Intellidex Reviews: NewFunds Equity Momentum ETF

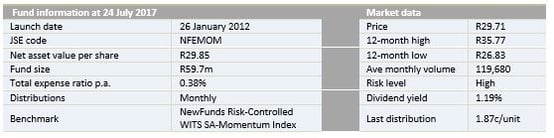

Since our review of this fund in March last year, it has changed its name and benchmark index to NewFunds Risk-Controlled WITS SA-Momentum Index from Barclays Capital/Absa Capital South Africa Equity Momentum index.

Important index changes relate to the rebalancing period, the universe and weighting methodology. Prior to the changes, the index drew constituents from the JSE’s top 40, weighted by the price momentum/movement, but excluded anything with negative price movement. However, the index now incorporates the 20 best-performing stocks in terms of absolute price increase, weighted such that there is equal risk contribution by each index constituent.

Rebalancing has changed to monthly from quarterly, which will probably increase transaction costs, but it is debatable whether it has superior return benefits since evidence suggests that the longer the holding period, the more likely the strategy will outperform.

Price momentum investing involves buying assets whose prices have been climbing and selling those that have been falling. The fund’s strategy is referred to as “smart beta” because it is different from the usual pure index (vanilla) investing represented by most of the listed ETFs which utilise market cap weightings.

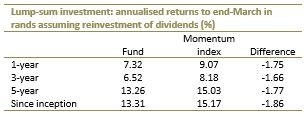

Performance review

The NewFunds Equity Momentum ETF performed well in the 12 months to end-March, returning 7.3% against the all share index’s 3.9%. However, the fund has shown sizeable tracking differences to its index, probably due to higher trading costs as frequent monthly trading takes its toll.

Outlook

The fund utilises share price momentum, which refers to the trajectory of share prices on the JSE. It backs winners and avoids losers. Momentum is an investment strategy that has been both advocated and criticised by financial theorists. Some studies show that momentum strategies do outperform the general market over the long run. Generally, this is explained by reference to behavioural biases – that investors tend to back winners and avoid losers based on recent price performance, so adding momentum to price movements. Critics, however, say momentum investing is “selling low and buying high”, which naturally underperforms. The evidence suggests that the longer the holding period, the more likely the strategy does outperform, while there are shorter periods in which it does not.

Overall, equities are driven by economic activity, which in SA is at a historical low, coupled with low consumer confidence. Following SA’s sovereign credit rating downgrade by two of the global ratings agencies, the government is under pressure to avoid further downgrades and the Treasury is pursuing fiscal consolidation. While this suppresses growth in the short term, the unexpected recent cut of 25 basis points in the core interest rate by the Reserve Bank may be positive for growth.

Key facts:

Suitability

The NewFunds Equity Momentum fund should be considered by investors with a long-term horizon, or a short-term view that market trends are going to hold for the period during which they will be invested. The strategy can be utilised in a core-satellite strategy that we discussed in June, with fund forming part of the satellite. Your core portfolio is the traditional long-term portfolio and you can add a small momentum portfolio, depending on your views on the market.

What it does

The NewFunds Equity Momentum ETF tracks the total return performance of the NewFunds Risk-Controlled WITS SA-Momentum Index, an index consisting of the top 20 JSE-listed shares. The shares are ranked by their absolute price momentum and then weighted by their risk (price volatility) contribution to the entire index. The weighting scheme neutralises index concentration and achieves equal risk contribution to the index by constituents. The ETF rebalances on a monthly basis. Any dividends received get reinvested back into the fund, which can be accumulated tax-free a tax-free savings account.

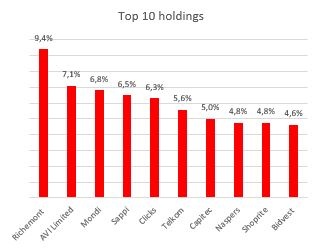

Top holdings: The top 10 holdings of this ETF occupy 61% of the fund. The biggest, Richemont, constitutes 9.4%.

Top holdings: The top 10 holdings of this ETF occupy 61% of the fund. The biggest, Richemont, constitutes 9.4%.

Risks: The fund is constructed based on observing short-term price movements of stocks, which may not persist. The fund is susceptible to being overweight in stocks that have had a hard run upwards but investors are about to rotate out of.

Alternatives

There are no direct peers.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex reviews:

Ashburton MidCap ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.