Intellidex 2020 reviews: Satrix S&P 500 ETF

Catch this insight by Intellidex on the South African equity market. This note is on the Satrix S&P 500 ETF. This ETF is ideal for investors seeking broad exposure to the US equity market. This ETF is ideal for someone with a high risk tolerance and a long investment period.

Intellidex insight:The S&P 500 started the year on a strong footing, but sentiment turned in mid-February when the implications of the coronavirus outbreak became apparent. The S&P 500 went on to shed more than a third of its value from its record closing high on February 19 within a few weeks. But the index has since bounced back with a vengeance, spiking more than 25% since 23 March when it bottomed out.

The rebound seems to have been driven by the economic interventions which were swiftly rolled out by the US Federal Reserve Bank (Fed) and the US government. The Fed focused mostly on boosting liquidity in the financial and business system while the government rolled out demand and supply side interventions worth about $3tn, about 14.6% of its GDP of approximately $20.5tn.

While the rebound provides some relief to a lot of investors, the situation on the ground remains dire. US retail sales plunged by a record 9% in March while American factories are reported to have had their worst month since 1946. Close to 17-million people filed for initial unemployment claims. Economists at JPMorgan Chase now estimate GDP will collapse by 40% during the second quarter, driving up the unemployment rate to 20%. Analysts polled by FACTSET expect earnings from the S&P 500 companies to decline by 14.5% in 2020Q1, which will be the largest year-over-year decline in earnings reported by the index since Q3 2009 (-15.7%).

From history we can glean a small comfort: no matter how dismal the short-term outlook for the global economy has appeared, brighter days have always followed. Every single stock market crash and bear market in history, no matter how drawn out, has eventually been followed by a rally. The US is the biggest and arguably the most resilient economy in the world, so It is one of the best places to be right now. SA investors in the Satrix S&P 500 ETF will also benefit should the rand weaken further against the dollar.

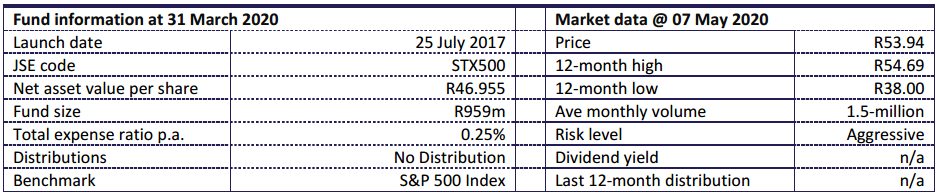

Fund description:The Satrix S&P 500 Index Feeder ETF tracks the S&P 500 index, which represents the 500 largest US companies. As a feeder fund, the Satrix S&P 500 ETF does not invest directly in underlying assets but rather holds shares in another ETF – iShares Core S&P 500 UCITS ETF – which in turn invests in the underlying companies.

Click logo to view

Satrix S&P 500 ETF

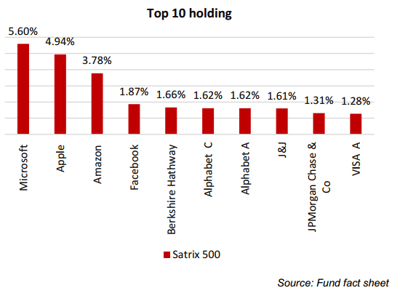

Top holdings:The top 10 companies constitute 25% of the fund. This fund is tilted towards technology companies, which account for 23.12% of the portfolio. However, the biggest holding (Microsoft) is at 5.6%,

making this fund a well-diversified ETF.

Suitability:This ETF is ideal for investors seeking broad exposure to the US equity market. While the fund is well diversified and has traditionally been able to deliver stable long-term returns, its violent swings over the

past few weeks remind us of how risky equities are. Given that backdrop, we see this fund sitting well in a portfolio with high risk tolerance and a long investment period.

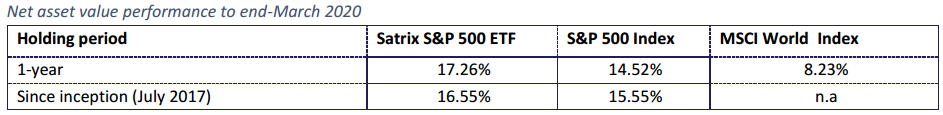

Historical performance:The Satrix S&P 500 provided staggering returns of 17.26% over a year and 16.55% since inception. These returns make it one of the best-performing ETFs on the market.

Source: https://www.etfsa.co.za/docs/perfsurvey/perform%20survey%20-%20March2020.pdf and March 2020 fact sheet

Analysis of the fund’s strategy:The Satrix S&P 500 ETF is one the five ETFs on the JSE which provide access to the broad US equity market. The S&P 500 index, which is tracked by this fund, is the most widely recognised barometer of US equities performance. It covers more than three quarters of the market capitalisations of listed equities in the US. Also, about a third of S&P 500 companies’ revenue comes from markets outside the US, which is good for diversification

Click logo to view

Satrix S&P 500 ETF

On a technical level, the fund is primarily momentum driven, rewarding winners and punishing losers, aligning with investors’ growth objectives. While in theory its US-centricity implies poor diversification, the companies in the index have extensive global operations which negates this perceived weakness. Additionally, the fund is well represented across sectors, which further enhances diversification.

Fund statistics:

Source: iress and March 2020 fact sheets

Alternatives:The fund’s direct alternatives are the Sygnia Itrix S&P 500, with the lowest total expense ratio of 0.16%; the CoreShares S&P 500 ETF (TER 0.39%); and the 1nvest S&P 500 Feeder ETF (TER 0.27%).

Click below to view

Satrix S&P 500 ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.