Catch this insight by Intellidex on the NewFunds MAPPS Protect ETF. The NewFunds MAPPS Protect ETF mimics the total return performance of South African equities and fixed income indices through the MAPPS Protect Index. The ETF suits a risk-intolerant investor. Its high weightings low-risk bonds and cash help moderate its volatility.

Intellidex Insight: The NewFunds MAPPS Protect ETF is one of the two JSE-listed funds that invests across asset classes – equities, fixed income and cash – to create a balanced portfolio. The NewFunds MAPPS Protect ETFs fund has 38.66% of its assets in equities through the JSE Swix Top 40 index, 49.62% in bonds and 11.72% in cash.

By investing across multiple asset classes that are not perfectly correlated, the NewFunds MAPPS Protect ETF is able to reap the benefits of diversification which most single-asset class funds are unable to do. Its asset class diversification enables it to absorb unanticipated shocks that may be specific to a particular asset class. Notably though, this benefit usually comes at a sacrifice of upside potential as multi-asset funds tend to have lower upside potential when compared to funds focusing on equities only.

First-time investors who are warming up to ETFs and risk-averse investors are likely to find this fund interesting. It is also compliant with regulation 28, legislation that stipulates the asset allocation limits of retirement funds, which means one can use it as a retirement investment for the tax benefits.

Fund description: The NewFunds MAPPS Protect ETF mimics the total return performance of South African equities and fixed income indices through the MAPPS Protect Index, which invests in equities through the JSE Swix 40 Index, nominal bonds through the GOVI Index, inflation-linked bonds through the ILBI Index and cash in allowable money market instruments.

Click logo to view

NewFunds Protect ETF

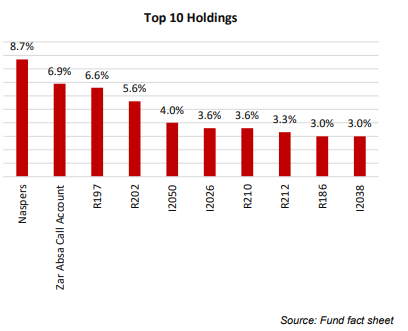

Top Holdings: The top 10 constituents contribute 48.3% to the fund portfolio. Eight of the top 10 holdings are bonds, which reflects the fund’s conservative investment approach.

Suitability: The ETF suits a risk-intolerant investor. Its high weightings low-risk bonds and cash help moderate its volatility.

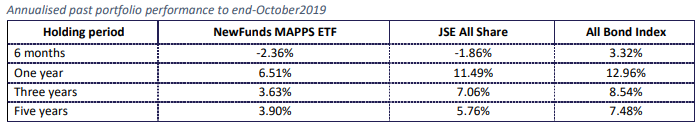

Historical performance: The NewFunds MAPPS Protect ETF’s returns lag those of the JSE All Share and All Bond indices

Fundamentals: The ETF has more than 50% of its funds invested in fixed income instruments. This asset class is particularly sensitive to interest rates but is also affected by macroeconomic risks, political risks and bond-yield movements.

Recent economic data on the domestic economy reinforces how gloomy the underlying economic condition is and investor sentiment remains fragile. In the third quarter of 2019, the issuing of unsecured, short-term debt instruments from big corporations was limited, with most issuance coming from banks.

Click logo to view

NewFunds Protect ETF

The tough economic conditions leave little revenue growth potential for South African companies. Offshore investors have generally been sellers, putting more pressure on the share prices of local stocks. On the global front, there is some positive sentiment emanating from consumer prices rebounding in the US and more stimulus measures expected to boost the slowing Chinese economy.

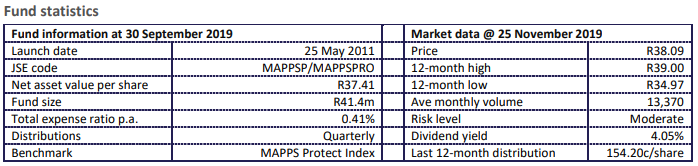

Fund statistics:

Alternatives: The NewFunds MAPPS Growth ETF is the only other fund that invests across multiple asset classes. It is more aggressive than the Protect fund with 74.3% of its assets in equities.

Click below to view the

NewFunds MAPPS Protect ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|