CoreShares Preference Share ETF

Global financial markets are going through an uncertain and volatile period, as shown by most Q3 2022 returns across listed asset classes. In its quarterly market review, JP Morgan Asset Management reports a 4.1% decline in its measure of commodity prices (Q3 2022), a 6.1% decline in developed market equities and a 11.4% drop in emerging market equities.

Accordingly, factor or investment style equities posted similar returns over the quarter: growth equities were down 5.0% while value lost 7.1%. Its gauge of global bonds decreased 6.9%.

Broadly, geopolitical tensions, inflation, hawkish monetary policy and concerns about global economic growth have weighed on markets. In addition, the UK’s announcement and eventual reversal of a decision to implement a substantial and unfunded fiscal package – which caused the British pound to tank and hit its bond yields – spooked financial markets even further.

In light of all this volatility and uncertainty, the prospect of stable income generation is welcome for investors. The CoreShares Preference Share ETF provides a solution investors can use as part of the income or yield portion of their ETF portfolios. One of the key advantages of this ETF is that while preference shares (like ordinary shares) may not always be paid, that companies will pay a fixed amount to preference shareholders. Preference shareholders also receive a higher level of income than creditors, given that the latter are guaranteed payments which makes credit less risky than preference and ordinary shares.

This illustrates the extent to which preference shares have some characteristics of both debt and equity. However, in addition to not being guaranteed a payment in a particular year, preference shares generally do not have voting rights. What’s more, and coming back to the CoreShares Preference Share ETF, we think that the historical yield of 5.4% (at end-August) is underwhelming – given SA’s annual consumer inflation rate of 7.6% in August.

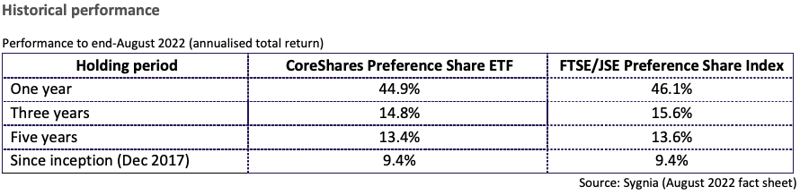

The investment policy of the portfolio (ETF) is to track the price and income performance of the FTSE/JSE Preference Share Index by buying constituent securities in the same weightings in which they are included in the index. The index measures the performance of non-convertible, floating rate perpetual preference shares and is reviewed on a quarterly basis.

Fund suitability

- This ETF is suitable for the income or yield portion of investor portfolios. CoreShares assigns a two out of five rating to this ETF, ranking it as conservative. Accordingly, we believe the fund has a low-to-medium risk profile, given that preference shares depend on the underlying company performance and may not be paid every single year.

Fees

- The fund has a total expense ratio of 0.64%.

Top Holdings

- Standard Bank Group Limited was the leading share in the ETF at end-August. The fund, which has only nine constituents, has most of its weight in financial services companies, at 80.4%.

CoreShares Preference Share ETF (JSE:PREFTX)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.