Intellidex Reviews: NewFunds S&P GIVI SA Industrial 25

We usually think of the JSE’s listed companies in terms of three main divisions: resources, industrials and financials. Industrials include everything that are not mining, banking or insurance companies. So manufacturing, retail, communications, and so forth, all fit within the industrial sector. It is particularly exposed to the consumer sector – the performance of companies tends to track consumer spending. That makes up about two thirds of SA’s GDP.

This week we look at one way investors can get concentrated exposure to the industrials index: Absa’s NewFunds S&P Givi SA Industrial 25 ETF. It is one of two ETFs that provide exposure to the industrial sector – the other is the Satrix INDI. They use different weighting approaches. The NewFunds ETF is weighted by intrinsic value and expected earnings. Intrinsic value is defined as the book value of the company adjusted for future earnings prospects, derived from consensus forecasts of financial analysts.

The Satrix fund weights companies according to their market capitalisation. The NewFunds ETF therefore has characteristics of forward-looking active fund management, while the Satrix fund conforms to passive index tracking. This is known as a “smart beta strategy” to distinguish it from normal passive index tracking.

What it does: The fund replicates the price performance of the S&P GIVI SA industrials Index, which represents 25 stocks from the S&P GIVI SA composite, constructed using the GICS financials sector classification (see below for a key to this alphabet soup). The approach favours counters with the highest intrinsic value and lowest volatility, subject to certain liquidity constraints. However, the maximum weight of each stock in the index is capped at 30%.

The acronyms stand for:

- GIVI: Global Intrinsic Value Index

- GICS: Global Industry Classification Standard. It is a globally accepted asset classification methodology (a way of deciding whether a stock is a “financial” or “industrial” for example) developed in 1999 by Morgan Stanley Capital International (MSCI) and Standard & Poor's (S&P).

Invest in NewFunds S&P GIVI SA Industrial 25 ETF

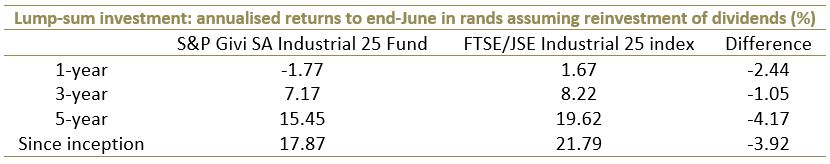

Performance review: The fund has underperformed its index over time. The main reason is that, for performance comparison, Absa uses a benchmark index which is fundamentally different from the fund in terms of construction/weighting. Whereas the fund is constructed using S&P GIVI rules which focus on intrinsic value and volatility, the FTSE/JSE index is a market cap-weighted index. What has been revealed here is that the pure indexing strategy has consistently outperformed the smart beta strategy.

Outlook: The fund provides concentrated exposure to industrial companies. Unlike diversified funds such as those that track the top 40 index, specialist fund constituents are likely to move in tandem, which reduces diversification benefits and increases risk. In practice the fund is more concentrated than implied by its 25 holdings – four counters dominate the fund’s holdings (see graph below).

Generally, industrial stocks are driven by consumer confidence. Due to SA’s poor economic performance in recent years, confidence has been low. However, retail sales for August were encouraging, showing year-on-year growth of 5.5%. The biggest risk factor to SA is political uncertainty and there is real possibility of further sovereign credit downgrade next month. On the brighter side, the companies which dominate this fund generate most of their income outside of SA, which somewhat lowers the risk.

Advantages: Compared with most listed ETFs which limit their universe to the JSE’s top 100 or fewer stocks, this fund has a wider universe which encompasses all JSE-listed stocks (large-, mid- and small-cap stocks) that meet the S&P SA Composite Index criteria.

Invest NewFunds S&P GIVI SA Industrial ETF

Suitability: Subsector assets can be utilised as “building blocks” when assembling a portfolio with different sector weightings from those found in more diversified portfolios. Furthermore, they enable you to calibrate your exposures, depending on your view of the prospects for the various sectors. For example, in a core-satellite portfolio, a core portfolio can be complemented by strategic concentrated sector exposures. Such funds suit more active investors who will need to take a view on the prospects of various sectors of the economy. For less active investors, a broader fund, more diversified fund is presumably more suitable, for example, a top 40 fund.

.jpg?width=320&name=24102017(1).jpg)

Top holdings: The top 10 holdings constitute 87% of the overall portfolio. However, 70% of fund’s return will be determined by just four companies, a reflection of poor diversification.

Risks: There are two important risks to consider. First, the fund is concentrated in one sector and all companies are responsive to similar risk factors. It is important therefore that this ETF forms part of a portfolio’s wider equity holdings that includes other sectors such as financials and resources. Second, it is an all-equity investment which is more volatile than other asset classes such as bonds and cash.

.jpg?width=555&height=150&name=24102017(2).jpg)

Alternatives: Its closest peer is the Satrix INDI ETF, which weights companies according to size and has a total expense ratio of 0.4% against this fund’s 0.21%.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews: CoreShares S&P SA Low Volatility ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.