1nvest Global REIT ETF

As highlighted in our previous Reit updates, we prefer diversified exposure to listed property offshore as we think global economic headwinds will affect listed property companies more adversely in SA than abroad.

In addition to diversification, global listed property may just be able to counter the effects of inflation, which is eating into nominal investor returns. Specifically, the US-based National Association of Real Estate Investment Trust’s analysis of Reits returns during inflationary periods in US history (1972-2021) indicate that during high inflation periods (7.0% or greater), Reits outperformed the S&P 500 by an average of 5.6 percentage points. Reits tend to outperform in these high inflation periods, with strong income returns offsetting falling Reit prices. This is due to the fact that long-term leases are typically adjusted for inflation, which protects the purchasing power of revenue.

Overall, our preference for diversified offshore exposure is now augmented by the potential for inflation protection during tough market conditions. However, the US inflation rate of 8.3% annually in August 2022 – which is the lowest since its 9.1% peak in June – exceeds the year-to-date 13.2% decline in the value of the FTSE Nareit All Reits index (to end-September). Consequently, we believe that the fund should be held as part of an overall portfolio, where the outperformance of one asset class may offset the decline in performance of the other. Finally, for investors who may be questioning how much of an allocation would be useful to Reits, NAREIT cites multiple studies into Reit allocations as guiding to a 5%-15% optimal allocation of Reits into an investor portfolio. We do, however, reiterate every investment decision must be made in view of investor risk profiles, money available to spend and the horizon of the investment.

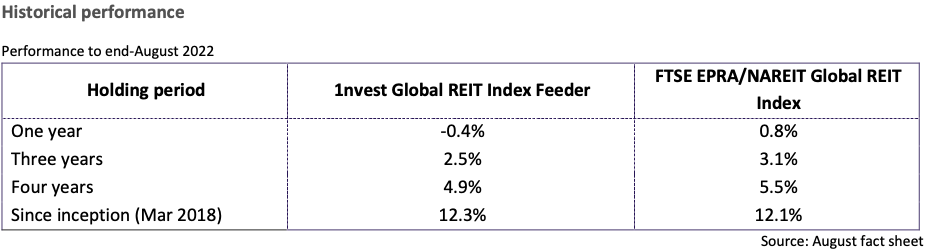

The objective of the 1nvest Global REIT Index Feeder ETF is to track the FTSE EPRA/NAREIT Global REIT Index as closely as possible, in SA rand. It achieves this by investing in the iShares Global REIT ETF, making the 1nvest Global REIT Index Feeder ETF a feeder fund.

Fund suitability

- This ETF was designed to give investors low cost, passive exposure to global listed property. While listed property has both debt (income generating) and equity (capital appreciation) characteristics, it remains high risk, especially in the short term. As such, we believe it will be beneficial to investors as part of an overall ETF portfolio.

Fees

- The fund has a total expense ratio of 0.34%.

Top holdings

- US-based logistics Reit Prologis accounted for 6.0% of the ETF. US Reits account for most of the funds’ assets (70.3%), followed by Japan (7.4%) and the UK (4.9%) which make up the top three geographical locations.

Analysis of the fund’s strategy

- The 1nvest Global Government Bond Index Feeder ETF aims to provide investors with price performance of the FTSE G7 index, net of fees. These bonds are issued by developed countries that have investment-grade rating, according to Moody’s and S&P Global.

1nvest Global REIT ETF (JSE:ETFGRE)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Get these insights first & for free

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.