Stock Pick Of Companies Safeguarding Their Earnings 💰🔐

The global economy is shifting towards a green economy, and companies are strategically safeguarding their earnings by embracing sustainable practices. The transformation in this era is characterized by a combined effort to mitigate carbon emissions and amplify the usage of renewable energy sources.

A pivotal move in this direction was initiated by the EU, which launched the pioneering phase of the world's first carbon border tariff, the Carbon Border Adjustment Mechanism (CBAM) - a move aimed at curbing the carbon footprint associated with imported goods.As businesses adapt to the demand of this new paradigm, energy remains at the forefront to move away from traditional fossil fuels and pivot towards eco-friendly alternatives such as solar, wind, and hydroelectric power. Achieving this necessitates substantial investments in pioneering infrastructure and cutting-edge technologies. In this research article, we'll look at:

- ExxonMobil's advancements in carbon capture and its strategic acquisition

- Technology giants like Apple, Amazon, and Microsoft commitments to renewable energy

- Investor sentiment towards these companies.

Carbon Capture & Storage (CCS)

Carbon Capture & Storage (CCS) emerges as a critical solution in this narrative. Companies can mitigate their environmental impact by capturing carbon dioxide (CO2) emissions from industrial processes and power plants. This facilitates their sustained operation and aligns with their commitment to combat climate change.

ExxonMobil, a prominent figure in the energy sector, has recently made strides in this domain. The company emerged as a winner in the UK's inaugural carbon storage licensing round, marking a significant milestone. Their strategic partnerships with entities like Nucor Corporation underscore their commitment to pioneering carbon capture agreements, thereby solidifying their stance in accelerating the journey to net-zero emissions.

Last week, ExxonMobil agreed to buy Pioneer Natural Resources via an all-stock deal that values Pioneer at $59.5 billion, or $253 per share - a deal expected to increase ExxonMobil's oil production despite climate change concerns.

It's worth noting that the ongoing surge in oil prices serves as a lucrative opportunity for oil companies to fortify their revenue, profits, and dividends. This can also enable a company to allocate more resources to exploration and production endeavours, positioning them for long-term gains while effectively balancing capital expenditure and operational costs.

Renewable Energy In Big Tech

When it comes to Technology, giants like Apple, Amazon, and Microsoft are making substantial commitments to renewable energy. By aiming to integrate renewable energy sources into their operations fully, these companies not only fulfil their environmental aspirations but also make astute financial decisions.

Apple is working with its suppliers to reduce emissions by 75% by 2030, investing in renewable energy projects in China and Japan. Amazon aims to achieve 100% renewable energy for its operations by 2025, surpassing its initial 2030 target by five years. Amazon now manages 401 renewable energy projects across 22 countries, and rooftop solar systems in North American fulfilment centres can supply up to 80% of their energy needs.

Microsoft also aims to use 100% renewable energy by 2025. The company is expanding its backing for domestic green energy equipment production worldwide to support this goal. Microsoft has partnered with Qcells, a leading solar product provider, which includes support for domestically manufactured components; it is the only U.S. company with a complete solar supply chain offering comprehensive clean energy solutions.

Investor Sentiment

Renewable energy and carbon capture & storage can safeguard earnings and improve a company's public image; from an investor's perspective, a company with a strong focus on renewable energy and sustainable practices signals its adaptability and potential for long-term growth. This favourable outlook can result in a high price-to-earnings (P/E) ratio, indicating that investors expect substantial future earnings growth from the company. The high P/E ratio reflects the market's confidence in the company's ability to increase earnings over time, possibly driven by its sustainable initiatives; it is often considered a gauge of investor sentiment towards a company and its potential future earnings growth. It is crucial to provide insights into their financial performance and the market's perception of their potential for sustained growth.

A high P/E ratio generally suggests that investors expect higher earnings growth, showing optimism about the company's prospects. Conversely, a low P/E ratio might indicate investors are more cautious, expecting lower growth or potential risks.

Compared to the Nasdaq 100 (which is heavily tech-weighted), P/E Microsoft is trading slightly above the P/E ratio of the index at 33x, and Apple is in the same position as the broader market at 30x. Comparatively, Amazon is trading at more than 100x its earnings, which is much higher than the P/E ratio of the Nasdaq 100. This could be because Amazon is a high-growth consumer discretionary and tech company expected to continue growing rapidly. When it comes to ExxonMobil Corp, the company is trading at 8x its earnings, fairly at the same level as the US oil and gas industry.

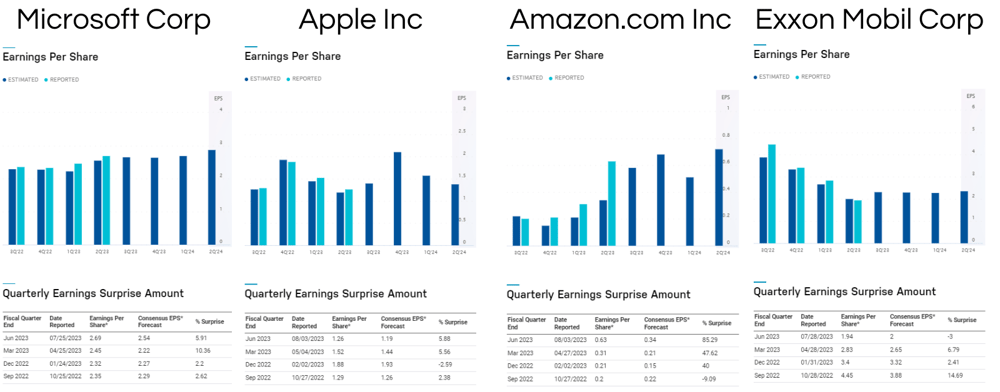

A contributing factor to a higher P/E ratio also includes the history of consistently beating earnings expectations, which can positively impact a company's perceived growth potential and financial strength and increase investor confidence and demand for the company's stock. Here's the table from Nasdaq, showing us the earnings reported and estimates from Q2'22 to Q2'23 for the four companies mentioned in this article:

It is crucial to consider various financial indicators and metrics in conjunction with the P/E ratio to understand the company's growth prospects and overall financial health. In fact, Microsoft, Amazon, and ExxonMobil are some of the big companies expected to announce their earnings next week and Apple in November.

The successful integration of renewables into operations can cut energy costs significantly, boosting earnings and alignment with sustainable trends, appealing to socially responsible investors and ensuring long-term resilience for potential stock demand.

Conclusion

In conclusion, the global economy's transition towards a green economy is marked by a crucial focus on sustainable practices and the adoption of renewable energy, exemplified by the EU's groundbreaking carbon border tariff.

However, this shift faces potential challenges in the form of rising inflation and interest rates. These macroeconomic factors could hinder the transition to a green economy. Heightened borrowing costs, reduced consumer spending power, and increased production expenditures could collectively dampen the momentum of sustainable practices adoption, hindering the ambitious transition to renewable energy sources.

Sources – EasyResearch, ExxonMobil Corp, Apple Inc, Amazon.com Inc, Microsoft Corp, Nasdaq, European Union, Wall Street Journal, Simplywall.st

Follow Cay-Low Mbedzi

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by an employee of EasyEquities an authorised FSP (FSP no 22588) as general market commentary and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.

.png?width=1200&length=1200&name=image%20(51).png)

.png?width=1200&length=1200&name=image%20(44).png)