Intellidex Reviews: NewFunds S&P GIVI SA Resource 15

Suitability: This week we look at the resources sector as the second in our series of specialist funds that invest in the three main subsectors of the JSE: financials, industrials and resources. These three sectors can provide the “building blocks” of a portfolio and active investors can adapt the weightings in each sector according to their view of prospects.

The resources sector has been through a rough time over the past few years as commodity prices have plummeted, but they have shown signs of life this year. This ETF is for investors who can stomach a bit of volatility and already have a diversified portfolio (one which already includes other equity holdings, cash and bonds). ETFs that invest directly in a single commodity such as platinum are not permissible under the tax-free savings account framework in SA so these diversified funds invested in mining companies are the best way to get exposure to the commodities cycle using a tax-free account.

There are two funds you can use: the NewFunds S&P GIVI SA Resources 15 ETF and the Satrix Resi ETF. We prefer the NewFunds S&P GIVI SA because it weights 15 resource stocks based on their prospects while the Satrix Resi invests in the 10 biggest according to their market capitalisation, irrespective of prospects.

The funds give concentrated exposure to commodities companies, unlike diversified funds such as those that track the top 40 index, specialist fund constituents are likely to move in the same direction. While this is a plus during a commodity boom it can result in larger capital losses in the case of a cyclical downturn.

Click here for general information and the benefits of ETFs.

What it does: The ETF replicates the price performance of the S&P GIVI SA Resources Index, which represents the top 15 resource stocks from the S&P GIVI (Global Intrinsic Value Index) SA composite index of general equities. The approach selects resource counters with the highest intrinsic value and lowest volatility, subject to certain liquidity constraints. However, the maximum weight of each stock in the index is capped at 30%. “Intrinsic value” is defined as the book value of the company adjusted for future earnings prospects derived from consensus forecasts of financial analysts.

Advantages: We think the intrinsic value weighting is a more robust way to construct a portfolio than the market-cap approach. And because it gives more weight to counters that have lower risk (low volatility), it also somewhat minimises the potential loss of capital.

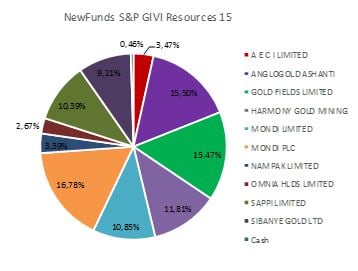

Top holdings: Basic resource stocks constitute more than 90% of the overall portfolio. More than half of the portfolio is invested in mining stocks.

Risk: There are two important risks to consider. First, the fund is concentrated in one broad sector and all companies respond to similar risk factors. It is important therefore that this ETF forms part of a wider portfolio that includes other sectors. Second, it is an all-equity investment which is more volatile than other asset classes such as bonds and cash.

Fees: The annualised total expense ratio which excludes brokerage and transactional costs for this fund is 0.16%.

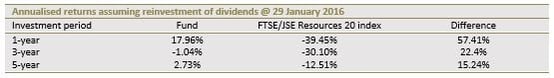

Historical performance: The fund’s performance depends on how you choose to invest – through a single lump-sum payment or regular instalments. (Note that a lump-sum investment mimics the index performance more closely). The performance report in the table below is for a lump-sum investment. The NewFunds S&P GIVI Resources 15 has outperformed the JSE Resources 20 Index since inception, which shows the impact of the forward looking approach to weightings.

Fundamental view

The S&P GIVI Resources 15 is trading at levels last seen in 2010. This is certainly an opportunity if you are bullish on commodity prices. The collapse in commodity prices which started in mid-2014 when China slowed down its consumption of industrial resources decimated the fund. There has been an uptick in commodity prices this year and the weak rand has further boosted returns. This, however, does not mean that the commodity bear market is over – there is still far too much supply around to meet demand – but the bottom of the cycle may be in sight. Most companies in the sector are undergoing dramatic restructurings that will leave them more efficient and potentially able to deliver serious value for shareholders should commodity prices rise. However, we expect most of the ETF’s constituents to cease or cut dividends until a meaningful recovery in commodity prices has been achieved.

Alternatives:

Its closest peer is the Satrix RESI ETF which is weighted according to the market capitalisations of each company. Satrix Resi is more expensive with an annual TER of 0.45%.

Other options are single-commodity ETFs. These invest directly in one commodity, bypassing the mining companies. For example, the Absa NewGold ETF invests in gold bullion debentures which are backed by physical gold. It is a way to invest in gold without having to invest in the mining companies that produce it. However, these are not allowed in tax-free savings accounts.

BACKGROUND: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, resource companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various share

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.