Intellidex 2019 reviews: Cloud Atlas AMI Big50 ex-SA ETF

Catch this insight by Intellidex on the Cloud Atlas AMI Big50 ex-SA ETF. The AMI Big50 ex-SA ETF tracks the AMI Big50 ex-SA Index, which is a market capitalisation-weighted index designed to serve as a benchmark for a broader representation of African equity markets, excluding South Africa. Cloud Atlas Big 50 is ideal for long-term investors with a high-risk.

Intellidex Insight: This fund presents the opportunity to invest in various African markets, excluding SA, in one transaction. This is a welcome development as African frontier markets are relatively illiquid and difficult to access. The fund gives exposure to the 50 biggest African companies by market capitalisation on various African exchanges. The AMI Big50 ex-SA ETF is offered by Cloud Atlas Investing, a relatively a new boutique which focuses on companies in Africa but excluding SA.

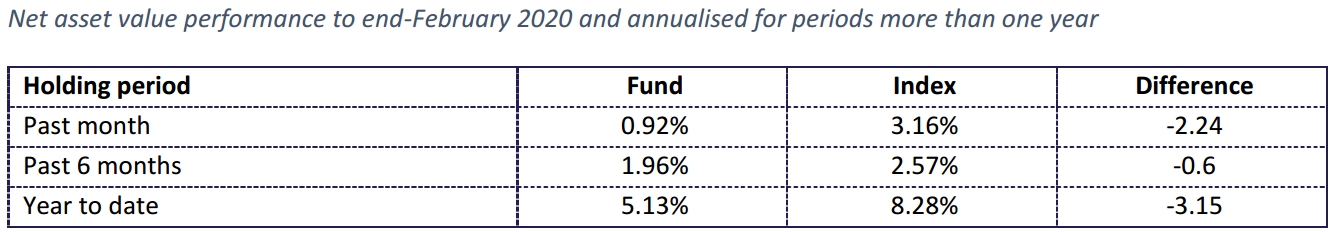

The fund has disproportionately higher exposure to a few North African countries – with Moroccan and Egyptian companies making up more than 46% of the fund’s investments. While this increases concentration/country risk, it gives South African investors exposure to the northern part of the continent, which is characteristically different from sub-Saharan African economies.

Given that the AMI Big50 ex-SA is invested in stocks denominated in non-rand currencies but measures its performance in rands, the exchange rate plays a crucial role in its performance. Effectively, what investors in this ETF would like to see is a weaker rand against its basket of currencies. A strengthening rand harms the ETF’s performance.

The fund is suitable for long-term investing and for investors who believe that Africa has growth potential. Results from Africa in the past 10 years are mixed. While Kenyan equities have outperformed both peers and most global equities in dollar terms, Angola and Africa’s biggest and most populous economy, Nigeria, have been disappointing. As such there is a need to be patient and have a longer investment horizon.

The promise of Africa lies in its young population and the growing middle class. Africa is considered the last real frontier and therefore should naturally progress to catch up with more developed economies . Coming from a low base, Africa should experience a relatively higher growth rate than the rest of the world. The counter argument to th is narrative is that corruption, political instability and maladministration characterise several African countries.

Fund description: The AMI Big50 ex-SA ETF tracks the AMI Big50 ex-SA Index, which is a market capitalisation-weighted index designed to serve as a benchmark for a broader representation of African equity markets, excluding South Africa.

Click logo to view

Cloud Atlas AMI Big50 ex-SA ETF

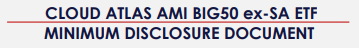

Top Holdings: The fund’s top 10 investments account for just over 59% of its total investments. This implies high concentration risk, but the constituents come from different countries and industries, which mitigates the risk to a degree.

Suitability: Equity prices are volatile, especially in the short term, which may lead to sizeable capital losses due to the workings of various market variables. These include interest rates, political developments or

economic activity. This is more pronounced for frontier markets. So, Cloud Atlas Big 50 is ideal for long-term investors with a high-risk appetite.

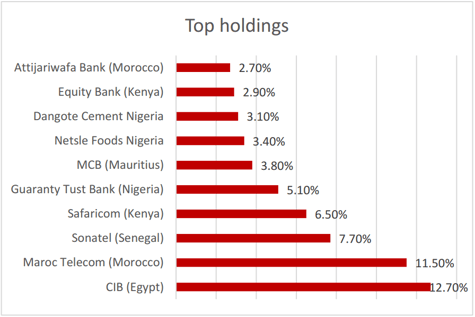

Historical performance: We are not enthused by how Cloud Atlas (or its administrator, Maitland) report the fund’s performance metrics. Our efforts to get some clarification were partially successful. The fund has been in existence for more than a year, but it does not publish annualised return performance, nor the performance since the fund’s inception. Separately, we attribute the sizeable tracking error to the illiquidity of African frontier markets.

Fundamentals: While Africa has the potential to rise economically given its abundant natural resources, good climate and a young vibrant population, its success lies in the proper stewardship of these resources by its governments. So far examples of success such as Botswana have been few and far in between. Countries like Rwanda, Ethiopia and Kenya look like they are on the right path but only time will tell.

The World Bank forecasts the sub-Saharan region to grow by 2.9% in 2020, which is above the average 2.5% expected globally – the rate includes SA, set to grow 0.9%, which is weighing down the figure given its overbearing position in the sub-Saharan Africa economy. The World Bank expects North Africa to grow 2.4% with Egypt, constituting 23% of the fund, forecast to outperform with growth of 5.8%, driven by higher investment and private consumption.

Click logo to view

Cloud Atlas AMI Big50 ex-SA ETF

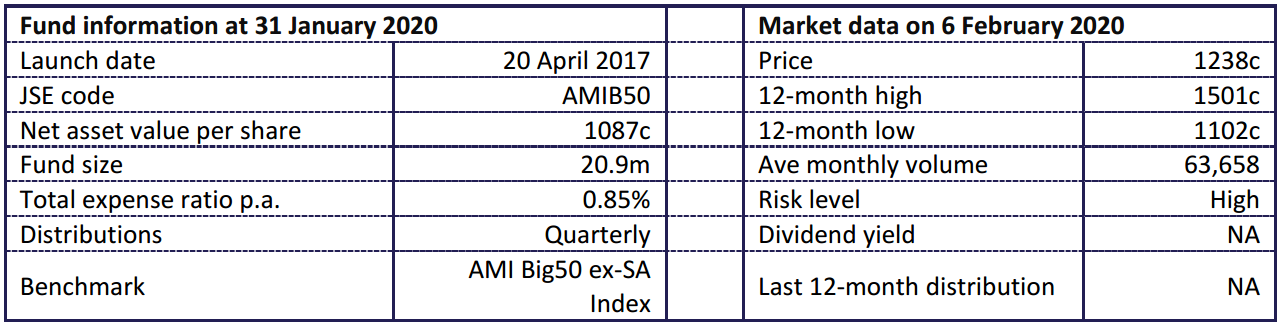

Fund statistics:

Alternatives: None

Click below to view the

Cloud Atlas AMI Big50 ex-SA ETF

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.