3 Defensive ASX Picks

Share Picks

If the iffy state of the markets, have you running to the dunny, hold on, there are better ways to handle your volatile disruption; check it out!

With the current economic uncertainty around the globe and while inflation and interest rates are rising, it is always sensible to look at defensive investments during these periods.

So as the world moves closer to a possible global recession, it does not hurt to be prepared with these 2 Defensive stock picks across different market sectors:

Utilities:

AGL Energy Limited (AGL)

All things energy seem to be the bee's knees nowadays, for all sorts of reasons, and the energy provider, AGL Energy Limited, personifies energy in Australia.

The energy company supplies energy and other services to residential, small, and large businesses and wholesale customers and has been an EasyResearch stock pick before.

This makes AGL Energy Limited an essential infrastructure services company with a relatively predictable earnings outlook regardless of the economic cycle. Another positive is the constant dividend and predictable dividend payments, which could come in handy during uncertain times.

- Share Price: AU$ 8.41

- Market Cap: AU$ 5.75 billion.

- P/E Ratio (TTM): 6.93x

- P/B Ratio: 0.9x

- Dividend (Annual Yield %): 5.84%

- Franking: N/A

- 52 Week range low of AU$ 5.10 and AU$ 9.15 share high.

Outlook – Loadshedding and rolling blackouts are not unique to South Africa anymore and more countries are battling to keep the lights on for various reasons. Some short-term headwinds for energy utilities like AGL were the suspension of the National Energy Market (NEM) by the Australian Energy Market Operator (AEMO). This suspension was due to the risk of rolling blackouts along the east coast spiked due to pricing caps in the market. Luckily for utility shares, the AEMO has started to gradually lift the suspension of the National Energy Market (NEM) as market conditions improve.

The energy leader's share price is still trading at a discount to fair value by our estimates, has a low P/E and excellent dividend track record, and has seen some insider buying activity.

Technical Outlook – The price action has been gaining momentum since the start to the conflict in Ukraine which has seen the share price higher by 36% year to date. The price action has been trending higher since December 2021 and has started to consolidate sideways which brings the AU$ 7.87 support level into focus. Short interest has increased on AGL to 2.1% from 1.4% in December 2021 but the share still has a low Beta of 0.20 and upside potential if the average analyst price target at AU$ 9.36 (green line) is anything to go by.

Login to view AGL Energy Limited (AGL) shares

on EasyEquities

Healthcare:

CSL Limited (CSL)

The Health Care sector has proven to be resilient against recessions over time, and this biopharmaceutical giant should be on your shopping list.

CSL Limited, an absolute giant in the health and biotechnology space, comes into focus as people need healthcare or medication regardless of the economic cycle or debt burdens. Also, most of these companies have an advantage through their Research and Development (R&D) and patents.

Formed over 100 years ago to save lives using the latest technologies, CSL is probably the definitive defensive company, not to mention its high return on equity and resilient earning capabilities. Half-year results did not surprise a challenging environment with total revenue up 5.3% and R&D investment up 13%. The gross margin was lower by 3% YoY, but the board maintained the interim dividend despite lower earnings.

- Share Price: AU$ 270.38

- Market Cap: AU$ 132.00 billion.

- P/E Ratio (TTM): 37.33x

- P/B Ratio: 6.5x

- Dividend (Annual Yield %): 1.09%

- Franking: N/A

- 52 Week range low of AU$ 240.10 and AU$ 319.78 share high.

Outlook – The company has retained its guidance for FY 2022, and by our estimates, the share is trading below fair value, considering the guidance is underpinned by expected future cash flows. The following earnings report scheduled for the 17th of August 2022 will show if revenue-driving factors like plasma collections and flu vaccines have ticked up.

Technical Outlook – Short interest on CSL Limited shares is very low at 0.26% and is expected to have low levels of volatility compared to the market with a Beta (5year monthly) of 0.10. Looking at the price action, we can see that the price did break out of the downtrend in February and is starting to make higher lows which is positive. But we need to see a daily close above the 282.81 resistance level to reach the average analyst price target of AU$ 317.06 a share (pink line).

Login to view CSL Limited (CSL) shares

on EasyEquities

Insurance:

Insurance Australia Group Limited (IAG)

Another exciting and sometimes overlooked industry during economic uncertainty is the insurance industry, believe it or not! Despite facing bushfires, COVID-19, and other peril headwinds over the last two years, Insurance Australia Group Limited could be set for a rebound.

Whatever the economic cycle, companies and households need insurance which plays a vital role in mitigating risk, and high-interest rate cycles favor insurers. This means Insurance Australia Group Limited could be an ideal defensive pick well below market valuations by our estimates.

Insurance Australia’s lackluster half-year results released in February 2022 were dampened by the elevated costs associated with the recent natural disasters, which led to a 58% decline in profits.

The insurer's positive FY 2022 guidance and longer-term outlook in the current macroeconomic environment have excited everyone. The company has upgraded its gross written premium (GWP) guidance from low to mid-single-digit growth and reaffirmed its reported insurance margin guidance of 10% to 12%.

- Share Price: AU$ 4.42

- Market Cap: AU$ 10.74 billion.

- P/E Ratio (TTM): 52.96x

- P/B Ratio: 1.8x

- Dividend (Annual Yield %): 4.35%

- Franking: 0%

- 52 Week range low of AU$ 4.02 and AU$ 5.51 share high.

