The 2020 Budget Speech Result

"Winning takes patience, prudence and perseverance. As Saint Paul tells us we must run in such a way that we may win”. – Finance Minister Tito Mboweni

No words spoken rang more accurate of our current situation, and some say the finance minister has pulled a rabbit out of a hat to avoid a downgrade.

Until then South African taxpayers can sigh a sigh of relief as they have been spared significant tax increases although there is a substantial shortfall of tax collections over 2019.

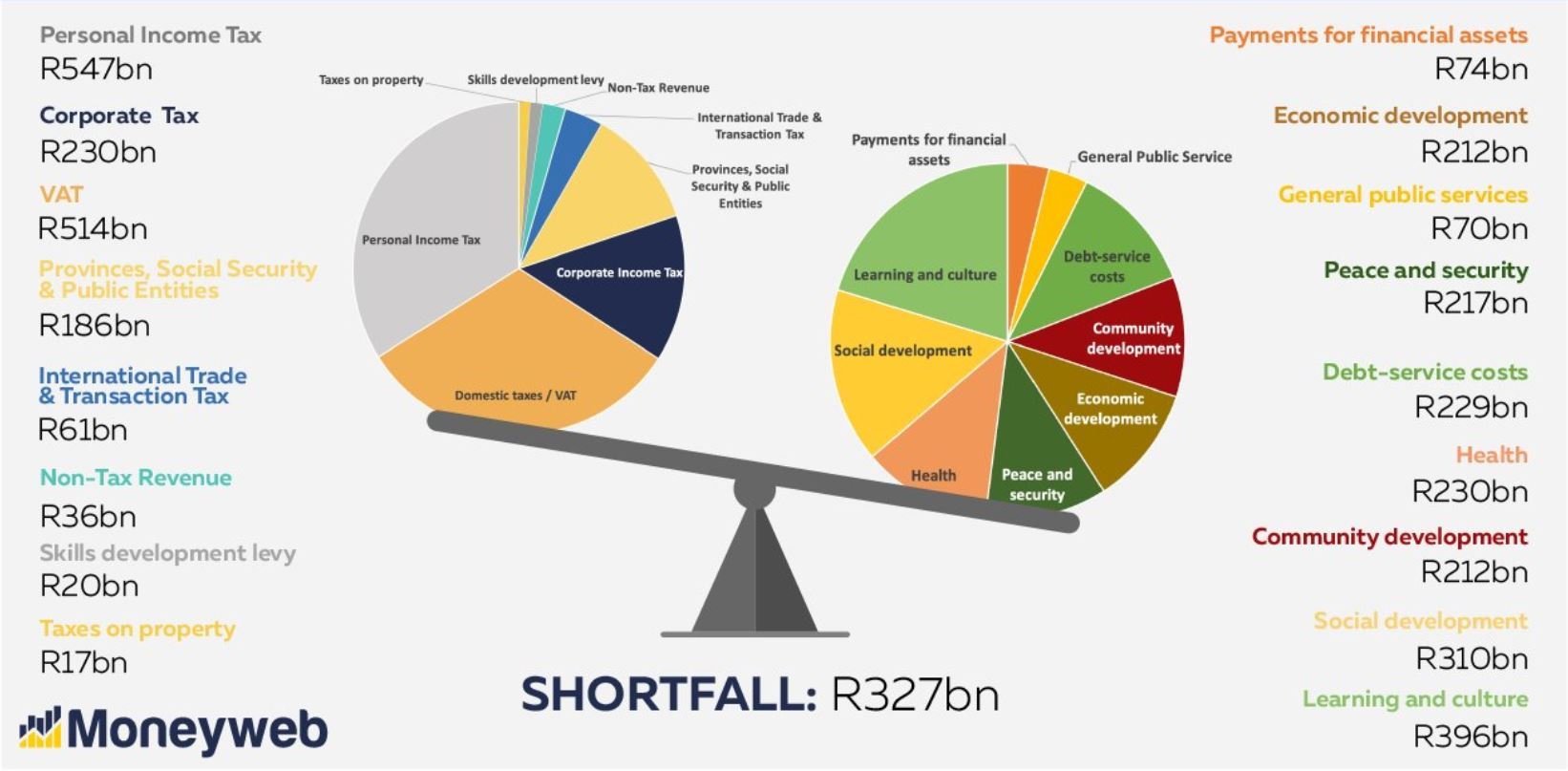

The graph below from the Moneyweb "Budget in Pictures" which shows the revenue and expenditure costs.

There are currently 7.6 million taxpayers compared to 18 million people receiving grants in South Africa, and the gross national debt is estimated to increase to 65.6% of GDP by 2021.

Here are some notable excerpts from the 2020 Budget Speech:

Taxation

While most analysts expected a hike in income taxes and an increase in VAT, the Finance Minister announced that we would indeed pay less income tax and no increase in VAT.

Click this calculator from Fin24 to see just how much.

More Good news is that the annual Tax Free Savings Account (TFSA) contribution limit for the next tax year has increased to R 36 000, so start investing.

"Tax on the following delights have increased":

- Can of beer: will cost an extra 8c.

- 750ml bottle of wine: 14c increase

- 750ml bottle of sparkling wine: 61c increase

- A bottle of 750 ml spirits, including whisky, gin or vodka, will rise by R2.89

- A packet of cigarettes: 74c

Heated tobacco products, like hubbly bubbly, will be taxed at 75% of the cigarette rate and Electronic cigarettes will be taxed from 2021.

Government also plans to reduce the corporate income tax rate over the medium term to try and boost the country's competitiveness as an investment destination.

Some off-Budget initiatives to grow the economy

State Bank – Mboweni said, “In July 2019, I tasked the Deputy Minister of Finance with the responsibility to undertake the state bank project” and “The architecture will be that of a retail bank operating on commercial principles. The state bank will be subject to the Banks Act and will have an appropriate capital structure and performance parameters on investments and loan impairments. It will be regulated by the Prudential Authority on its own merits”.

Sovereign Wealth Fund – “Today we announce the formation of the South African Sovereign Wealth Fund with a target capital amount of about R30 billion, which converts to about US$2 billion or so. There are a variety of possible funding sources, such as the proceeds of spectrum allocation, petroleum, gas or minerals rights royalties, the sale of non-core state assets, future fiscal surpluses and money we set aside”. – Finance Minister Tito Mboweni

Easy clients

One of our Easy clients, Luke van Rensburg, had this to say "With so many negatives facing the South African economy, I cannot see how the finance minister will be able to keep everyone happy. There will be sacrifices which will need to be made in order for the economy to improve.”

What does EasyResearch say

What a turn of events, a total 180-degree spin on what most analysts and myself expected. No significant tax increase to try and curb debt, no Value Added Tax increases. Instead, it seems that the thought process has changed to long term sustainability and growth.

I do agree with our Easy client Luke who said “The economy is more likely to get worse before it gets better and we, as the people should be prepared for the ‘best of the worst’”

Conclusion

Most South African taxpayers will welcome the income tax relief, but the “debt” elephant in the room remains the government’s biggest challenge. Moody's, on the other hand, might be reluctant to downgrade SA in March and might wait to see how the new budget proposals play out and decide in November.

The complete budget can be found at the National Treasury for a more comprehensive look into the 20/21 fiscal budget speech.

Sources – EasyResearch, National Treasury, Fin24, Moneyweb, BizNews, Luke van Rensburg, Bloomberg

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.