Intellidex Reviews: Sygnia 4th Industrial Revolution ETF

Local investors now have a viable option to invest in the world’s most exciting global technology stocks that have the potential to fundamentally change the way economies work. Sygnia recently launched the Itrix Fourth Industrial Revolution Global ETF, the first of its kind in SA on the JSE, which invests in companies that are on the front line of the “fourth industrial revolution.”

The premise behind the fund is that it will position investors in what is thought to be a new phase of economic development. The first, dubbed the first industrial revolution, was the transition to new manufacturing processes, moving from hand-production methods to machines, between 1760 and 1840. The second industrial revolution was driven by use of new sources of energy such as oil and electricity in the manufacturing processes, which led to mass production. The third saw the introduction of computers, the internet and new information communication technology developments.

The fourth industrial revolution is characterised by the coming online of a range of new wave technologies such as autonomous vehicles, cleantech, drones, 3D printing, robotics, nanotechnology, smart buildings and virtual reality. The Itrix ETF invests in such companies.

Suitability: Ideal for long-term investors with high risk tolerance.

What it does: The fund tracks the Kensho New Economies Composite Index (KNEX). The index is compiled by Kensho, a US analytics company funded by Goldman Sachs, Google Ventures, Accel Partners and CNBC, among others. Using big data analytics and natural language programming, it scours millions of pages of financial statements and other public information to identify companies propelling the fourth industrial revolution and combines them to form sector indices. Each index focuses on a different sector: drones, robotics, space, wearables, cybersecurity, 3D printing, autonomous vehicles, nanotechnology, smart buildings, virtual reality, cleantech, genetic engineering and clean energy. It also forms an overall composite index across sectors, and it is in this index that the Itrix fund invests.

Advantages: Although invested offshore, the ETF is considered a local asset, which means investing in it will not affect your offshore asset allocation limit of R10m a year.

Invest: Sygnia 4th Industrial Revolution Global Equity ETF

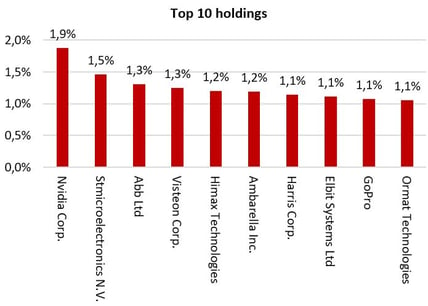

Top holdings: The index is well diversified with the top 10 holdings accounting for just 13% of the fund. Given the experimental approach of some of the companies in this index, that diversity helps to reduce risk. Of the top 10, GoPro is probably the only one with which South Africans might be familiar – its action cameras are available in local stores. Others mostly manufacture components or software for other electronic products. Nvidia, the largest counter in the fund, designs graphics processing units for the gaming, cryptocurrency, and professional markets, as well as systems on chip units for the mobile computing and automotive markets.

Fundamental view: Like any other foreign ETF, the Itrix 4th Industrial Revolution’s returns will come from two sources: the performance of the underlying equities and the rand/dollar exchange rate.

The concept underpinning the fund is exciting. The astounding scope of the breakthroughs being made by technology companies is likely to disrupt almost every sphere of life as we know it and investors’ portfolios need to be prepared for that. However, investors should also be aware of the risks posed by the fund’s strategy. It invests in more than 250 companies which are working on some exciting technologies. While that increases your chance of investing in the next Apple or Google, some of its holdings are likely to fail, which will depress overall returns. Another factor is that, unlike other indices that are built on factors that have been proven in terms of their persistence and robustness, the methodology used by this index is purely speculative. We also think the risk of the fund overpaying for some stocks is high considering that the value of the fund’s constituents is derived from their intellectual property.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash, but the returns over time should compensate for volatility. An investment in this ETF should therefore form part of a more diversified portfolio.

Fees: The fund has a target total expense ratio of 0.7%. It will be one of the most expensive foreign ETFs on the market.

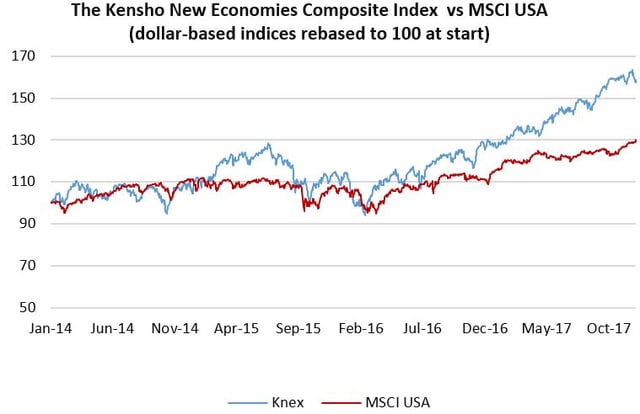

Historical performance: The Knex index has a returns history from the beginning of 2014. It has grown at an average of 12.45% a year, outperforming the MSCI USA index, which grew at 6.89% a year over the same period. The growth in both indices is higher if measured in rands.

Fundamental view: Like any other foreign ETF, the Itrix 4th Industrial Revolution’s returns will come from two sources: the performance of the underlying equities and the rand/dollar exchange rate.

The concept underpinning the fund is exciting. The astounding scope of the breakthroughs being made by technology companies is likely to disrupt almost every sphere of life as we know it and investors’ portfolios need to be prepared for that. However, investors should also be aware of the risks posed by the fund’s strategy. It invests in more than 250 companies which are working on some exciting technologies. While that increases your chance of investing in the next Apple or Google, some of its holdings are likely to fail, which will depress overall returns. Another factor is that, unlike other indices that are built on factors that have been proven in terms of their persistence and robustness, the methodology used by this index is purely speculative. We also think the risk of the fund overpaying for some stocks is high considering that the value of the fund’s constituents is derived from their intellectual property.

Alternatives: There are no close alternatives to this fund, though several other funds give exposure to foreign equities such as the Ashburton Global 1200 ETF and the Satrix S&P 500 ETF.

Invest: Ashburton Global 1200 - Satrix S&P 500 ETFs -

-

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews: Sygnia Itrix S&P 500 ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.