Brait Brexited?!

I’ve been bearish on the Brait valuation for months now with a Trading Sell recommendation and a fair value south of the prevailing share price. It’s taken Brexit to really bring it down to earth.

The fall has less to do with a derating of the multiples that Brait has used to value its investments but more a currency and rating depreciation effect. This is similar to my “double whammy” Capital & Counties pre-Brexit scenario - a lower value on pound assets and weaker currency.

Pre-Brexit, the market was pricing in a premium to what was already a generous rating applied by Brait on UK assets and the currency was in the region of R21/R22 to the pound. This premium has now evaporated and on top of that the rand has appreciated to R18,80/£ at the time of writing.

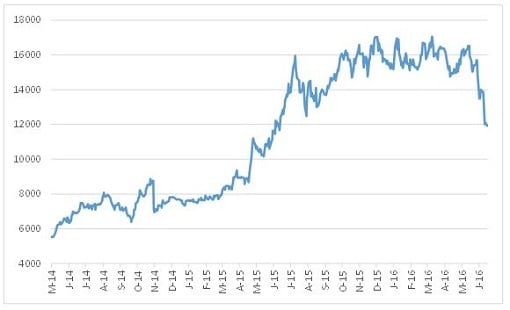

In the weeks before the referendum outcome, the stock was trading in the region of R160 and its high for the year was R174 in March. The year to 23 June average closing price was R158.

Last Friday, 8 June, the stock traded down to just above R116 before closing at R120. At the time of writing, the stock has slipped back to R119.

Brait share price in ZA cents

Brait has lost approximately a quarter of its value prior to Brexit and 30% since the highs or the equivalent of R26 billion in market value – almost enough to buy all of Imperial.

In addition to the trend in the equity value, the listed bonds also show a similar picture.

Brait’s £350 million convertible bonds trade on the Frankfurt Stock Exchange. Pre-Brexit, the bonds traded at a premium to face value but since 23 June have drifted down to a small discount. The coupon is 2,75% but the yield to maturity is just below 3,2% whereas the yield to maturity pre-Brexit was just below the coupon.

With four years and two months to maturity, the bond value is therefore £343,90 million rather than £350 million if the yield were 2,75% and in line with the coupon. The present value of the face value is £306,64 million rather than £305,34 million at 2,75% and the present value of interest is therefore £37,26 million rather than £44,68 million.

I’d caution though about getting too enthusiastic about better value for new money. The valuation method used by Brait may well be transparent but an analyst needs to interrogated and stress test for assurance. In my own view, Brait has been valued too generously and the market correction is a welcome development.

The Brait portfolio is orientated to Britain – in excess of 70% of NAV. An overwhelming majority of New Look and Iceland profits are generated in Britain and a substantial proportion of Virgin Active profits. Whilst these are good, well run companies that have proven business models they are not immune from economic challenges and prevailing uncertainties. Perfection pricing was not appropriate pre-Brexit and it is certainly not appropriate now.

Last year I had a fair value of R85 and a target of R95 assuming an exchange rate of R20/£.

With recent operating performance taken in to consideration and applying what I regard as more representative multiples than the market has previously been ascribing, a value closer to R93 would represent reasonable value with up to R100 per share defendable. Pricing below R120 therefore starts to look interesting for new money, with the caveat that underlying profitability is maintained or improved and the exchange rate does not strengthen materially.

Dissecting the valuation

A few pointers to consider in understanding the valuation of Brait:

- The EBITDA multiples applied to value the underlying four key investments as at the year-end date of 31 March 2016 were already relatively generous and had little cushioning room. Moreover, the implied valuations suggested by the share price were at a premium to this and resulted in the net asset value being approximately 20% higher than the Brait net asset value.

- The valuation of the four key assets is a function of so-called “maintainable EBITDA”, a multiple applied to this and then a deduction for debt to arrive at a fair value for the proportion of the investment that Brait holds.

- Maintainable EBITDA is effectively the run-rate on current profitability – essentially the last audited annual result and with Premier the annualised nine-month year-to-date EBITDA. Whilst there could be an improved result in future there is no certainty that this recent or current run-rate can be maintained.

