Intellidex 2019 reviews: NewFunds GOVI ETF

Catch this insight by Intellidex on the NewFunds GOVI ETF The NewFunds GOVI ETF aims to capture the returns of all sovereign bonds issued by the South African government and fall into the top 10 positions of the all bond index (Albi). The fund is ideal for long-term investors who require a high level of income from their capital investment.

Intellidex Insight: Bonds are traditionally seen as a haven in turbulent times. This is largely because they tend to be less volatile than stocks and research shows their prices often move in the opposite direction to equities in the long run, making them an excellent portfolio diversifier. The benefits offered by local bonds have been compromised somewhat by SA’s poor credit ratings. SA’s long-term local and foreign debt is rated as junk – below investment grade – by two of the three major rating agencies. With the government determined on rolling out elaborate welfare programmes such as the National Health Insurance while most SOEs are battling to make ends meet and the economy is stuttering, SA’s last investment grade rating – by Moody’s – hangs by a thread. Junk bonds tends to behave more like equities during periods of economic uncertainty.

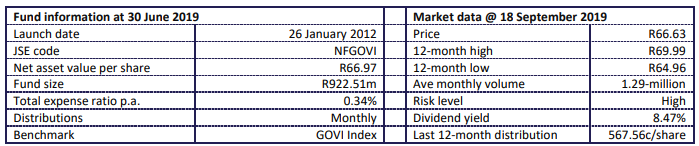

That said, the negative investor sentiment on SA bonds, coupled with fears of a global recession, have pushed yields (prices) of emerging market bonds up (down). SA’s benchmark 10-year bonds are offering a real yield (yield above inflation) of 4.21%, which is one of the highest on the market. Given that inflation is largely expected to remain under control in the short to medium term, the Absa NewFunds Govi ETF, the only one on the JSE not linked to inflation, seems like the best avenue for those seeking high yields. The ETF gives investors undiluted exposure to SA government bonds at an attractive dividend yield of 8.5%. Note that dividends received from shares in Absa NewFunds GOVI are considered interest income, not dividends. Thus, it is added to one’s annual income and taxed at the investor’s marginal rate, subject to rebates. The first R23,800 earned as interest is exempt from tax. Investors older than 65 receive a secondary rebate which increases the total exempt amount to R34,500. While this is unlikely to affect investors in the lower-income tax brackets, higher-income earners may be affected negatively.

Fund description: The NewFunds GOVI ETF aims to capture the returns of all sovereign bonds issued by the South African government and fall into the top 10 positions of the all bond index (Albi). Albi uses average market capitalisation and liquidity and considers conventional listed bonds with a remaining life greater than one year throughout the quarter.

Click logo to view

NewFunds GOVI ETF

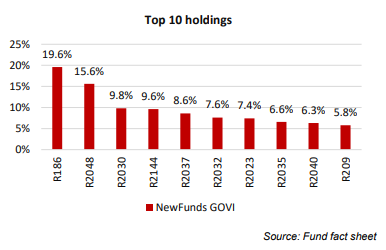

Top Holdings: More than 60% of the ETF funds are in bonds with maturities of 12 years or more. The R186 government bond series is the largest holding, accounting for 19.6% of the fund.

Suitability: The NewFunds Govi ETF is ideal for long-term investors who require a high level of income from their capital investment. While the fund invests in bonds it may behave more like equities during periods of high economic uncertainty, which means it should be considered by investors with an appetite for risk, but less so

than that for equities.

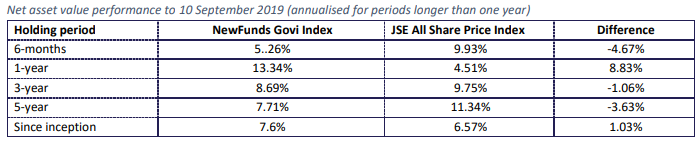

Historical performance: The NewFunds Govi ETF’s historical performance has been quite impressive with its return beating equities over some holding periods. It has returned 7.61% a year since its inception, ahead of the 6.57% returned by the all share index. It gained 5.26% over the past six months.

Fundamentals: Several factors drive the value of bonds including the credit profile of the issuer, liquidity, maturity profile and interest rates. Most SA government bonds held by NewFunds Govi have decent liquidity, so liquidity is usually not an issue.

Moody’s recent decision to maintain SA’s long-term local and foreign debt’s investment grade, to a certain extent, enhances the investment case of South African government bonds which have already been receiving some attention from fund managers because of their juicy yields.

SA’s benchmark 10-year bonds are offering a real yield (yield above inflation) of 4.21%, which is one of the highest on the market. Real yields in some developed markets are in negative territory, which means investors are losing money in real terms. Negative real returns in developed markets come as investors shift their money into asset classes deemed to be safe havens on fears of a global recession. Indeed, most analysts expect global yields to remain low due to fears of a slowdown in global economic growth and low inflation. This makes emerging market bonds attractive from a yield perspective. However, high yields also reflect investors’ lack of confidence in the South African government’s ability to honour its debt obligations. Thus, they are demanding higher compensation for a perceived high risk in holding South African bonds.

Click logo to view

NewFunds GOVI ETF

On the flip side, high yields simply could be due to market jitters. Usually when faced with a global economic slowdown, investors turn to developed markets for safety, which temporarily pushes yields in emerging markets up. However, when the dust settles and the search for yield ignites, several high-yield bonds in emerging markets, including SA, may gain significantly, which will result in bumper capital gains for those who would have bought on the low.

Fund statistics:

Alternatives: The NewFunds GOVI ETF direct alternative are the NewFunds ILBI (0.35%) and Satrix ILBI (lowest TER of 0.25%).

Click below to view the

NewFunds GOVI ETF Fact Sheet

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.