Intellidex Reviews: ETF strategy 2: Portfolio completion

Intellidex and EasyEquities teamed up to run a series of articles explaining how retail investors can use ETFs as part of their broader investment strategies.

The ultimate objective for any investor is to have an optimised portfolio that balances risk and returns to fit the investors’ needs in the most rational way. ETFs can be an excellent help in that objective. In this note we consider how to use ETFs in a holistic context, so considering every other asset an investor owns.

In last week’s note we explored how to build a well-diversified portfolio from scratch. This week we look at how ETFs can be used to fill gaps in one’s investment portfolio as whole, including all assets like a pension fund. This is called a portfolio completion strategy.

ETFs are a rapidly growing form of investment worldwide. In the US, ETFs now hold more than $3-trillion in assets, which is four times larger than the market capitalisation of Apple, the largest company in the US. The uptake in SA is improving but is still behind the curve: total ETF holdings are less than R50bn, smaller than the market capitalisation of the smallest of the top 40 JSE-listed companies, PSG.

South African investors have an added advantage in that ETFs are allowed in tax-free savings accounts, so returns from ETFs can accrued tax free. The major challenge for most retail investors is how to fit these newcomers alongside the rest of their portfolios.

Who can use a completion strategy?

This is ideal for investors who may have gaps in their existing portfolios—perhaps with little or no exposure to certain asset classes, market segments or sectors. It is also useful for an investor who might want to quickly gain exposure to specific sectors, styles or asset classes without having to obtain the prerequisite expertise in these areas. This can be done in two steps as shown below.

Step 1 - Identify holes in portfolio

The basic thinking underpinning the completion strategy is that every investment portfolio should have a good balance of the main asset classes: equities, bonds and cash. The equity portion should also have a good exposure to different styles and sectors. We recommend that investors seek advice from their financial advisors on how to determine the asset allocations that best suit their individual needs.

As a rule of thumb, investors who will need their money soon generally avoid equities, which are too volatile. Short-term domestic government bonds are usually thought to be a better bet over short time frames. Alternatively, with an investment horizon of 10-20 years, investors are more likely to tilt heavily towards equities. The historical track record of bonds shows they are unlikely to deliver the kind of returns that are possible with equities, and you’ll probably have plenty of time to recover from any periods of equity underperformance.

Regardless of your goals and time horizon, if your risk tolerance is low then you’ll need a high percentage of lower risk assets to limit your exposure to the volatility of equities. However, if you’re after a good, risk-adjusted return then consider diversifying as widely as possible across global equities, bonds, property and commodities, as investment theory suggests that a broad blend of assets can deliver long-term performance while protecting your portfolio from the worst of any downturns.

So the first step is to look at the gaps. For example, an investor might own a home and have a pension fund structured for a long-term investment strategy. That would give (concentrated) property and riskier equities exposure, but leave gaps for assets like bonds, cash and commodities.

Step 2 - Fill the gaps with ETFs

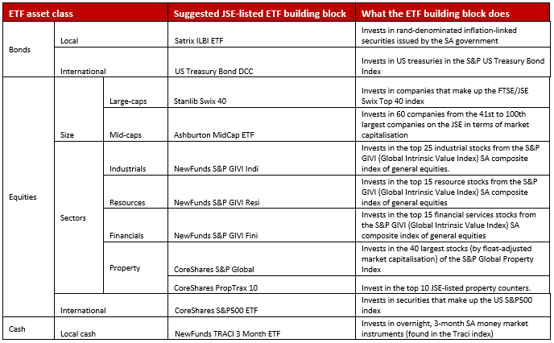

After identifying holes in one’s portfolio, the next step will be to look for the right ETFs to fill them. With so many ETFs on the market today, it can be tough to determine which product will work best in your portfolio. Below are Intellidex’s picks of what it believes are the optimal funds in each asset class and equity sector.

- Satrix ILBI ETF

- US Treasury Bond DCC

- Stanlib Swix 40

- Ashburton MidCap ETF

- NewFunds S&P GIVI Indi

- NewFunds S&P GIVI Resi

- NewFunds S&P GIVI Fini

- CoreShares S&P Global Property

- CoreShares PropTrax 10

- CoreShares S&P 500 ETF

- NewFunds TRACI 3 Month ETF

We have not considered any commodities in the list largely because no commodities ETF is allowed to be included in tax-free savings accounts. However, ETFs can be used to gain exposure to gold (NewGold, Krugerrand Custodial Certificates ETF).

Consideration

Greater diversification entails the possibility of underperformance relative to a concentrated portfolio but has potential for less volatility.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews: Using ETF's to allocate your portfolio across assets

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.