Intellidex 2019 reviews: CoreShares S&P Global Dividend Aristocrats

Catch this insight by Intellidex on the CoreShares S&P Global Dividend Aristocrats. The CoreShares S&P Global Dividend Aristocrat ETF invests in aristocrat indices in Canada, Europe, Asia and the US. The CoreShares S&P Global Dividend Aristocrats suits investors seeking dollar-based strategies that generate consistent income.

Intellidex Insight: The JSE offers three dividend-focused non property equity funds: Satrix Divi ETF, CoreShares South Africa Dividend Aristocrats ETF (CoreShares Divtrax) and CoreShares S&P Global Dividend Aristocrats ETF. Satrix Divi and CoreShares Divtrax invest in stocks listed on the JSE. The CoreShares S&P Global Dividend Aristocrat ETF invests in aristocrat indices in Canada, Europe, Asia and the US.

An advantage of the CoreShares S&P Global Dividend Aristocrats ETF is that it not only provides access to cash focused companies but adds an offshore component, which is important given the gloomy prospects for SA. Since its constituents are denominated in foreign currencies while it is traded in rands on the JSE, the fund cushions investors against weakness in the rand. However, the fund suffers when the rand strengthens against major currencies.

The CoreShares global fund, in its short lifespan, has already demonstrated its ability to deliver decent capital appreciation. This is important because a return from any equity investment is made up of two components: dividend yield and capital appreciation. Investors should not be made to sacrifice one for the other’s main downside is that it is a slightly costly when compared with peers. It has an annual total expense ratio (TER) of 0.62%. Satrix Divi has a TER of 0.39% and CoreShares Divtrax is on 0.54% -- but you’re paying extra for the foreign investments

Fund description: The CoreShares Global Dividend Aristocrats ETF tracks the performance of the S&P Global Dividend Aristocrats Blend Index. This index is designed to mimic a portfolio of S&P dividend-paying companies diversified across Canada, Europe, Asia and the US.

Click logo to view

CoreShares S&P Global Dividend Aristocrats

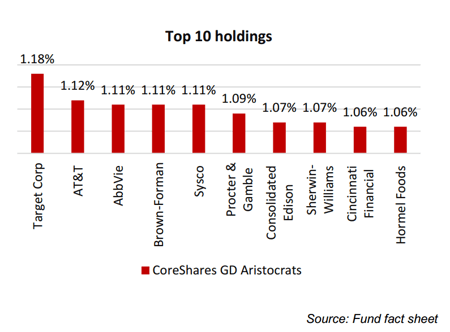

Top Holdings: The fund is well diversified with the largest holding, Target, making up only 1.18% of the

entire find while the top 10 combined constitute 10.08%. These foreign companies are consistent dividend payers.

Suitability: The CoreShares S&P Global Dividend Aristocrats suits investors seeking dollar-based strategies that generate consistent income. The fund’s constituents have a strong track record of delivering consistent and growing dividends through economic cycles.

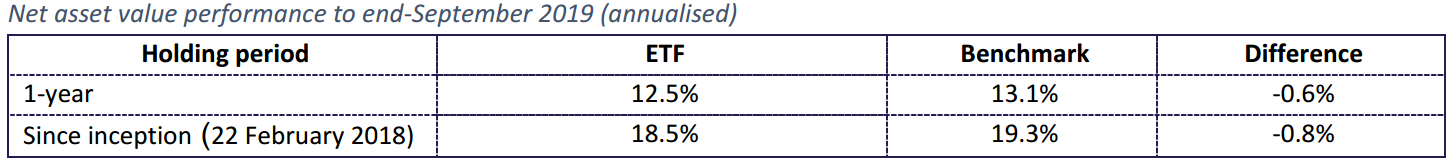

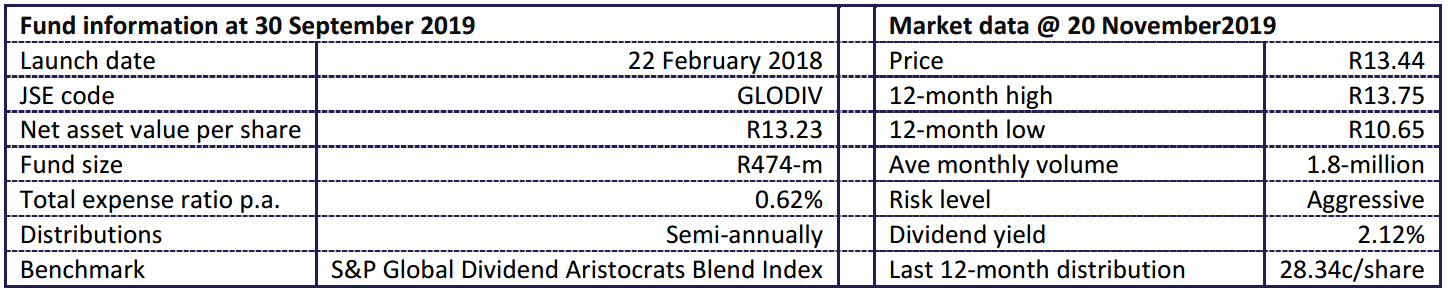

Historical performance: The CoreShares Global Dividend Aristocrats ETF is still relatively new, launched in February 2018, but its performance has been impressive so far, streaks ahead of the JSE all share index’s returns.

Source: September 2019 fact sheets

Fundamentals: We are seeing the following key themes playing out in the markets:

1) Moderate global economic growth: The global economy is expected to remain on a moderate growth path, albeit softer than 2018. The Organisation for Economic Cooperation and Development is forecasting global GDP growth of 2.9% this year and 3% next year. The IMF is a bit more optimistic with projections of 3.2% this year and 3.5% next year, while growth in the US is expected to remain above 2% in both years. Risks include escalating trade tensions between China and the US and the US mid term elections next year which could significantly change the global political and economic landscape.

2) Low inflation: Inflation in most developed markets remains stubbornly low, reflecting low demand.

3) Downward pressure on interest rates: The US Federal Reserve recently delivered a second consecutive rate cut of 25 basis points on the back of global uncertainties. This follows a big rate cut by the European Central Bank which left the EU’s benchmark rate in negative territory. Locally, the South African Reserve Bank cut its benchmark interest rate in July but has left it unchanged since.

Click logo to view

CoreShares S&P Global Dividend Aristocrats

The global economic growth projections of above 3% bode well for this fund. It means that its constituents should be able to sustain their strong earnings. The ETF would be further bolstered should the rand weaken against the dollar.

Fund statistics:

Alternatives: The CoreShares S&P Global Dividend Aristocrats closest alternatives are the Satrix Divi (TER of 0.39%) and CoreShares Divtrax ETF (0.54%).

Click below to view the

CoreShares S&P Global Dividend Aristocrats

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.