Outlook – The Insurance Australia Group Limited could see a rebound from its recent 10-year lows as macroeconomic factors favor the insurance sector. This should lead to solid earnings as higher interest rates should lead to higher returns on the insurer's capital. "Underlying business momentum is starting to show, with premium-rate hikes continuing to outpace claims while inflation pressures and higher bond yields further support earnings." - Anna Milne.

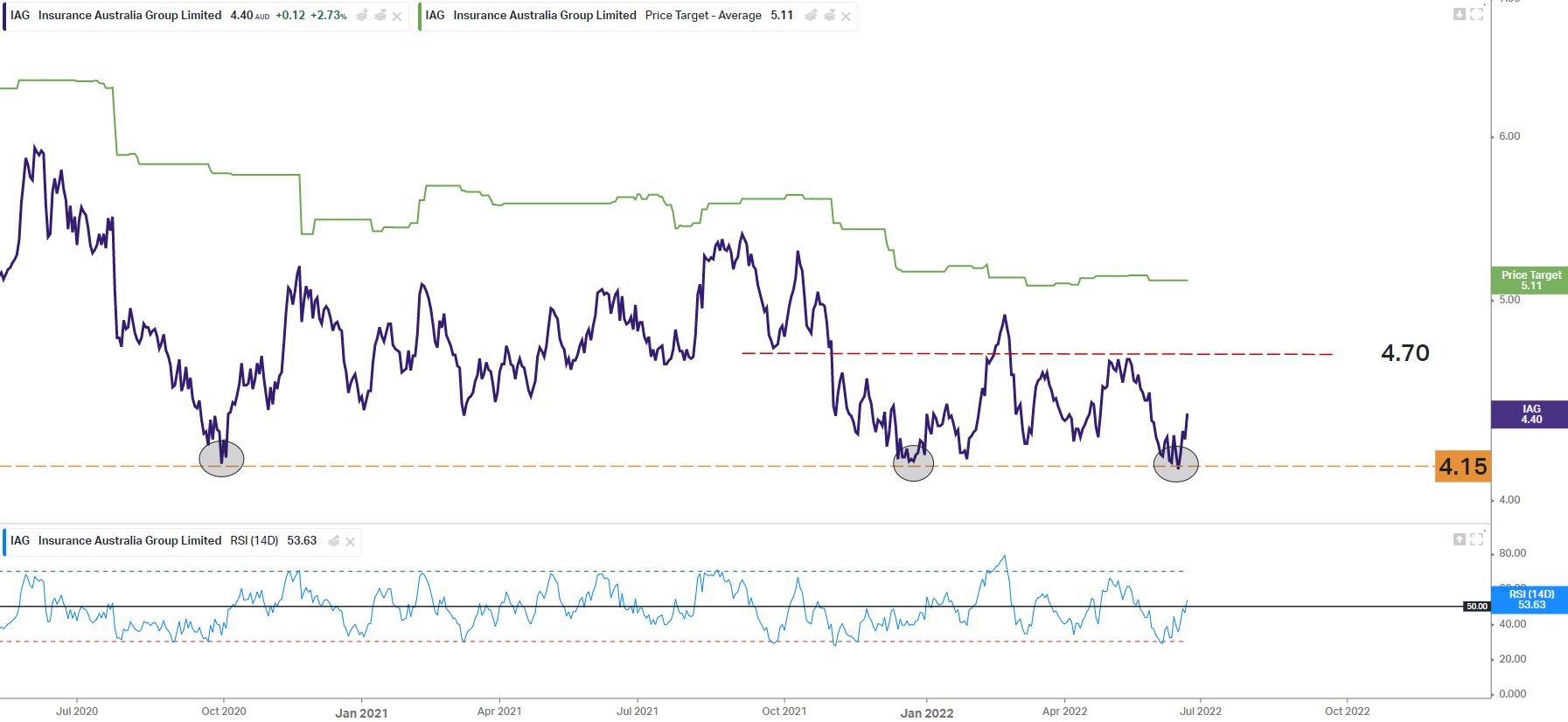

Technical Outlook – The price action on Insurance Australia Group has been trading relatively sideways since October 2021 until now. Price has tested and rebounded from the AU$ 4.15 support level and could see higher levels targeted at the AU$ 4.70 resistance level. Daily aggregate short positions on the share have seen a slight increase and are currently at 1.3%, while the average analyst price target expectation is at AU$ 5.11 a share (green line).

Login to view Insurance Australia Group Limited (IAG) shares

on EasyEquities

Informed decisions

Bear markets and recessions are part of a normal economic cycle, but there are ways to mitigate some portfolio risk during economic downturns. Quality defensive shares with good cash flows and strong balance sheets should be front of mind and tend to weather the storms. The above-mentioned sectors have stood the test of time during recessionary periods of low economic growth and uncertainty as demand for their products and services is likely to grow.

Although we are not in a recession now, it does not hurt to be prepared.

New to investing

and want to know more about our other stock picks?

Read: Income from coal amid uncertainties

Sources –EasyResearch, Australian Securities Exchange (ASX), Australian Securities & Investments Commission (ASIC), Koyfin, Reuters, Tony Yoo, CSL Limited, Wilsons Advisory, David Cassidy, James Mickleboro, Insurance Australia Group Limited, AGL Energy Limited, Listcorp, HotCopper, Sebastian Bowen, Australian Energy Market Operator (AEMO).

Take note: all share data was taken on 28/06/2022

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.