“Junk Status”

They say history repeats itself and patterns are fractal? Twenty-five years ago, South Africa received Moody’s Investment Services investment-grade credit rating, and all was well in our land. Yet we managed to find ourselves back to sub-investment grade a.k.a “junk status”.

Moody’s Investor Services

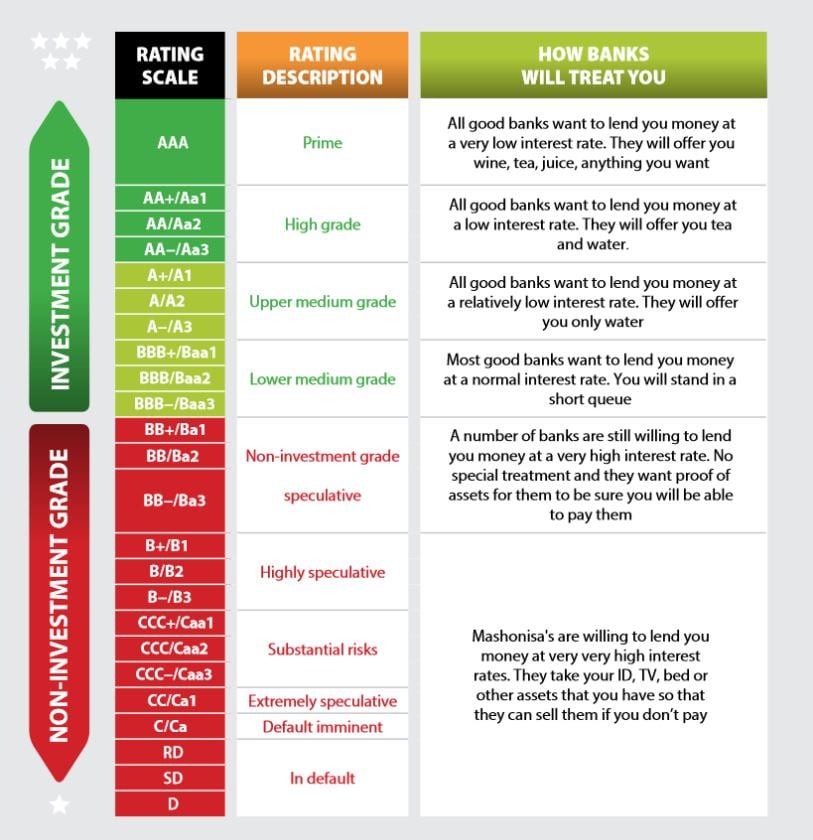

On Friday the 27th of March, South Africans held their breaths as we awaited the rating agency Moody's, the last to have our credit rating at investment grade, decision. Moody’s did indeed cut South Africa’s sovereign credit rating to Ba1, “junk”.

Moody’s cited a continued deterioration in government’s fiscal strength and weak economic growth for its decision. Moody's outlook remains negative, and it estimates that South Africa's debt burden will reach 91% of its Gross Domestic Product (GDP) in the 2023 fiscal year.

This could not have come at a worse time; the country is in a 21-day lock down to try and slow down the spread of the coronavirus (COVID-19) while the Government attempts to keep the boat afloat.

What’s expected next?

The possibility of a market rally is slim but looking back to Brazil in 2016 when the country was also downgraded to sub-investment grade the Brazil Stock Exchange Index (IBOV) rallied. Keep in mind that the economic and political landscapes from 2016 and today, differ significantly.

We might expect to see a widespread sell-off of equities across the financial and retail sectors on the JSE as uncertainty sets in on an already stressed financial market. The extent of the sell-off is unknown as some market participants have stated that the downgrade has already been priced in.

South African government bonds will automatically be excluded from the FTSE World Government Bond Index (WGBI). Government bonds will see significant capital outflows because fund managers with investment-grade mandates will be forced to sell South African government bonds.

The FTSE World Government Bond Index (WGBI) was set to rebalance at month-end, which would have seen South Africa excluded from the index. The Index will not rebalance at month-end and will continue the rebalance schedule on April month-end. FTSE, who run the Index stated, “In the event of a downgrade of South Africa, it will not exit the WGBI or WorldILSI for the April Index". Some light in the tunnel but we will, however, be excluded from these Indices after April 2020.

The Rand (ZAR) is expected to depreciate significantly over the coming months against all the major currencies around the world, which will lead to an increase in imported goods.

What does it mean for South Africans?

No sugar coating here, we are all in for some pretty hard economic times ahead, not to even mention the social effects of COVID-19. South African’s can expect interest rates to increase significantly at some point, Inflation to rise, petrol prices to rise along with food prices. We might expect unemployment to grow as business close down while government spend less on social programs.

What does EasyResearch say

With interest rates set to rise significantly, one might look to increase one’s positions in cash, fixed interest-bearing instruments and other hard assets. Offshore assets might also become attractive in the short term before the South African Rand depreciates further.

The news that South Africa will not be excluded from the FTSE World Government Bond Index (WGBI) immediately is most welcome to curb outflows and buy us some time if only for a month. We might see some relief from this in the initial phase, but we are in no way in the same position as that of Brazil back when they were downgraded.

Our clients

Clients have been positioning themselves over the last couple of months which shows education in the investment space has come a long way. Also, if recent market volatility is anything to go by, then clients might take advantage of the current risk environment.

Conclusion

Things will get tough, but opportunities will present themselves in the coming months as there are always ways to safeguard your portfolio against market volatility.

Source – EasyResearch, FTSE Russell, National Treasury, Moody’s Investment Services, Fin24, Moneyweb, Bloomberg.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.