Catch this insight by Intellidex on the Satrix MSCI Emerging Markets ETF. The Satrix MSCI Emerging Markets ETF is one of a kind on the JSE, and like it's name suggests it exposes investors to emerging markets. It adds a good growth dimension while diversifying away from SA. Satrix MSCI Emerging Markets ETF is ideal for long-term investors with a high-risk appetite.

Intellidex insight: The Satrix MSCI Emerging Markets Feeder ETF is one of a kind on the JSE. It adds a good growth dimension while diversifying away from SA, which is, of course, also classified as an emerging market. The fund’s geographical reach extends to other countries including China, India, Taiwan, South Korea, Russia and Brazil. The ETF gives exposure to global consumer brands such as Samsung, Alibaba and Tencent. Although emerging market equities carry more risk than developed markets, they have their merits.

Emerging countries have demonstrated a distinct path towards development which is absent in frontier markets and they have higher growth rates than developed economies. In a portfolio context, this fund is a diversifier, giving exposure to markets that are underrepresented in SA. However, there is risk of overexposure in the Chinese tech giant Tencent because Naspers is part of the same index. Naspers’ biggest asset is its Tencent equity holding.

Fund description:The Satrix MSCI Emerging Markets Feeder Portfolio tracks the MSCI Emerging Market Index, which measures the performance of large, mid and small capitalisation stocks across emerging market countries which meet size, liquidity and freefloat criteria. As a feeder fund, it indirectly invests in the benchmark index through the iShares Core MSCI Emerging Markets IMI UCITS ETF.

Click logo to view

Satrix MSCI Emerging Markets Feeder ETF

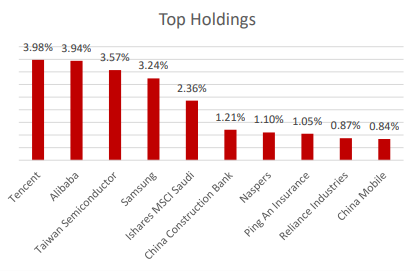

Top holdings: The fund’s top ten investments account for just over 22% of its total investments. The fund is well diversified, containing more than 3,000 constituents across multiple sectors and economies.

Suitability: Equity prices are volatile, especially in the short term, which may lead to sizeable capital losses due to the workings of various market variables such as interest rates, political developments or economic activity. This is more pronounced for emerging markets. So, Satrix MSCI Emerging Markets ETF is ideal

for long-term investors with a high-risk appetite.

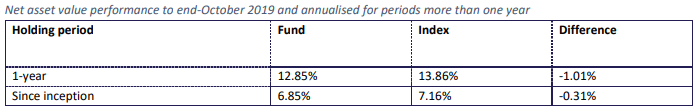

Historical performance:The last 12 months have produced impressive returns. However, since the fund has only been in existence for just over two years, we cannot read much into the fund’s performance.

Fundamentals: Recent positive developments on the international front has brought some welcome cheer to global equities, with China and the US finalising a “phase one” trade deal. Coupled with accommodative monetary policies across the globe, including emerging markets, it is a boon for global growth. While emerging economies have a higher risk profile, they also promise much higher potential growth than developed economies. Although SA is an emerging economy, its growth trajectory leaves much to be desired with no end in sight for its challenges, which looks to keep the economy in a low growth trap for the foreseeable future. This makes the emerging market fund a good addition to a portfolio for South African investors.

Click logo to view

Satrix MSCI Emerging Markets Feeder ETF

Fund statistics:

Alternatives: None

Click below to view

Satrix MSCI Emerging Markets Feeder ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|