This ETF’s biggest differentiator is that it selects and weights its constituents based on their value based

on fundamental factors. It uses book value plus the present value of expected residual income as well as low volatility – whereas most of its peers use market capitalisation. The advantage of this attempt to determine a company’s intrinsic value is that it is forward looking – it invests based on the prospects of the company, not its size. While we like the appeal of this selection approach, we think investors seeking to mimic the domestic equity market are better off with the market cap weighted version of the top 50 offered by CoreShares or the top 40 funds.

NewFunds S&P GIVI SA Top 50 ETF’s selection and weighting methodology, which is materially different from that of the SA equity market benchmark, is likely to result in a higher active risk. Its residual income approach also tends to skew the portfolio towards cyclical basic materials. The fund is relatively

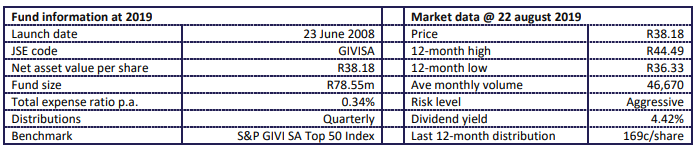

cheap with a total expense ratio of 0.26%.

Fund description: The NewFunds S&PGIVI SA Top 50 ETF invests in the 50 largest JSE-listed stocks selected on book value, expected residual income and lower volatility. It invests in any counter with a

market capitalisation of R10bn or higher if that counter meets its other eligibility criteria. As a result, it holds both mid- and large-cap stocks.

Click logo to view

NewFunds S&P GIVI SA Top50 ETF

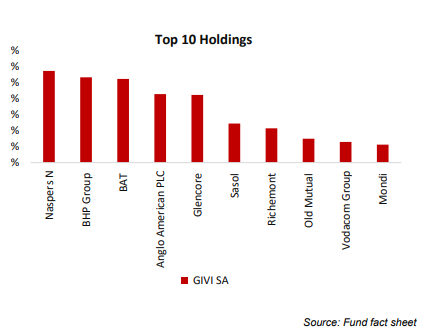

Top holdings: The top 10 holdings constitute 66.8% of the fund. No single stock dominates the fund. However, it is notably heavy in basic materials.

Suitability: The NewFunds S&P GIVI SA Top 50 ETF is suitable for long-term investors seeking to beat the market.

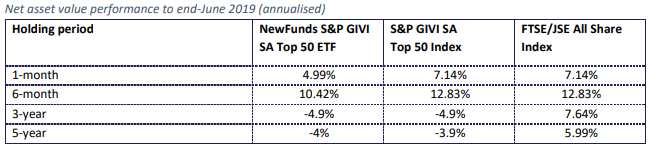

Historical performance: The NewFunds S&P GIVI SA Top 50 ETF’s historical performance is not that impressive. It has lost an average of 4% a year over the past five years, in line with its underlying index. Notably it significantly lags the all share index which gained 6% a year during that period. It has improved recently with a gain of 10.4% during the last six-months.

Source: http://www.etfsa.co.za/docs/perfsurvey/perf_survey_June19.pdf and June 2019 fact sheets

Source: http://www.etfsa.co.za/docs/perfsurvey/perf_survey_June19.pdf and June 2019 fact sheets

Fundamentals: The NewFunds S&P GIVI SA Top 50 ETF is highly sensitive to the rand exchange rate because many of the companies in its top 10 holdings operate globally. Similarly, because it holds a relatively high weighting of basic material companies, commodity prices also affect its performance.

Click logo to view

NewFunds S&P GIVI SA Top50 ETF

The residual income valuation approach which the fund uses to calculate each company’s intrinsic value favours mature, capital-intensive counters as well as those that pay no or low dividends. This tends to skew the portfolio towards basic materials and the bigger companies with global operations that have exposures to foreign currencies.

While we expect the rand exchange rate and commodity prices to move in favour of the fund, the global economy is expected to slow down. The IMF has cut its global growth forecast for 2019 to 3.3% from the 3.6% predicted last year. The local picture is far worse: the South African Reserve Bank expects GDP growth for 2019 to average 0.6% (down from 1.0% projected in May) and 1.8% and 2% for 2020 and 2021 respectively.

Fund statistics:

Alternatives: CoreShares Top 50 is the closest alternative to NewFunds S&P GIVI as they both track the same index. However, CoreShares Top 50 has the cheaper total expense ratio of 0.26%.

Click below to view the

NewFunds S&P GIVI SA Top50 ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|