September was characterised by a global investor rotation from havens to riskier asset classes. This saw equities bouncing back from a soft performance in August to post the strongest performance among the major asset classes. The MSCI World Index grew 2.2% while the JSE All Share Index ended 1.01% higher. There was a bit of a selloff of bonds and commodities with the JP Morgan Global Aggregate Bond Index shedding 0.8%. The rand was volatile as usual but closed the month near its September opening valuation.

The Global view

On the international scene escalating trade conflicts, increasing fears of a global economic slowdown and pre-emptive fiscal stimuli shaped risk attitudes and the performance of assets. In the US, the Federal Reserve delivered a second consecutive rate cut of 25 basis points, a move aimed at buttressing the economy. Europe expanded its stimulus package with the European Central Bank slashing its already negative interest rate and instigating quantitative easing. The economic bloc has committed to asset purchases to boost inflation which printed at 1.4% in August, towards its target of arround 2%.

In the UK, the twists and turns of the Brexit monster were on steroids with the British parliament clashing head on with its newly elected prime minister Borris Johnson. The parliament passed legislation that will force the government to ask for an extension if it can’t agree to a deal with the EU. But Johnson remains adamant that he will not seek an extension even if he can’t reach a deal.

The US-China trade war also flared up. Further tariffs are due to kick in by the end of the year unless renewed talks between make sufficient progress. The Chinese economy slowed further. Its industrial output rose 4.4% from a year earlier in August, the lowest for a single month since 2002, while retail sales came in below expectations. Fixed-asset investment slowed to 5.5% in the first eight months.

Image source: Getty

Incoming third quarter economic data point to a continued slowdown in the global economy. However, several authorities are pre-emptively putting measures in place in a bid to prolong the global economic expansion. The US is relying on monetary policy easing but the Trump administration has indicated it may cut taxes should a need arise.

China has a cocktail of economic stimulus measures ranging from cuts to banks’ reserve ratios and taxes to issuance of special bonds. Earlier this month the People’s Bank of China lowered the required reserve ratio by 0.5 percentage points (1 percentage point for some city commercial banks), which is expected to release about $126bn of liquidity. The EU and Japan are digging deeper into unconventional monetary policy tools to stimulate inflation and mitigate economic slowdown.

ETFs featured

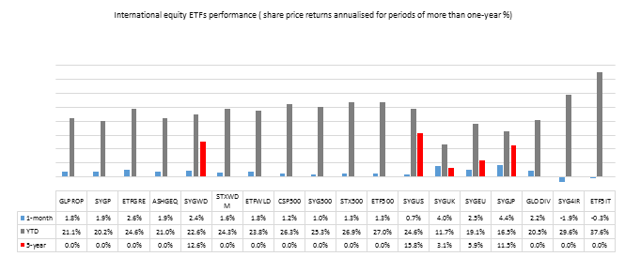

We have split international equities into developed and developing markets:

Developed:

We maintain our exposure to the broad-based Satrix MSCI World Equity Feeder ETF which is dominated by US equities. We think US stocks are more resilient than other developed market equities during turbulence, given the relatively stronger US economy. We are, however, cognisant of the elevated US valuations relative to other developed markets. This fund grew 1.6% in September. A good alternative, though, is the Ashburton Global 1200 Equity ETF (up 1.9% in September) but it has a higher total expense ratio.

Other more focused international equity themes include property, dividend and technology funds. These are worth considering for tactical or other investor-specific reasons.

Click logos to view ETFs

Emerging:

We choose the Satrix MSCI Emerging Markets ETF (up 2%) as our core portfolio for developing markets exposure. It invests in a wide range of emerging economies including some of the fastest-growing markets like China and India. The Cloud Atlas AMI Big50 (-5.1%), which focuses on African equities, can be used as a satellite fund to the core Satrix MSCI Emerging Markets fund.

Click logos to view ETFs

There's plenty more from where that came from. The team at Intellidex have more insights for the month of October. To see more in-depth analysis and market insights (global and local), check out the full note here.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.