by market capitalisation, traded at a low of R25 in January and closed Friday at R59.

Whilst rising spectacularly of late, share prices of Amplats, Implats and Royal Bafokeng Platinum are below levels of two years ago whilst Northam is slightly ahead. Lonmin had a discount rights issue and 100:1 share consolidation in late December 2015 and so past share statistics are not comparable.

An analysis of both Amplats and Implats, the two largest miners by market capitalisation and tradability, illustrates the sensitivities to two key variables.

Furthermore, Northam, Lonmin, Implats and Royal Bafokeng between them have had to raise over R15 billion in new funding in just two years and long term value diminution suggests appetite for further cash injections is waning.

Unless platinum prices spike further there is the likelihood of further cash outflows with Implats possibly the most vulnerable.

With such variability in earnings, depending on moves in the two key variables of metals price and currency, it is no wonder that institutional financial analysts forecasts vary widely. Be cautious of consensus earnings forecasts therefore.

If commodity prices continue with a strengthening undertone the rand, absent materially improved political sentiment, is likely to firm too. The reverse is true. If the political landscape improves then that adds a strengthening overlay regardless of commodities as a political discount has resulted in the rand being weaker than the fundamentals would suggest.

My earnings scenarios on Amplats and Implats are a function of different currency and platinum price points. However, this is not an exact science so caveat emptor.