In the month of September we saw the markets remain subdued. After resource-themed ETFs had solid returns around the mid-year mark, we have seen them fall behind the pack by September. Domestic markets remained depressed, while investors in international markets began to feel the pinch from a looming global economic slowdown. The team at Intellidex have produced some insights on which exchange traded funds have outdone themselves, and which have underwhelmed in a blase market.

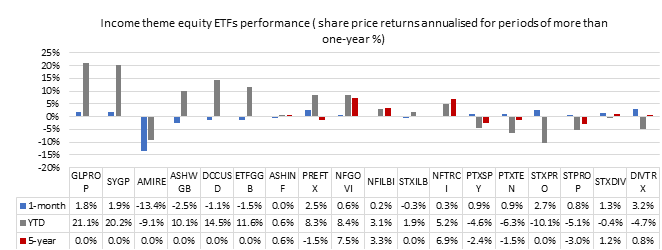

The Satrix Fini 15 ETF was the top-performing non-commodity ETF after its share price rose 4.2% but has lost -4.8% year to date (YTD). The CoreShares S&P South Africa Dividend Aristocrats ETF was next best with growth of 3.2% (YTD: - 4.7%). The NewFunds S&P GIVI South Africa Financials ETF (3.1%), the NewFunds S&P GIVI South African Industrial ETF (2.8%) and the Satrix Property ETF (2.7%) complete the top five performers for the month.

The Satrix Resi ETF, which shed 1.2%, was the laggard. However, the fund is up 6.5% YTD, a credible number on the JSE. Other big losers were the Satrix Indi 25 (-0.8%), Satrix Inflation-Linked Bond ETF (-0.3%), NewFunds Shariah Top 40 ETF (-0.3%) and Satrix Rafi 40 ETF (-0.1%).

The Macroeconomic view

We think South African-facing stocks will remain under pressure, with the JSE generally marked by high volatility and low liquidity. This underscores a need for offshore diversification. Locally we think investors should tilt their portfolios towards income-focused assets.

ETFs featured

We have split the ETFs featured into three broad categories:

Fixed income and Cash:

Fixed income securities should find their way into a well-diversified portfolio due to their risk-diversification attributes. If you are investing for a short period, usually less than a year, then the NewFunds TRACI (up 0.3%) is a natural choice because it is least sensitive to adverse interest rate movements. For a longer investment horizon, protecting your investment against inflation is paramount.

We maintain our choice of the Satrix ILBI ETF (0.2%), which has the lowest expense ratio in this category. Furthermore, nominal bonds add a unique risk-return dimension that differs from inflation-linked bonds and improves overall portfolio performance. The only option for local nominal bonds is the Newfunds GOVI ETF (+0.6%).

As with equities, investors also need to diversify their bond portfolios internationally. Our choice is the Stanlib Global Bond ETF (-1.5%), which tracks investment-grade sovereign bonds mostly issued by the US, UK, Japan and selected European countries. The Stanlib Global Bond ETF has the lowest TER in this category.

Click logos to view ETFs

Dividend or income:

If you rely on your investment income for day-to-day expenses you may want to allocate a portion of your portfolio to ETFs that have a high distribution ratio. Property funds tend to have even higher pay-out ratios. Our pick here is the Satrix Property ETF which has a brilliant diversification approach.

For foreign property funds we like the Sygnia Itrix Global Property ETF (+1.9%). It has an aggressively low total expense ratio (TER) of 0.19% that significantly undercuts its competitors, whose charges range from 0.29% to 0.69%.

Click logos to view ETFs

Diversified funds:

If you find the process of diversifying your portfolio daunting, two ETFs can do it for you. They combine equities and bonds to produce a diversified portfolio for two investor archetypes with differing risk appetites:

Mapps Protect is more conservative, usually suitable for older savers.

Mapps Growth suits investors with a long-term horizon.

They were up 0.6% and 0.9% respectively.

Click logos to view ETFs

There's plenty more from where that came from. The team at Intellidex have more insights for the month of October. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Intellidex Reviews

August 2019: Other Picks

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.