- Brait uses as its benchmark for the EBITDA multiples an eclectic mix of listed “peers” – both spot share price and three-year trailing. Few are exactly like the Brait assets and one should take account of the balance sheet characteristics of the differing companies, their respective business life cycles, strategic objectives and real world results.

- Both New Look and Virgin Active are valued higher than their recent acquisition multiples whilst Premier and Iceland too are at a premium to multiples used in recent years.

- The net asset value is highly sensitive to the multiple applied and less so to the rate of exchange.

- The following examples illustrate the point:

- If the 9x multiple that Brait bought New Look for with effect from 26 June 2015 was applied, rather than the 13,3x applied to value the business a scant nine months later, the equity value would halve from £1 644 million to £864 million. Moreover, the enterprise value would fall from £3 022 million to £2 045 million, about 7% more than Brait bought New Look for with effect from 26 June 2015.

- A 9x to 10x multiple is very much in line with the EV/EBITDA multiples I calculate for local retailers Foschini, Mr Price, Massmart, Woolies, Shoprite and Truworths.

- If the 10x multiple that Brait bought Virgin Active for with effect from April 2015 was applied, rather than the 11,0x applied to value the business as at 31 March 2016, the equity value would reduce by 11% from £829 million to £734 million. The enterprise value would fall from £1 480 million to £1 345 million, which is slightly more than the EV at the time of purchase.

- If the 6,5x multiple that Brait was applying only two years ago to Iceland, when in fact the maintainable EBITDA was £200 million rather than £150 million today, the equity value would fall by 58% from £389 million to £141 million whilst the enterprise value would fall by a quarter from £1 324 million to £978 million.

- Brait previously valued Premier on a 6,5x EBITDA multiple but increased this to 12,3x as of March 2015 and further to 12,7x as at March 2016. Given the outstanding turnaround, growth and development of this business under excellent leadership a 6,5x multiple is probably too low and thus a value more in line with a Tiger Brands is reasonable. EBITDA is 35% higher in 2016 than in 2015 and 2,2x the EBITDA in 2014. Whilst Brait has upped its stake from 84,6% to 91,1% even on a like for like basis the increase in value since 2014 is 3,6x.

- All these examples indicate that much of the value uplift has come from increased multiples rather than from the operating performances of the underlying investments.

- The exchange rate effect is much less pronounced – if the exchange rate for the year ended 31 March 2016 was R19/£ rather than R21,21/£ then stated NAV would have only fallen from R136 to R125 per share, an 8% difference. The differential between the 10% move in the currency and the 8% move in NAV is because Premier and miscellaneous assets are South African and in this example account for 25% of total assets.

Valuation scenarios

Pre-Brexit Scenario based on 31 March 2016 exchange rate and assuming a R160 share price. The stock market pre-Brexit is pricing in substantially higher multiples than Brait has applied as at balance sheet date.

Click here to view

Monday 11 July 2016 scenario assuming an exchange rate of R18,80/£ and share price of R120. In this scenario, the multiples have fallen from a large premium pre-Brexit to approximate the multiples Brait applied as at 31 March 2016. The share price therefore has a double whammy – not only do the underlying values fall but the rand strengthens too for an approximate post-Brexit 25% decline. If an exchange rate of R17,00/£ were used rather than R18,80/£ then NAV falls by 7% from R120 to R112 per share.

Click here to view

Scenario for the year ended 31 March 2016 using acquisition multiples for New Look and Virgin and earlier Brait multiples on Premier and Iceland of 6,5x each. In this scenario, the NAV is R79 per share, 42% less than the stated NAV as at 31 March 2016.

Click here to view

With recent operating performance taken in to consideration and applying what I regard as more representative multiples than the market has previously been ascribing, a value closer to R93 would represent reasonable value with up to R100 per share defendable. I have applied a 10x multiple for New Look, in any event a premium to the 9x paid, but if 11x were applied to account for future international diversification then NAV rises to R100. Pricing below R120 therefore starts to look interesting for new money, with the caveat that underlying profitability is maintained or improved post-Brexit and the exchange rate does not strengthen materially. If an exchange rate of R17,00/£ were used rather than R18,80/£ then NAV falls by 6% from R93 to R87 per share.

Click here to view

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.