The Absa NewFunds TRACI 3-month ETF

With global equity markets experiencing turmoil, it makes sense to seek low-cost, convenient alternatives to traditional non-listed products. The Absa NewFunds TRACI 3-month ETF is one of a select few funds that have exhibited positive returns year-to-date. Money market funds tend to have minimal volatility and returns.

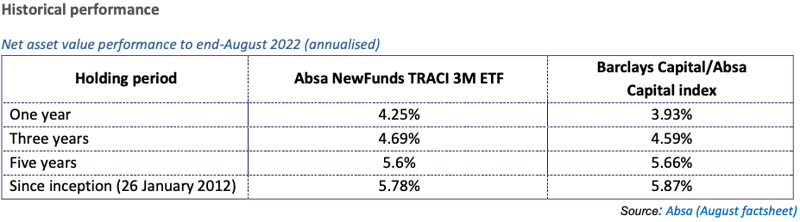

Moreover, these funds hold highly liquid, short-term instruments. These include cash, cash-equivalent securities and investment-grade, debt-based securities with a short-term maturity. Over the past five years the fund has returned a decent 5.6%.

More than two thirds of the fund’s holdings are SA banks. The SA banking system ranks among the best in the world and is efficiently regulated by the South African Reserve Bank. The country is home to several major banks, multinational insurers, a large stock exchange and a wide range of investment services providers. The level of sophistication of the banking industry masks the country’s high level of income inequality, where a large portion of the population are excluded from formal financial services. Banking assets are highly concentrated in the hands of the top five banks, which leaves room for consolidation among the smaller institutions.

The objective of the NewFunds TRACI 3-month ETF is to track the total return version of the Barclays Capital/Absa Capital ZAR Tradable Cash Index 3 Month, an index consisting of three-month SA money market deposit rates. The fund has a tracking error of 0.15% and a total expense ratio of 0.35%.

Fund suitability

- This ETF is ideal for investors who seek low-cost convenient alternatives to traditional non-listed products. The fund offers great diversification benefits as it does correlate with equity market volatility.

Fees

- The fund has a total expense ratio of 0.35%.

Top holdings

- The fund holds assets from the banking sector, the majority being the top five banks.

The Absa NewFunds TRACI 3-month ETF (JSE:NFTRCI)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.