BCG’s definition of sustainable investing includes environmental, social and governance (ESG) investing with a focus on the environmental factor.

1nvest MSCI World Socially Responsible Investment Index Feeder, this week’s ETF pick, focuses on ESG as well as socially responsible investing (SRI). Financial analytics giant S&P Global defines socially responsible investing as different from ESG investing.

In the latter approach, investors use ESG in their decision-making to invest sustainably while maintaining the same level of financial returns as they would with a standard investment approach.

In SRI, investors assign a premium on positive social change by considering both financial returns and moral values in investment decisions. This strategy emphasises financial returns as a secondary consideration after investor’s moral values have been accounted for in their decision- making, according to S&P Global.

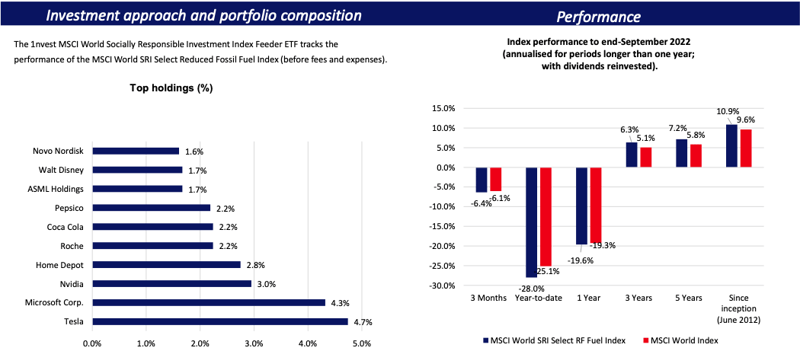

The mandate of the 1nvest MSCI World Socially Responsible Investment Index Feeder ETF is to track the performance of the MSCI World SRI Select Reduced Fossil Fuel Index by investing in the iShares MSCI World SRI UCITS ETF. The index includes large and mid-cap securities across 23 developed market countries.

It aims to represent the performance of companies that are consistent with specific values and climate change-based criteria, and those that exhibit a high minimum level of ESG performance. The fund actively excludes companies in industries related to a vast list of business activities. These various businesses include; weapons operations, tobacco, alcohol, gambling, nuclear power, genetically modified organisms, thermal coal and oil- related business activities. It also seeks to limit exposure to companies prone to socio- political controversies. Overall, the result is a fund that excludes companies on both an SRI and ESG basis, enabling investors to invest in line with their values.

This strategy performed strongly relative to the MSCI World (US dollar terms) as at Q3 2022 . While the ETF’s index was down 28.0% year-to-date compared to the MSCI World (-25.1%), it outperformed the MSCI World over three, five and ten years, with returns of 6.3%, 7.2% and 9.9%, respectively.

Also, an advantage we’ve identified is that the outperformance came at similar risk levels – the MSCI World SRI Select Reduced Fossil Fuel Index’s long term standard deviations (over three, five and ten years) were all comparable to that of the MSCI World, a pleasing result for investors as at Q3 2022.

However, in addition to the fact that past returns are not indicative of future returns, one drawback of the strategy is that the elimination process results in a portfolio of 370 shares in the index compared to the 1,513 in the MSCI World Index. This resultant selection bias may raise the chance of underperformance of the fund if the broader index performs strongly.

Finally, the feeder fund of the ETF (iShares MSCI World SRI UCITS ETF – US dollar) has an estimated tracking error of 0.04%. Given the low figure, it suggests that the feeder fund is highly efficient at tracking the index, which bodes well for local investors investing in the ETF.