Intellidex Reviews: Sygnia MSCI US ETF

Investors in the db X-tracker ETFs are poised to get better rand returns from their investments as their new owner cuts costs. Sygnia recently acquired the five db X-trackers – which track international indices – from Deutsche Bank. Sygnia CEO Magda Wierzycka has been a staunch critic of the costs of ETFs in SA. She has promised to cut both the total expense ratio (TER – the costs of operating the ETF portfolios, including the management fees and costs of the issuing company) and the distribution costs (cost of purchasing, selling and owning the products).

Investors who were using the Deutsche Bank platform, and who will now be moved to Sygnia’s platform, Sygnia Alchemy, will gain the most as they will no longer have to pay debit order fees, and platform administration fees will be sliced from 1% to 0.2% for investments of R2m or less, and to 0.1% for investments over R2m. Investors using other platforms such as Satrix Now, a platform administered by EasyEquities, will benefit from lower TER, which is likely come through as a result of cuts in management fees of between 0.1% and 0.2%. Satrix Now does not charge any administration fees but levies a recurring investment fee of 0.2%.

Performance review

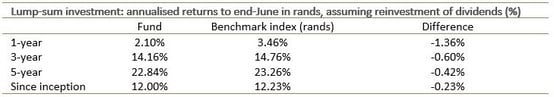

US stock markets have been rallying since the election of Donald Trump as president late last year. Trump has vowed to invest in the nation's roads, bridges, airports and railways, and cut taxes for individuals and corporations. Investors are buying into his promises, which has seen major stock market indices in the US breaking all sorts of records since he assumed office. However, the db X-tracker MSCI USA has not benefited from this rally thanks to the rand, which has been strengthening against the dollar in that period. The MSCI USA index gained 17.15% in dollar terms in the year to end-June. However, those gains were offset by the rand which strengthened 11.62%. The table below show the performance of the fund since inception.

ETF outlook

The change in fund manager is unlikely to affect the performance of the fund since Sygnia will continue tracking the underlying index in the same manner as Deutsche Bank. However, investors are likely to receive improved returns due to the lower fees.

The performance of US equities and the rand will remain the key drivers of the ETF. By investing in this ETF, you are investing in the underlying portfolio of equities and the dollar. Your ultimate return will be influenced by the movement of the rand against the dollar as well as the share price movements of the underlying companies. A weakening of the rand against the dollar will mean higher dividends and higher net asset value of capital invested. Any strengthening of the rand will, however, be bad news for your investment.

Key facts

Suitability

If you have a portfolio with a heavy concentration of South African stocks and want to add some global exposure, this ETF is worth considering. While it tracks companies listed in the US, the MSCI USA index has a very good exposure to the global economy as most of the companies operate in global jurisdictions.

What it does

The fund tracks the MSCI USA index by holding stocks in the same weightings as the index. The MSCI USA index is a capped index representing 626 of the biggest listed companies in the US with a total market capitalisation of approximately US$14 trillion. The index covers about 85% of the free float-adjusted market capitalisation of the US equity markets. The free float adjustment means they exclude shares held by strategic investors such as governments, corporations, controlling shareholders and management, as well as shares subject to foreign ownership restrictions. This ensures that the fund invests in the most liquid stocks

Advantages

The main attraction of this ETF is that you can invest in international stocks without the hassle of externalising capital. By buying just one rand-denominated unit of the ETF you have access to a broad spread of US equities. Also, while registered in the US, most of the stocks tracked by this fund are multinationals with business interests that span various continents, generating earnings in multiple currencies

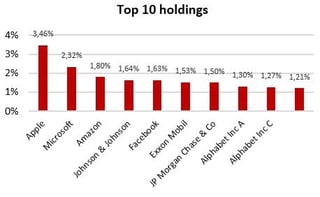

Top holdings

The top 10 holdings are dominated by technology companies. Given the limited number of technology stocks on the JSE, this is an advantage for most local investors. No single asset has a disproportionate influence on the portfolio, with the largest exposure being 3.5% invested in Apple.

Risk

This is a pure equities investment, so the performance is likely to be volatile. Investment in this fund exposes you to many risks including general market risks, exchange rate risks, interest rate risks, inflationary risks, liquidity risks, and legal and regulatory risks.

Fees

For the year to end-June, 0.86% of the average net asset value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. While this is slightly elevated compared with most local equity ETFs, it is far lower than what one would incur using other means of gaining offshore exposure.

Alternatives

As an alternative to this ETF, you may consider Satrix S&P 500 and CoreShares S&P 500. They are similar to the Sygnia MSCI USA but track the S&P 500 which has slightly different exposures.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex reviews:

NewFunds Govi ETF

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.