Intellidex Reviews: CoreShares S&P South Africa Low Volatility

Suitability: The best feature of shares can also be its worst: they are risky. That’s good if you can take on risk, because the probability is that you will earn higher returns for it. But risk is also a downside: it means volatility with share values going up and down and, at least in the short run, it’s often not a good idea to expose yourself to too much risk of downside.

The ETF we look at this week tries to strike a balance between these two faces of risk. It chooses stocks based substantially on how volatile their prices are, packing the portfolio with ones that have a history of low volatility. That doesn’t entirely mean you give up on returns. The fund is designed to take advantage of what is known as the “low volatility anomaly”. This is a phenomenon that has been found in a range of research on the financial markets which shows that low volatility portfolios actually outperform higher volatility portfolios. This is an anomaly because the normal expectation is that taking on risk should be compensated with higher returns, not the other way around.

It does that with a two stage screening process. Any stock that winds up in the fund first has to pass the S&P SA Composite Index criteria and then the S&P SA Low Volatility Index methodology. The first pass picks out assets that meet yardsticks for liquidity, market capitalisation and volatility. So this fund suits people who can still stomach some degree of risk – these are shares, after all – but want that risk diminished by focusing on the lower end of the volatility spectrum.

What it does: The CoreShares S&P South Africa Low Volatility ETF tracks the price and yield performance of the S&P SA Low Volatility Index (volatility index). First, all JSE companies are subjected to the S&P SA Composite Index screening, which selects stocks that meet minimum liquidity and market capitalisation requirements. From those that pass the test, the 40 least volatile stocks are then picked to make up the S&P SA Low Volatility Index, based on the one year trailing standard deviation. This is a statistical measure of volatility – basically how much daily returns jump around the average. Stocks with steady returns are more likely to make the cut. Among the 40, the lower volatility stocks get a bigger waiting than the higher volatility stocks.

In finance, volatility (as measured by standard deviation of an asset) is widely used to measure risk. The interpretation is that a low measure of standard deviation (low volatility) means the risk of an asset is low and vice versa.

Advantages: Compared with most listed ETFs which limit their universe to the JSE’s top 100 or fewer stocks, this fund has a wider universe which encompasses all JSE-listed stocks (large-, mid- and small-cap stocks) that meet the S&P SA Composite Index criteria. The fund is also well diversified with the biggest asset taking up only 3% of the fund. This eliminates the idiosyncratic influence of individual stocks, compared with popular market cap-weighted approaches.

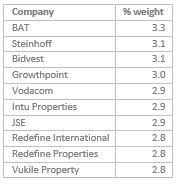

Top holdings: The top-10 holdings constitute less than a third of the fund and the biggest holding takes up only 3.3%.

Risk: This is a 100% investment in equities, which remains a riskier asset class than bonds or cash – but the fund is less volatile than other equity investments. However, potential higher returns over time should compensate for the relatively higher risk.

Fees: The annualised total expense ratio (excluding brokerage and transactional costs) is 0.41%.

Historical performance: The fund’s performance depends on how you choose to invest – through a single lump-sum payment or regular instalments. A lump-sum investment mimics the index performance more closely and the performance report in the table below is for a lump-sum investment. The fund was formed two years ago.

On a total return basis, the volatility index has outperformed the composite index since 2010, consistent with the low volatility phenomenon. We’re don’t think this return should be relied on in the future. What is important is that it offers lower volatility rather than that it has beaten returns of higher volatility stocks in the past. Consequently we don’t think this should picked as a fund that will outperform on returns. Rather it should be chosen for its lower risk profile.

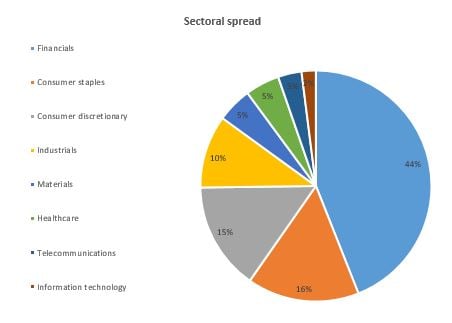

Fundamental view: While the fund is lower risk and widely diversified, SA’s muted economic growth prospects pose a significant threat to the fund’s prospects given its 44% exposure to financial companies, which generate a big portion of their earnings in SA. In contrast, 31% of the fund is made up of consumer stocks (staples and discretionary) which are somewhat defensive and generate a significant portion of earnings outside SA.

Alternatives: There are no available listed ETFs which track the S&P SA Low Volatility Index. Several other ETFs can provide exposure to equities in general

BACKGROUND: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

What are the benefits of ETFs?

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

You can check out other ETF Tuesday posts here.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.