Catch this insight by Intellidex on the NewFunds Low Volatility ETF The NewFunds Low Volatility ETF was designed specifically to cushion investors against turbulence on equity markets. The fund has a two-pronged mechanism for managing its risk exposures. This fund should be considered by investors who are risk-averse.

Intellidex Insight: The NewFunds Low Volatility ETF was designed specifically to cushion investors against turbulence on equity markets. The fund has a two-pronged mechanism for managing its risk exposures.

First, it tilts towards low-risk counters by investing in 20 highly liquid companies on the JSE which have exhibited low volatility over the previous year. This rule tends to skew the portfolio towards sectors such as consumer staples, financials and healthcare stocks, which are usually stable and resilient. Then to minimise overall fund volatility, it scales its constituents according to their

contribution to risk. That is, each share weighting is set to contribute equally to the overall portfolio risk, which prevents disproportionate risk contributions.

We like the NewFunds Low Volatility ETF’s risk-focused approach. However, we think the recently listed CoreShares Scientific Beta Multi-Factor ETF, which applies a multifactor approach to selecting constituents, is a more solid option for investors seeking risk-controlled funds. The CoreShares Scientific Beta Multi-Factor Index ETF selects its constituents using equal contributions of six factors which are well-grounded in academic literature: value, size, low volatility, momentum, profitability and investment. This enhances its chance of delivering stable returns. Single-factor funds such as the NewFunds Low Volatility ETF tend to be to be highly cyclical.

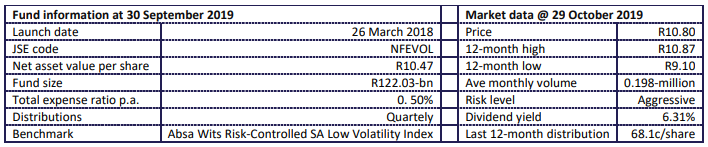

Fund description: The NewFunds Low Volatility Equity ETF (NFEVOL) tracks the Absa Wits Risk-Controlled SA Low Volatility Index, which invests in 20 JSE-listed companies with the lowest price volatility.

Click logo to view

NewFunds Low Volatility ETF

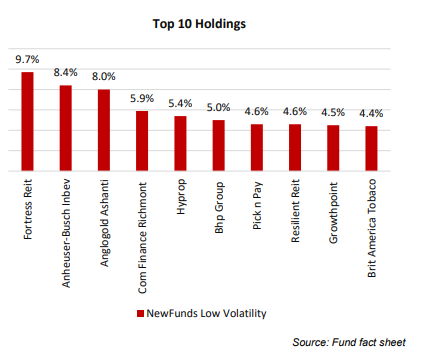

Fund Holdings: The fund is dominated by some of SA’s leading companies. It has a good balance of SA-Incs and rand hedges, which is a valuable attribute from a diversification perspective. It’s also relatively well distributed across its constituents with its top 10 holdings accounting for just 60% of its total assets. However, the fund lacks a bit on sector spread. Close to the three quarters of the fund is in financials and consumer-focused stocks. Technology stocks account for less than 5%. This is somewhat at odds with the composition

of the main bourse where basic materials and technologies are the top two sectors.

Suitability: The ETF is most appropriate for investors who are risk-averse and might be more inclined to panic during market corrections. Low volatility funds tend to provide better downside protection and fluctuate less than the overall market

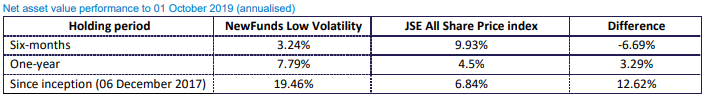

Historical performance: NewFunds Low Volatility ETF ‘s performance has been impressive, yielding 19.46% since inception, well ahead of the all share index.

Source: etfcib.absa.co.za

Fundamentals: Prospects for this fund are mixed as it generates earnings both locally and internationally.

The international exposure means the fund is exposed to economies that are doing better than SA while also offering a hedge against an underperforming rand. A positive trend internationally is the easing of monetary policies to buttress the slowing global economy. However, geopolitical tensions are increasing while the US-China trade relations are a constant cause for concern.

Click logo to view

NewFunds Low Volatility ETF

In South Africa, a slew of incoming third quarter economic data confirms the dire state of the economy – the International Monetary Fund has slashed SA’s GDP growth forecast for this year to 0.7% from 1.2% and to 1.1% from 1.5% for next year. Manufacturing production and mining production contracted 1.8% and 3.2% in August while the Absa Purchasing Managers’ Index hit its 10-year low in August. The NewFunds Low Volatility ETF ‘s however tends to skew towards defensive sectors.

Fund statistics:

Alternatives: The fund’s indirect alternatives are the NewFunds Volatility Managed Moderate Equity ETF with a total expense ratio of 0.50% and CoreShares Scientific Beta Multifactor (TER 0.55%).

Click below to view the

NewFunds Low Volatility ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|