Satrix 40 Portfolio ETF

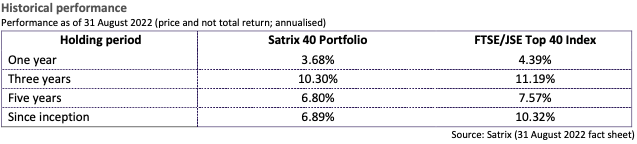

This ETF has delivered 3.68%% on a one-year basis (as at 31 August 2022), underperforming its, the FTSE/JSE Top 40 Index, which delivered 4.39%. The fund has seen pressure in companies such as MTN, while Naspers remained relatively flat, with British American Tobacco (BAT) having improved over the period.

BAT paid out four quarterly dividends of 54.45p per share. So, the total dividend paid was 217.8p per share. At the current share, that equates to a yield of around 6.7%.

As for the forecasts going forward, analysts currently expect the group to pay out 232p per share for 2022 and 251p per share for 2023 implying higher pay-outs are expected relative to 2021. At the current share price, these estimates equate to yields of around 7.2% and 7.7%.

These yields are certainly attractive. It’s often said that shares generally return 7-10% over the long run. However, in this case, BAT is potentially generating that kind of return for investors on dividends alone. It is worth noting that as well as paying big dividends, BAT has also been buying back its own shares. Early this year, the board approved a £2bn share repurchase for 2022. Buybacks are essentially another form of returns for shareholders. Over time, they can increase earnings per share. However, there is concern about growth in the long run. All around the world, governments are making life difficult for tobacco companies by introducing new regulations designed to stop smoking, and the situation is expected to become more focused in the years ahead. This could put pressure on the company’s profits, dividends and share price.

The investment objective of the ETF is to track the FTSE/JSE Top 40 Index. The fund is an index tracking fund, registered as a collective investment scheme and is also listed on the JSE Securities Exchange as an exchange traded fund. This ETF provides performance of the FTSE/JSE Top 40 Index (J200) as well as pays out, on a quarterly basis, all dividends received from companies comprising the index, net of cost. To reduce costs and minimise tracking error, the fund engages in scrip lending activities. Manufactured (taxable) dividends could arise from such transactions. Its tracking error (the standard deviation of ETF returns minus benchmark returns) of 1.32% suggests that any given return deviation from the benchmark may be an additional 1.32% higher or lower. This tracking error is higher than that of its peers such as FNB Top 40 ETF (0.1%), 1nvest Top 40 ETF (0.04%) and 1nvest SWIX 40 ETF (0.04%).

Fund suitability

-

This is an aggressively managed, high- risk portfolio that aims to deliver capital growth over the long term. Given that it is structured to track the benchmark and is a pure equity fund, there may be some volatility in the short term, although higher returns may be expected from five years or beyond. Therefore, it is suitable for an investor willing to take on some risk whilst seeking higher rewards in the long term. Short- term volatility is likely to prevail in SA and the UK due to current inflationary pressures.

Fees

- The fund has a total expense ratio of 0.15%.

Top holdings

-

Richemont, Anglo American and Naspers are among the top holdings in the fund.

With regards to sector weighting, the fund has 31.35% in Basic Materials, 26.45% in Financials and 16.89% in Consumer Cyclicals. Investment by country has the most weighting in South Africa (SA) at 58.26% followed by the UK at 17.98%.

Satrix 40 Portfolio ETF (JSE:STX40)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.